Revisit RN Workforce Strategies to Address Re-energized Unions Amid Worker Shortages

The stability of your RN workforce is critical.

Put the right programs in place to drive equity and engagement.

With union activity on the rise and a nursing shortage expected to worsen, hospital leaders must re-evaluate how to meet their RN workforce’s needs better.

SullivanCotter’s Cathy Loose was recently featured in Healthcare Business Today to discuss how leaders can be more proactive in ensuring the right compensation programs and rewards are in place for all nurses.

Lay the foundation for greater RN retention and performance by meeting the expectations of non-union employees while also creating an environment that is equipped to meet future union needs.

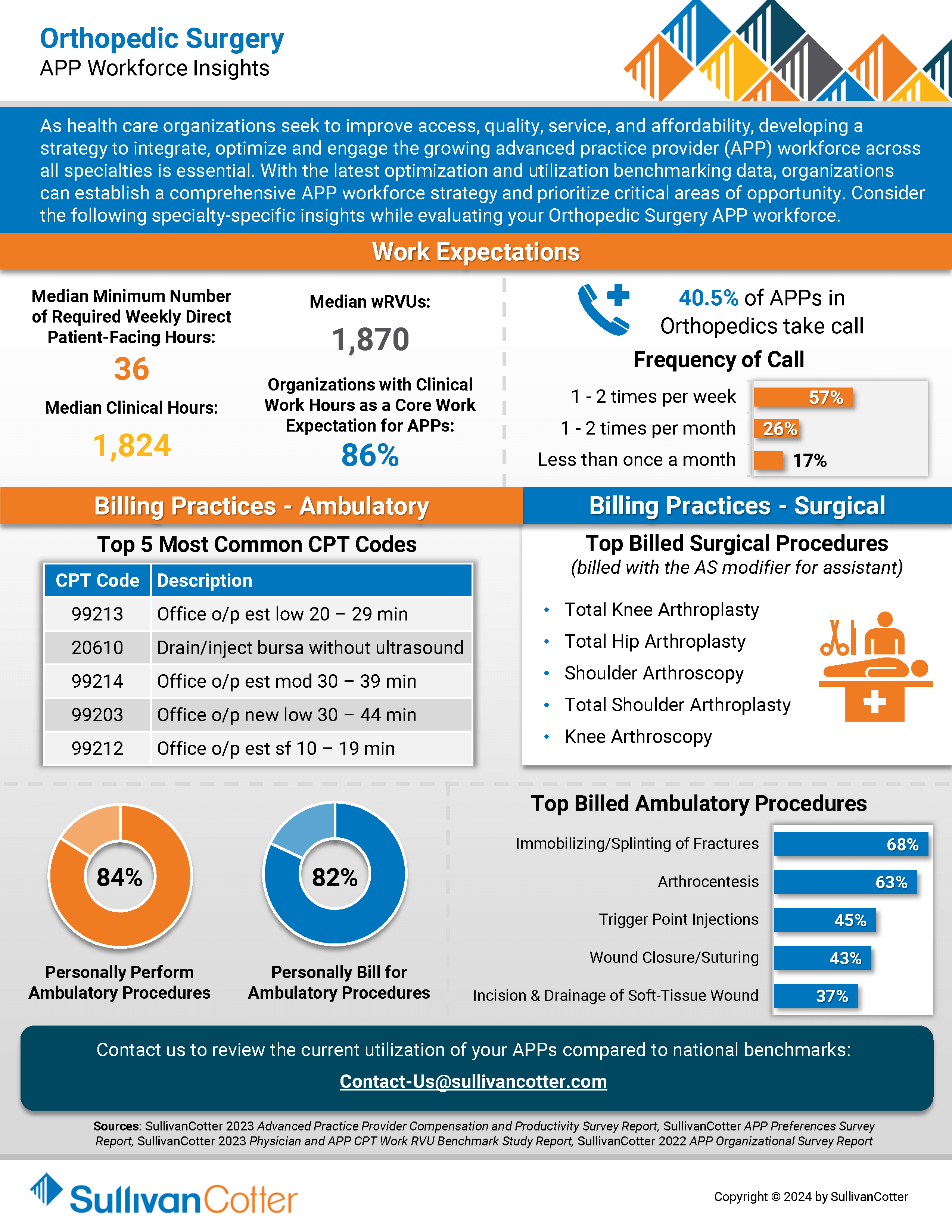

INFOGRAPHIC | APP Workforce Insights: Orthopedic Surgery

Learn more about Orthopedic Surgery work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Orthopedic Surgery when evaluating your APP workforce.

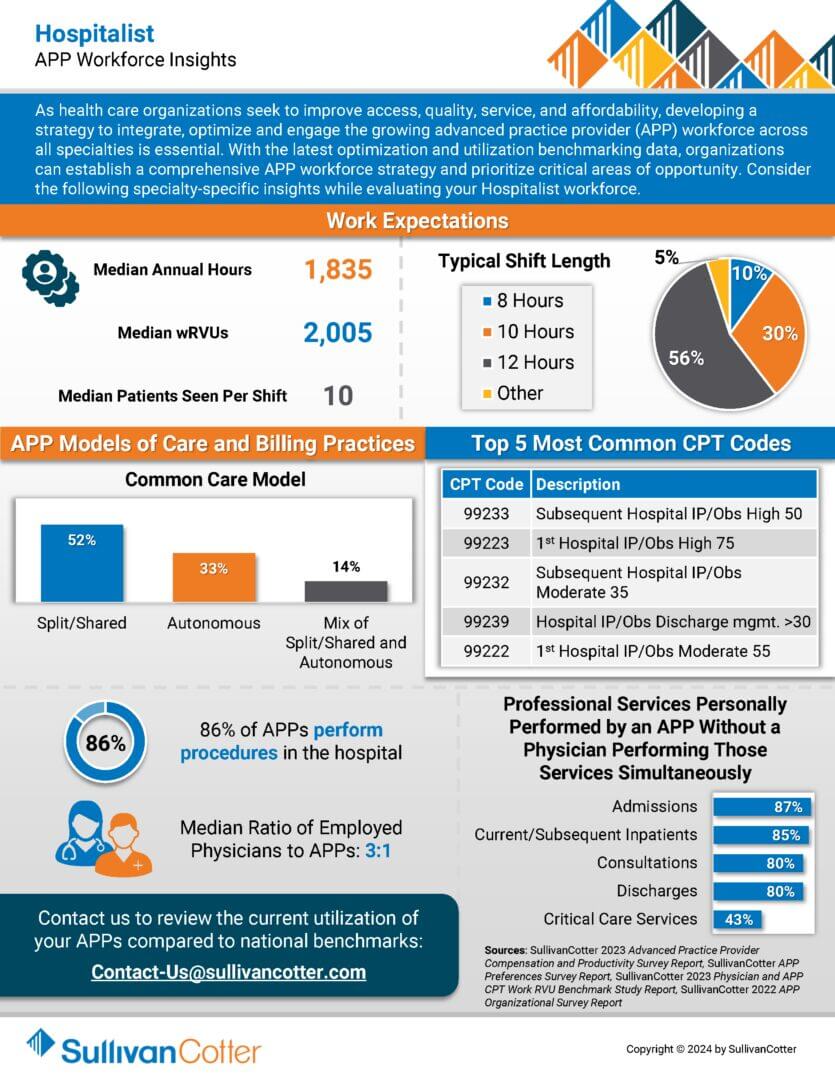

INFOGRAPHIC | APP Workforce Insights: Hospitalist

Learn more about Hospitalist work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Hospitalists when evaluating your APP workforce.

Succession Planning and the Role of a Dynamic Provider Needs Assessment

Addressing the Health Care Workforce Crisis: Succession Planning and the Role of a Dynamic Provider Needs Assessment

Originally published by the American Association of Provider Compensation Professionals

READ FULL ARTICLE

Health care organizations are under pressure to ensure proper staffing and continuity of care to support the communities they serve. In addition to determining the right number and type of clinicians, organizations must also monitor potential retirements and reductions in clinical productivity levels to help inform succession planning needs. As more physicians ease into retirement over the next 3-5 years, having a succession plan in place can help fill key vacancies and support an overall talent strategy.

In this article, SullivanCotter discusses:

- Addressing the imbalance in clinical supply and demand

- Assessing clinical workforce requirements and succession planning

- Deploying a dynamic Provider Needs Assessment (PNA)

- Measuring the impact of clinical talent demand on compensation

Mergers and Acquisitions: Integrating Total Rewards Strategies to Drive Value

By Cathy Loose, Employee Workforce Practice Leader, SullivanCotter and Liz Snyder, Principal, SullivanCotter

INTRODUCTION

As health care continues to evolve at a rapid pace, many organizations are exploring opportunities to expand and scale their operations to support long-term growth. One of these strategies includes pursuing mergers and acquisitions (M&A) – a practice that began to gain momentum again near the end of 2022 following a two-year slowdown in the wake of the COVID-19 pandemic. According to Kaufman Hall’s Hospital and Health System M&A in Review report, this momentum continued through 2023 with 65 announced transactions – a 10% increase from 2022. Sixteen of the 65 transactions were reported near the end of 2023. Two primary factors have contributed to this growth in M&A activity. Foremost, there has been an increase in the number of financially distressed organizations seeking partnerships. Transactions involving these circumstances, including smaller hospitals and health care systems, rose from 15% in 2022 to 28% in 2023. Due to financial hardship, many seek to secure partners to help ensure financial sustainability and maintain access to care delivery within their community. Reorganization in regional markets, with the realignment of both for-profit and not-for-profit health system portfolios, also contributes to the rise in M&A activity. Many organizations consider this is critical to expanding into complementary capabilities and delivering more coordinated care across a broader market.

TOTAL REWARDS: ADDRESSING COMMON INTEGRATION CHALLENGES

An essential key to success while undergoing a merger or acquiring another organization is addressing financial and operational goals and making the transition as smooth as possible for employees.

This includes the alignment of total rewards strategies – which requires critical input and information from the Chief Human Resources Officer and the Human Resources function that may influence critical decisions, timing, milestones, and integration approaches to mitigate human capital risks during implementation.

This article focuses on common total rewards challenges that many health care organizations encounter during an M&A transaction. Recognizing and addressing these opportunities early will help minimize potential risks and deal-breakers, prioritize pre- and post-merger activities, and support a successful implementation process.

- Inefficient Workforce Structure

Assessing your current workforce structure to ensure an efficient mix of management and staff to streamline performance and manage costs is critical for the integration process. The question of centralization vs. decentralization remains the key focus for the M&A process. A recent workforce survey from SullivanCotter showed that, for most support functions, centralization is a more efficient staffing model than either decentralized or hybrid structures.

- Misalignment of total rewards philosophy

Establishing a consistent total rewards philosophy should be the foundational element that governs the new organization’s pay strategy. Differing approaches between the two merging organizations on essential program elements such as market pay positioning, targeted market comparators, incentive opportunities, benefits programs, and more will lead to inconsistent rewards and pay practices. While harmonization and consistency are critical, it is also an opportunity for the new organization to reevaluate and differentiate the philosophy where appropriate. Many health care organizations have recently recognized the need to differentiate certain reward programs and practices by their specific workforce segment. As an example, SullivanCotter’s 2022 Nursing Compensation Pulse Survey reports that staff nurses are more likely to have their pay philosophy set higher than the market 50th percentile (median) as 32% of organizations target the 60th or 65th percentile and 26% of organizations target the 75th percentile. This is due to unprecedented nursing labor shortages, pressure to remain competitive with the unionized workforce, and the prioritization of recruitment and retention goals.

- Outdated and/or uncompetitive legacy pay structures

M&A often presents an opportunity to update the total rewards philosophy. Organizations can streamline pay structures to address internal pay equity issues and ensure market alignment. This is becoming even more critical as organizations continue to source talent outside the traditional health care market.

- Inconsistent pay practices and program administration

While ensuring consistent and equitable pay practices across the new organization is essential, organizations must first identify the most significant differences and determine the level of harmonization required. Programs and practices such as supplemental pay, premium pay, and incentives/bonuses often require the most reconciliation between two merging organizations. The annual compensation planning process – including pay increases and promotions – also tends to vary. Organizations can prepare for post-close integration by conducting program and practice audits before the deal closes.

- Conflicting and costly benefit offerings

During the M&A process, integrating benefit programs and policies is vital to ensuring a cost-effective and seamless transition that will deliver positive outcomes for the organization and its employees. A comprehensive due diligence process followed by a clearly defined integration strategy aligned with the overall goal of the transaction can reduce duplicative costs and create a more attractive total rewards package.

- Lack of a cohesive and well-defined career architecture

Addressing workforce structure, compensation and benefits programs is only half of the battle. As organizations come together, a comprehensive career architecture that optimizes the new organization’s structure and helps to identify redundancies will drive the M&A integration process. It will also ensure consistent job titling and leveling, enable better workforce reporting and analysis, and provide leaders with clear guidelines for promotion. High-performing companies continuously examine and restructure the overall career framework to promote talent mobility, enhance learning opportunities, and improve employee engagement and retention.

- The need for greater transparency

M&A is a complex business strategy that requires clear lines of communication and a high level of transparency. Despite the confidential nature of these transactions, effective communication and change management strategies are imperative to help build trust and confidence across merging entities and support employee productivity and morale. Whether combined with an overarching plan or one focused exclusively on total rewards, an ideal communications strategy allows for several ‘touchpoints’ throughout the process. Leaders, managers, and employees must be earnestly included in the transition and implementation journey to understand how the new organization will positively impact the employee rewards experience.

KEY TAKEAWAYS

It’s important to note that only some M&A transactions are successful – many struggle to achieve the strategic goals and operational efficiencies originally envisioned within the timeframe established. While effective integration of an organization’s total rewards strategy does not define a transaction’s overall success or failure, it is a critical contributing factor. Organizations should look to complete this integration in a timely manner and with as much compassion and transparency as possible.

Although these considerations are relevant during any stage of an actual transaction, they also pose important planning questions for organizations that are contemplating but have yet to pursue any M&A opportunities. Given the current environment – with a strong emphasis on cost containment, operational efficiency, and employee retention and engagement – organizations not currently considering any partnerships can benefit from a more holistic and continuous assessment of these foundational aspects to help ensure consistency and market competitiveness.

PODCAST | 2024 Priorities for the Board Compensation Committee

Tune into our expert-led podcast to elevate your executive compensation strategy!

LISTEN TO PODCAST

The complexity of operations is at an all-time high for many hospitals and health systems nationwide. As some leaders continue to step away – leaving a critical gap in expertise – the search for qualified executive talent is more pressing than ever.

Here at SullivanCotter, we understand that securing leadership capable of leading through such change while balancing ongoing financial constraints is easier said than done.

In this AHLA-sponsored podcast, we collaborate with legal expert Michael Peregrine to provide a blueprint for compensation committees to follow as they redefine their approach to executive compensation.

Tune in to hear us tackle topics such as:

- Differentiating rewards in a dynamic marketplace

- Aligning talent strategy with important recruitment and retention needs

- Assessing incentive plan effectiveness

- Implementing critical governance structures

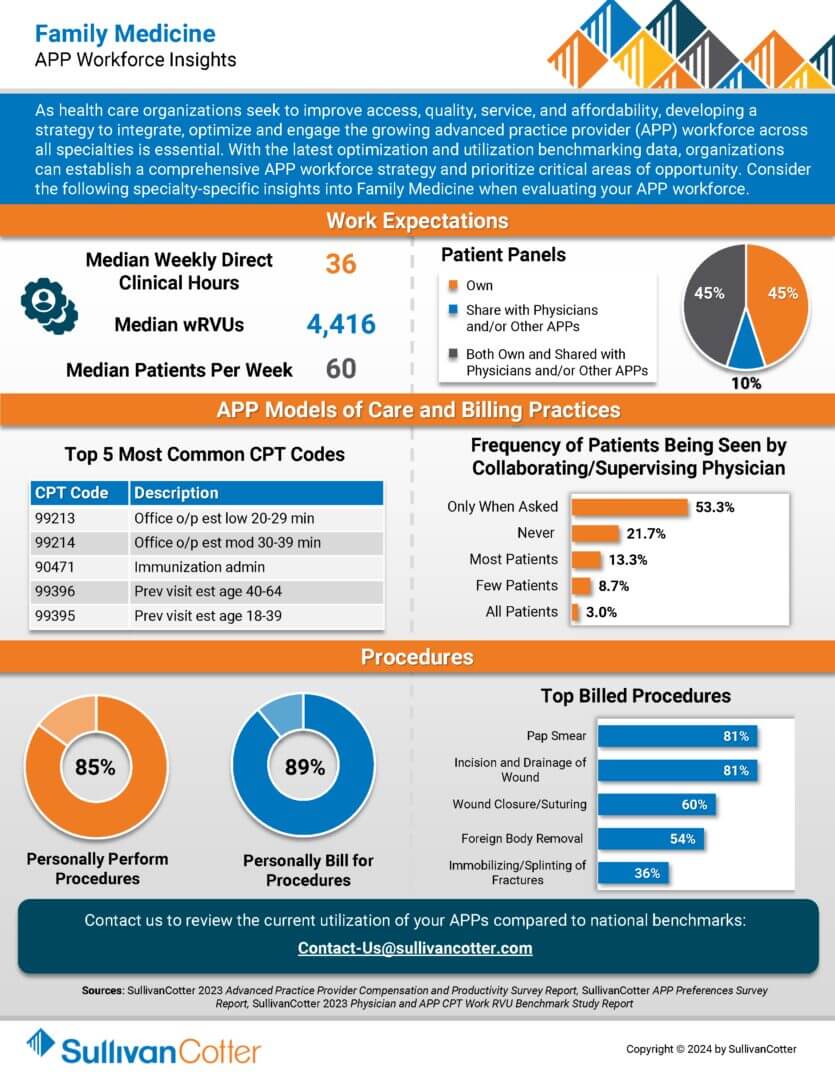

INFOGRAPHIC | APP Workforce Insights: Family Medicine

Learn more about family medicine work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Family Medicine when evaluating your APP workforce.

Examining the Implications of Increasing Executive Pay Scrutiny

How can your organization ensure executive compensation programs are responsible, reasonable and sustainable?

Renee Stolis, Managing Principal SullivanCotter, and John Putnam, Managing Principal SullivanCotter

Many not-for-profit health systems nationwide have struggled to sustain or improve performance in recent years due to unprecedented financial concerns, workforce shortages, wage pressures, inflation, and other operational issues. In addition to addressing operational performance, health care organizations are growing considerably more complex as they consider options for continued growth, diversification of revenue, and optimization. As a result, the executive talent market remains highly competitive as the demand for leadership with the necessary skills and experience to lead through such unprecedented times continues to outpace supply.

This is driving up executive compensation in an already competitive market. Against this backdrop, broader issues of patient access and affordability, the ability for employees to earn a living wage, ongoing government deficits, and the current political environment are fueling scrutiny of the health care delivery system. Executive compensation is front and center in these discussions:

- Lawmakers, unions, and the media continue to focus on the ratio of CEO pay to the average worker. While not specific to not-for-profit health systems, it highlights the broader dialogue around the relationship between executive and broader workforce compensation.

- Ballot initiatives are also being introduced to limit hospital executive pay. For example, a ballot initiative had been introduced in Los Angeles on whether or not to cap the total compensation of executives, managers, or administrators at local privately owned hospitals at $450,000.1

- Pay transparency laws are on the rise – requiring organizations to post pay ranges for employment opportunities. Several states already have such laws, while many others are considering or intending to follow them. Federal pay transparency legislation is also pending.2

- The relationship between the public charity provided by not-for-profit health systems and tax-exempt status is being examined by the media and state and federal legislators. In October 2023, the Senate Health, Education, Labor, and Pensions Committee issued a report citing limited charity care provided by not-for-profit hospitals relative to organizational revenues and CEO compensation.3 As another example, the state court in Pennsylvania has challenged real-estate tax exemptions.4

While the Boards of not-for-profit health systems have long overseen executive compensation consistent with accepted best practices and governance standards, continued scrutiny may present greater risks for how executive compensation practices are perceived. Executive compensation practices deemed unreasonable or unfair may raise compliance concerns, increase reputational risk and influence consumer preferences, exacerbate workforce tensions, be leveraged by unions in organizing efforts and contract negotiations, and motivate elected officials and regulators to influence broader health care policy.

As such, the Compensation Committee must ensure that executive pay programs are reasonable, responsible, and sustainable while supporting recruitment, retention, and performance needs in a dynamic labor market. This requires considering the executive compensation philosophy, program, and pay decisions more broadly across multiple perspectives beyond market competitiveness.

Taking a Broader View of Executive Pay

By adopting a more holistic, data-driven approach to reviewing and refining the executive pay philosophy, designing the executive compensation program, and effectively assessing and governing pay decisions, Boards and Compensation Committees can ensure that executive rewards programs remain highly defensible and beyond reproach as market conditions evolve, new risks emerge, and organizational dynamics shift.

Below are several key considerations for management and the Compensation Committee to address as part of an ongoing process to ensure alignment of executive compensation with the organization’s mission, while also meeting objectives related to recruitment, retention, equity, affordability, and performance.

Performance:

Aligning pay with performance has long been a cornerstone of executive compensation programs. Within not-for-profit health systems, the use of incentive-based compensation is the norm. To help support defensibility, organizations should clearly define performance objectives and demonstrate a strong connection between executive compensation and organizational performance.

- Do our incentive plans reflect the organization’s key operating and strategic priorities?

- Do our incentive performance goals represent an appropriate degree of stretch so payouts are commensurate with performance outcomes? Have we externally validated the performance standards to ensure they are meaningful?

- Do we consider our organization’s relative performance versus peers when determining incentives?

- Does our competitive positioning of pay align with the organizational performance?

Mission:

Tax-exempt health systems are responsible for showing how they serve the broader public good. Some external stakeholders have questioned the appropriateness of tax-exempt status by citing high levels of executive compensation in relation to community benefit. While ‘community benefit’ is not well-defined, it calls into question an organization’s overarching mission, vision, and values and whether it effectively serves the community in which it operates. Compensation should be evaluated in the context of how well the organization fulfills its mission.

- How do we define if we have succeeded in our mission? Do our performance-based incentive plans effectively align with our mission, vision, and values?

- Are there specific measures that should be incorporated into our incentive program to ensure a positive impact on the broader communities served? Are there opportunities to incorporate other attributes of our mission in the compensation program (e.g., education, research)?

- How does the compensation structure balance financial results with other performance measures aligned with our mission?

- Should we consider having specific measures related to community benefit or other impact in our incentive programs or as a funding trigger?

Market Competitiveness:

Offering competitive compensation ensures the organization can secure skilled and experienced executives. This is not just about where pay is relative to peers but also about ensuring that executive compensation and benefits programs are contemporary and effective in achieving their objectives.

- Are current compensation levels aligned with the competitive targets articulated within the philosophy?

- Should we segment our compensation philosophy to articulate different market targets for different roles or businesses based on their criticality to the mission?

- What mechanisms exist to regularly review and update compensation programs to maintain relevance and effectiveness?

Talent Strategy:

As the scope of responsibility widens and organizations continue to diversify their business strategies, the need for broader skill sets has expanded the search for executives beyond the traditional health care market for select positions. Furthermore, given a constrained talent market, succession and talent management plans are being adapted to mitigate risk during an unplanned transition and identify leadership deficits in key strategic areas. Comparing to the right peer groups can help ensure that the compensation program supports the organization’s growth and enables it to effectively recruit and retain its executives. Furthermore, given certain financial constraints, directing compensation to high performers or potential successors is critical.

- Do our compensation peer groups reflect where we source executive talent? Does this differ for certain positions and areas of the business?

- How are we mitigating talent risks to ensure we retain the talent we have and plan for the talent/skills we need? Is our succession planning process sufficiently robust?

- Do our programs allow for adequately differentiating between high-performing and high-potential talent?

- Are we optimizing the use of our compensation spend? Are we directing differentiated pay to the roles and incumbents that are most critical, highest performing, and most likely to impact the success of our mission?

- Have we reviewed the collective holding power of various compensation programs to understand how such programs support executive retention?

Efficiency:

With changing care models and greater pressure on financial performance, health systems must look more holistically at their leadership structure to ensure it is optimized for operational excellence and supports cost efficiency. This includes examining headcount, spans of control, and the titling/leveling distribution across the organization.

- What is our total expenditure for the executive rewards program?

- How does our overall executive leadership count and spend compare to peers?

- Is our leadership structure optimized for growth and efficiency? Is it aligned with the capabilities and processes needed to optimize the impact we have on carrying out our mission and impacting the communities we serve?

Equity:

Equitable pay practices are crucial for attracting and retaining top-tier talent by demonstrating a commitment to fair rewards for all leaders, regardless of age, race, or gender. This applies to how similar leadership roles are paid in relation to each other and includes how pay practices and policies align across the organization’s entire workforce. While this does not imply that all programs must be employed universally across the organization, it does suggest that similar guiding principles are applied to all compensation decision-making.

- Have we conducted a formal pay equity analysis?

- How do our executive compensation pay philosophy principles align with the broader workforce? For example, are the peers, compensation and benefits program attributes, and market targets appropriate across workforce cohorts? If they are not consistent, can we clearly articulate why?

- Are our rewards programs designed fairly to deliver comparable value and benefits for leaders at similar levels across the organization?

Committee Transparency and Compliance:

Organizations must remain actively engaged and vigilant. This includes ongoing education on industry trends and regulatory developments. It also includes reaffirming the Committee’s role, evaluating its performance, and regularly updating the Board on compensation decisions, compliance initiatives, and policy changes.

- Have we revisited our governance process to ensure proper oversight and alignment with regulatory requirements?

- Are we conducting regular committee education and orientation?

- Is the full Board appraised of the executive compensation governance process?

- Are we keeping abreast of emerging market trends and best practices?

- Do we have a media strategy to respond to scrutiny and communicate executive compensation decisions to key stakeholders?

Conclusion

As health systems realign their strategic objectives within a rapidly changing health care environment, executive compensation programs are evolving in kind. Increasingly, this evolution includes developing a more holistic executive compensation program that optimizes total expenditure while balancing key considerations such as pay competitiveness, talent strategy, mission alignment, performance and equity.

Scrutiny of executive compensation – from the media, regulators, and other internal and external stakeholders – is expected to persist amidst ongoing financial pressure while competition for talent increases and compensation levels grow. To help proactively mitigate potential risks associated with this heightened level of scrutiny, it’s important to ensure that the compensation program aligns with the organization’s mission and is highly defensible and beyond reproach. While competitive pay is important, this requires a more holistic and balanced review of multiple dimensions embedded within the Compensation Committee’s ongoing process.

Sources:

1. Reyes, E.A. (June 21, 2023). “LA Voters Clamp Down on Pay for Hospital Executives”. Los Angeles Times.

2. H.R.1599. (March 14, 2023). Salary Transparency Act. 118th Congress.

3. Senate Health, Education, Labor and Pensions Committee. (October 10, 2023). “Executive Charity Report”. United States Senate.

4. Brubaker, H. (December 5, 2023). “PA Supreme Court won’t hear Tower Health’s appeal of Phoenixville Hospital’s property tax case”. The Philadelphia Inquirer.

PRESS RELEASE | Health Care Organizations Deploy Cost-Cutting Initiatives as Labor Costs Grow

Health Care Organizations Deploy Cost-Cutting Initiatives as Labor Costs Grow

—

March 7, 2024 – CHICAGO – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for health care and not-for-profits, has released findings from its 2023 Workforce Metrics Benchmark Survey.

While many health care organizations have begun to experience modest post-pandemic financial recovery, ongoing workforce challenges – high turnover, employee burnout, wage pressure and other recruitment and retention issues – are adding to cost concerns. As labor expenditure remains high, hospitals and health systems are reevaluating the size and shape of their employee populations to offset rising costs and create a more affordable and sustainable workforce architecture.

Despite only slight increases (up less than 1% from 2022) in the overall size of the workforce, year-over-year comparisons show that the cost of labor continues to rise at a much faster rate. Annual base payroll expense, which constitutes the vast majority of an organization’s labor expenditures, has gone up almost 10% from 2022 to 2023. For the average participating organization with an annual base payroll expense of over $2 billion, this has added about $200 million to the expense line.

Diving deeper into these findings – including data reported on multiple job families and demographic groupings throughout different career level stages – provides insight into how organizations can support ongoing expense management and workforce efficiency initiatives.

Assessing Workforce Cost and Structure

Although growth in the size of the workforce has slowed across all career stages – Executives, Leaders, Managers and Individual Contributors – as compared to last year, many organizations are still experiencing unsustainable wage growth when adjusted for headcount. Base payroll cost for Individual Contributors, comprising the largest career stage, has increased by 9.6% as compared to 7.2% in 2022. Executives, Leaders and Managers are seeing labor cost growth (up to 5-6%) on par with last year’s results after adjusting for changes to headcount.

“While this analysis is consistent with prevailing industry wage pressures, there are also several other factors, such as new technology, clinical innovations, investments in new services, key strategic initiatives, and more driving changes in the composition of the workforce. Organizations continue to react to an evolving labor market, and they may see new positions being created, fewer lower-paying jobs, or a change in the mix of different job levels and career stages – all of which have a profound impact on overall labor expenditure – as these factors play out,” said Tim Pang, Principal, SullivanCotter.

As hospitals and health systems rebalance the size and shape of their workforce to help address cost and efficiency concerns, many are focusing more acutely on optimizing managerial oversight and span of control. The survey results indicate that a typical reporting structure based on the median number of FTEs consists of almost 180 FTEs reporting up directly and indirectly through each individual Executive. This includes 4.3 Leaders for every Executive, 2.4 Managers for every Leader, and 15.8 Individual Contributors for every Manager. These benchmarks, however, can vary widely depending on the functional area. Targeting a wider span of control can enable a more efficient management model where less supervision is required and employees are able to work more autonomously. This can correlate with higher levels of employee engagement and satisfaction – particularly when direct patient care is involved.

Additionally, many organizations continue to review Executive, Leader, and Manager positions that do not have formal people oversight to ensure appropriate leveling and accountability and reduce redundant management layers. When analyzing the direct span of control by career stage, this year’s survey reports that more than 10% of Executives do not have any direct reports. This increases to 21.9% and 26.7% for Leaders and Managers, respectively.

“Whether due to a lack of formal leveling criteria, having too many layers of management hierarchy, or running out of room on the Individual Contributor career ladder, this practice can impact perceived equity across the organization and dilute the management and leadership structure. Creating clear job and level definitions can help move people into the right roles and ensure that their title is reflective of their intended scope of responsibility,” said James Roth, Managing Principal, SullivanCotter.

Workforce Demographics – Gender, Age and Race

As important diversity, equity and inclusion (DE&I) initiatives remain a top priority for health care organizations nationwide, many are looking for greater insight into the diversity of their employee populations as represented across race, gender, and other demographic characteristics.

Across the 19 clinical and non-clinical job families included in the survey, gender representation is highly skewed with females comprising 73% of the workforce in 2023. This representation is highest in Financial Services, Nursing, and Health Information Management. While the three job families with the highest male populations are Facilities, Information Technology, and Emergency Medical Services, these are more evenly split and range from 49.7% – 59.8% males.

When analyzing by career stage, female representation at the Manager level is strong at 72.4%, but steadily declines to just under 50% for Executive roles – driven by large female populations in a small number of functional areas such as Nursing – indicating that fewer females are getting promoted into senior leadership roles despite comprising a majority of the workforce. Increasing female representation at this level continues to be an important area of focus for many organizations.

Generational representation also remains fairly stable but with slight shifts as Baby Boomers retire and open up new career pathways for Millennials into Director-level and management positions. Facilities Services and Health Information Management have the largest populations of Baby Boomers (both over 25%) and carry the most significant retirement risk. The positions attracting the most Millennials and Centennials – the youngest members of the workforce – include Basic Science and Research (76.5%) and Emergency Medical Services (71.6%).

Conversely, minority representation increased greatly year-over-year across all career stages – up 17.1% for Leaders, 15.7% for Managers, 13.6% for Individual Contributors, and 11.5% for Executives. When analyzed by distribution across career stage, minority representation is highest at the Manager level (25%) but then slowly decreases to 15.4% at the Executive level. Ongoing retirements over the next five to 10 years have the potential to change the demographic landscape of the health care workforce.

“We are starting to see some positive improvements in gender and minority representation across the board. To help maintain this progress and keep moving in the right direction, organizations must remain committed to supporting critical DE&I initiatives and building a more representative workforce. This includes bridging the gap in minority representation as you move up into the Executive ranks,” said Ted Chien, President and CEO, SullivanCotter.

Planning Considerations for 2024 and Beyond

Although health care organizations are cautiously optimistic about recent improvements in financial performance, many plan to reduce administrative expenses by modifying the size and shape of their workforce, centralizing key services, redefining job levels and career stages, and optimizing managerial span of control. There are several important considerations related to workforce cost and structure that organizations must be aware of as they move further into 2024 and beyond.

This includes:

- Address rising payroll expense by leveraging technology more effectively, improving key processes, and rebalancing the size and shape of the workforce to create a more sustainable and affordable model moving forward.

- Focus on capturing cost savings associated with the standardization and centralization of key services. The push for greater efficiency is putting internal service delivery in the spotlight and, given the somewhat fragmented operating models of non-clinical/administrative job families, it is important to understand the impact that centralization can have within functions like Human Resources, Finance, Information Technology, and more.

- Review span of control to help optimize managerial oversight and identify potential cost-saving opportunities. This includes understanding the importance of having clear job-level definitions so you can move people into the right roles as needed without diluting your management structure, creating potential inequities, or introducing redundant management layers.

- Succeed in health equity by committing to critical DE&I initiatives. Minority representation has increased across all career-level categories. Optimizing the workplace so that all employees can thrive is imperative to continued business success. It requires ongoing consideration to help avoid workforce stagnation to ensure progress.

SullivanCotter’s 2023 Workforce Metrics Benchmark Survey includes critical benchmarking data across clinical and non-clinical job families, six career-level categories, and important demographic groupings to provide insight into the following metrics:

- SIZE: Number of FTE headcount

- SHAPE: Career stage distribution of FTE headcount

- COST: Annualized base payroll expense of FTE headcount

- DEMOGRAPHICS: Gender, racial and generational representation

- OVERSIGHT: Management direct span of control

For more information on SullivanCotter’s surveys, please visit our website at www.sullivancotter.com, or contact us via email or by phone at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and data products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

Note to media: Additional data and interviews are available on request.

Case Study | Co-Sourcing: Don’t let critical compensation initiatives fall to the wayside

Improve operational efficiency and reduce the burden on in-house HR and compensation functions with our innovative new co-sourcing solution.

It remains challenging for organizations to successfully manage critical compensation functions amidst an ongoing health care workforce crisis. Our approach to co-sourcing combines the insight and operational expertise of SullivanCotter consultants with the capabilities of your organization’s in-house professionals.

Learn how SullivanCotter worked with one organization to address time and resource constraints by assisting with compensation planning, management of annual survey submissions, and the delivery of additional strategic and operational support as needed.

Without a well-defined and consistent approach for various market benchmarking activities, the client was struggling to support the annual compensation planning process.

SullivanCotter worked closely with the client to manage critical compensation functions that had previously been hindered by a lack of internal resources, time or expertise.

Seeking operational support allowed the organization to leverage SullivanCotter’s expertise in developing a more consistent and accurate compensation management process.

Interested in discussing how co-sourcing can work for your organization?

Our approach to co-sourcing allows us to provide annual compensation planning, survey operations, market benchmarking, and other services to help your organization strategize, effectively manage, and enhance results in a complex environment.

Contact us to learn more.

Fill out the form below to access the infographic.

Case Study | Transform Your Operations with Co-Sourcing

Don’t let critical compensation initiatives fall to the wayside

Improve operational efficiency and reduce the burden on in-house HR and compensation functions with our innovative new co-sourcing solution. We combine the insight and operational expertise of SullivanCotter consultants with the capabilities of your organization’s in-house professionals.

We recently stepped in to provide support to an organization who was not satisfied with their previous co-sourcing relationship – which caused them to fall behind on compensation management.

Due to several issues affecting the organization’s in-house compensation team, the client was unable to autonomously administer the compensation program without co-sourcing support.

SullivanCotter worked closely with the client to identify and take charge of important initiatives that were falling behind due to lack of internal resources or gaps in expertise.

The organization leveraged SullivanCotter’s deep industry expertise to develop a strong co-sourcing partnership – allowing them to more effectively address critical operational needs.

Interested in discussing how co-sourcing can work for your organization?

Our approach to co-sourcing allows us to provide annual compensation planning, survey operations, market benchmarking, and other services to help your organization strategize, effectively manage, and enhance results in a complex environment.

Contact us to learn more.

Fill out the form below to access the infographic.

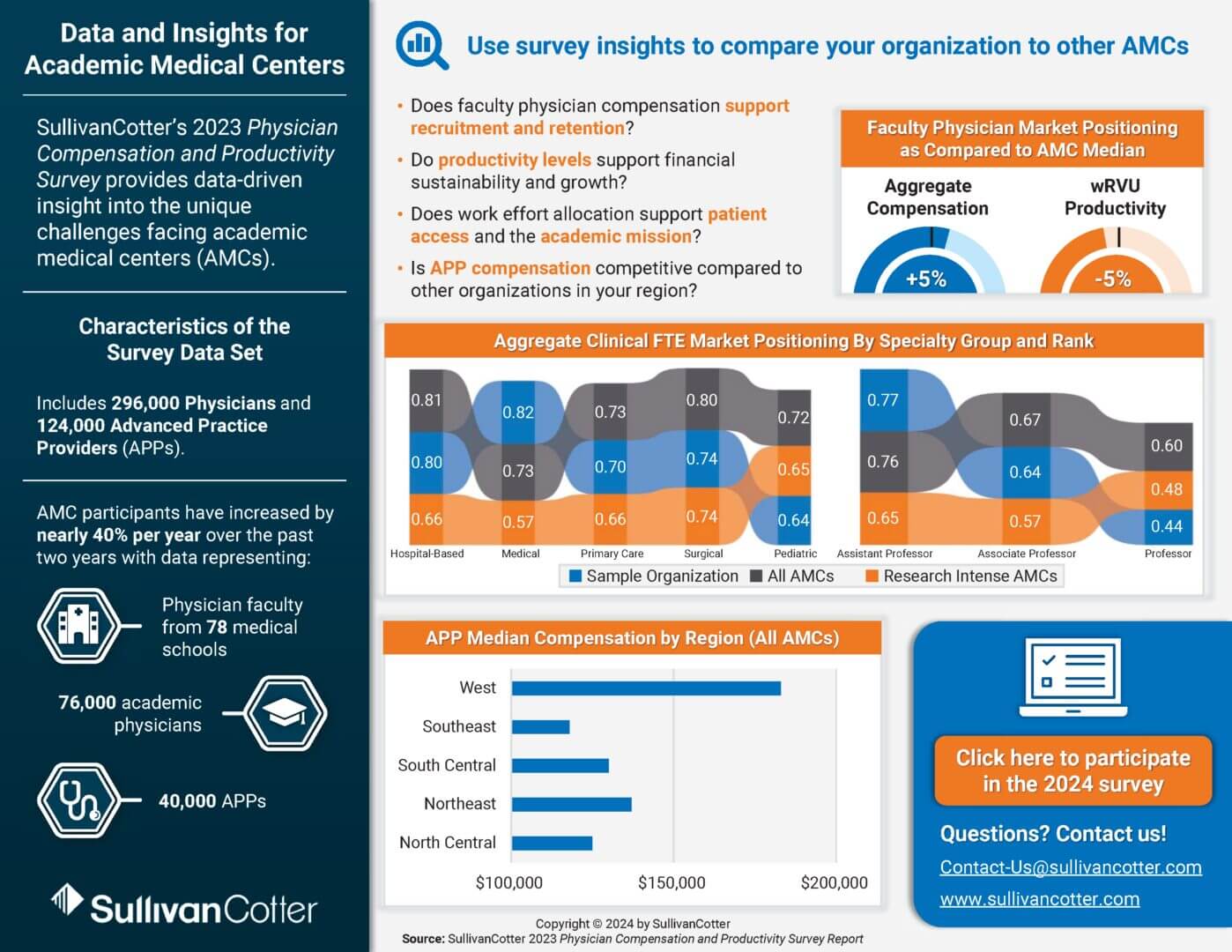

INFOGRAPHIC | Academic Medical Center Compensation Trends

How does your physician and APP compensation strategy compare to other academic medical centers?

Due to the tripartite mission of education, research, and patient care, academic medical centers (AMCs) face a number of unique challenges.

Amid intense competition for faculty physicians and advanced practice providers (APPs), many are looking to adopt a more strategic approach to compensation – requiring comprehensive, data-driven insight into pay levels, productivity, work effort allocation and more.

Utilize benchmarks from SullivanCotter’s 2023 Physician Compensation and Productivity Survey – which features data from 78 medical schools on 76,000 academic physicians and 40,000 APPs – to help address the following questions:

- Does faculty physician compensation support recruitment and retention?

- Do productivity levels support financial sustainability and growth?

- Does work effort allocation support patient access and the academic mission?

- Is APP compensation competitive compared to other organizations?

ARTICLE | Physician Practice Valuations - The Evolving Asset Approach

Physician Practice Valuations – The Evolving Asset Approach

Determining the most effective approach for strategic and competitive growth.

Although market consolidation has been a longstanding industry norm – even increasing in recent years due to the rise of new industry players and challenges associated with operating an independent physician practice – the valuation methods used to assess practice enterprise value are evolving.

In this article, SullivanCotter outlines the importance of utilizing a more modern and holistic approach to asset valuation – one that considers all capital, both tangible and intangible – to understand the true value of a transaction. Partnering with a firm that specializes in health care valuations helps organizations to ensure that valuations are accurate, compliant, and strategically aligned with competitive growth goals.

Originally published by the American Association of Provider Compensation Professionals

Reevaluating Health Care Executive Compensation to Support a Diversified Business Strategy

Support business diversification and innovation with total rewards programs that address unique operating models, performance expectations and talent needs

In response to an extremely challenging operating environment and sustained financial headwinds, many not-for-profit health care organizations are seeking new business opportunities to diversify and expand their revenue streams.

In a recent article, SullivanCotter outlines important considerations for developing an executive total rewards program for new businesses with strategies and operating objectives that may differ from traditional health system goals.

Organizations must determine how to compensate leaders of a diversified business by considering the specific organizational structure, operating status, talent market, and strategic focus of the entity to inform an appropriate compensation philosophy and program design.

Fill out the form below to access the full article.

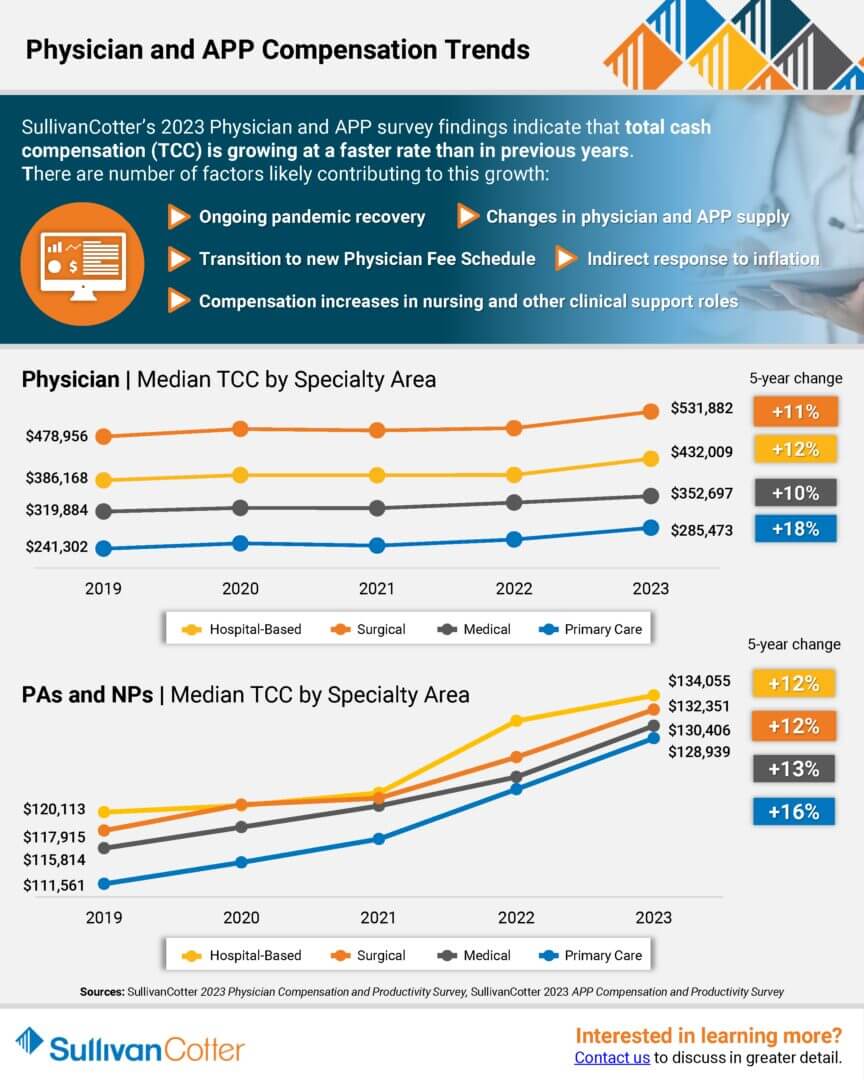

INFOGRAPHIC | 2023 Physician and APP Compensation Trends

Median total cash compensation for physician and APPs continues to grow across all major specialty areas

SullivanCotter’s recent survey findings indicate that total cash compensation for physician and advanced practice providers is growing at a faster rate than in previous years.

There are a number of factors likely contributing to this growth:

- Ongoing pandemic recovery

- Changes in physician and APP supply

- Transition to the new Physician Fee Schedule

- Indirect response to inflation

- Compensation increases in nursing and other clinical support roles

Learn more about median TCC by specialty area and track the growth in annual compensation for Primary Care, Medical, Surgical and Hospital-Based specialties over the past five years. Findings are from SullivanCotter’s 2023 Physician Compensation and Productivity Survey and SullivanCotter’s 2023 APP Compensation and Productivity Survey.

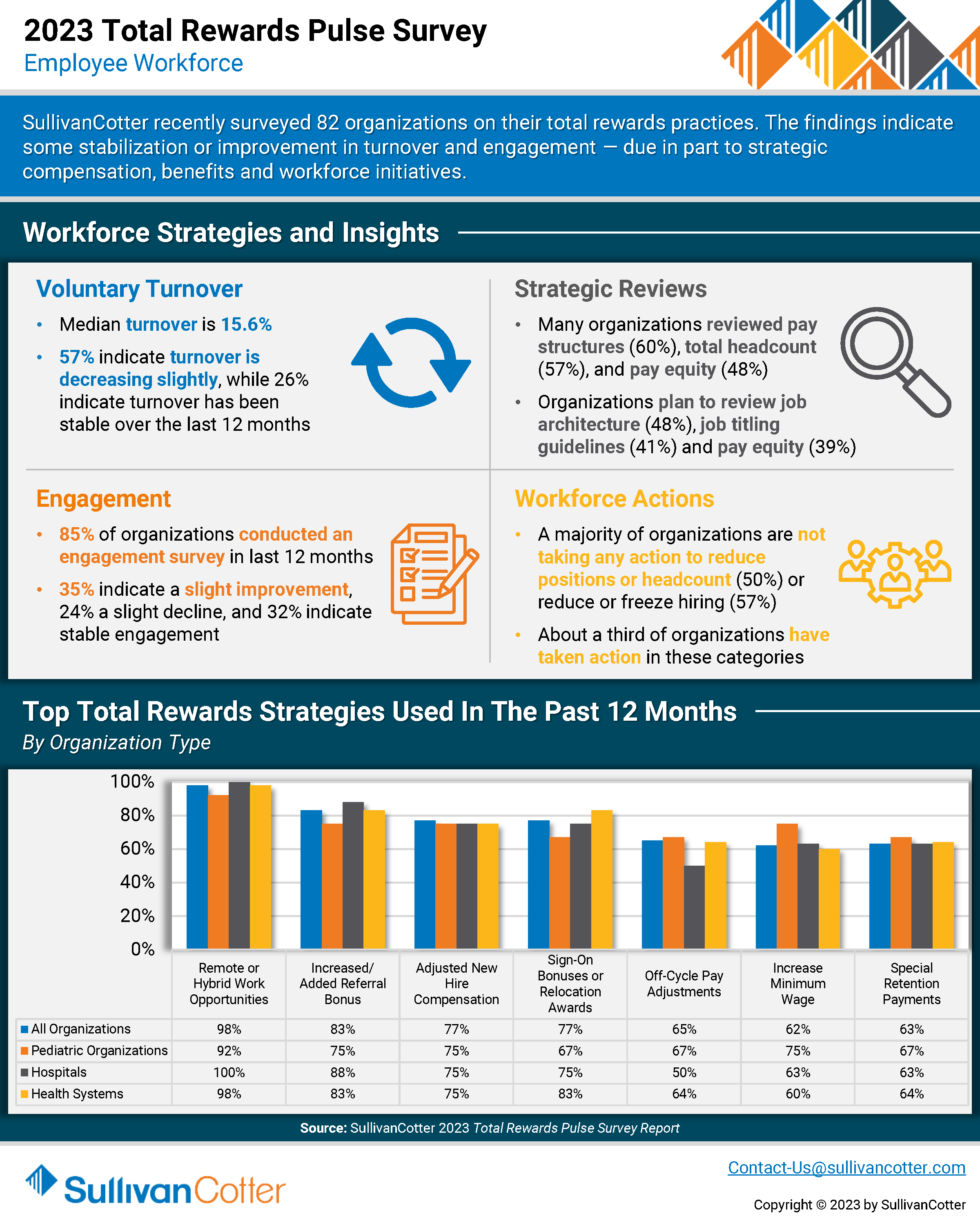

INFOGRAPHIC | 2023 Total Rewards Pulse Survey

Total rewards strategies continue to evolve in response to ongoing health care workforce crisis

SullivanCotter recently surveyed 82 health care organizations on their total rewards practices. The findings indicate some stabilization or improvement in turnover and engagement — due in part to strategic compensation, benefits and workforce initiatives.

In light of recent health care workforce challenges, many organizations are reassessing various workforce strategies in order to stay competitive in a tight marketplace for talent. This includes reviewing employee pay structures, pay equity, job architecture, headcount and more.

Learn more about the top total rewards strategies that organizations have utilized within the past 12 months, different actions organizations are taking to address turnover, and other additions and enhancements being introduced.

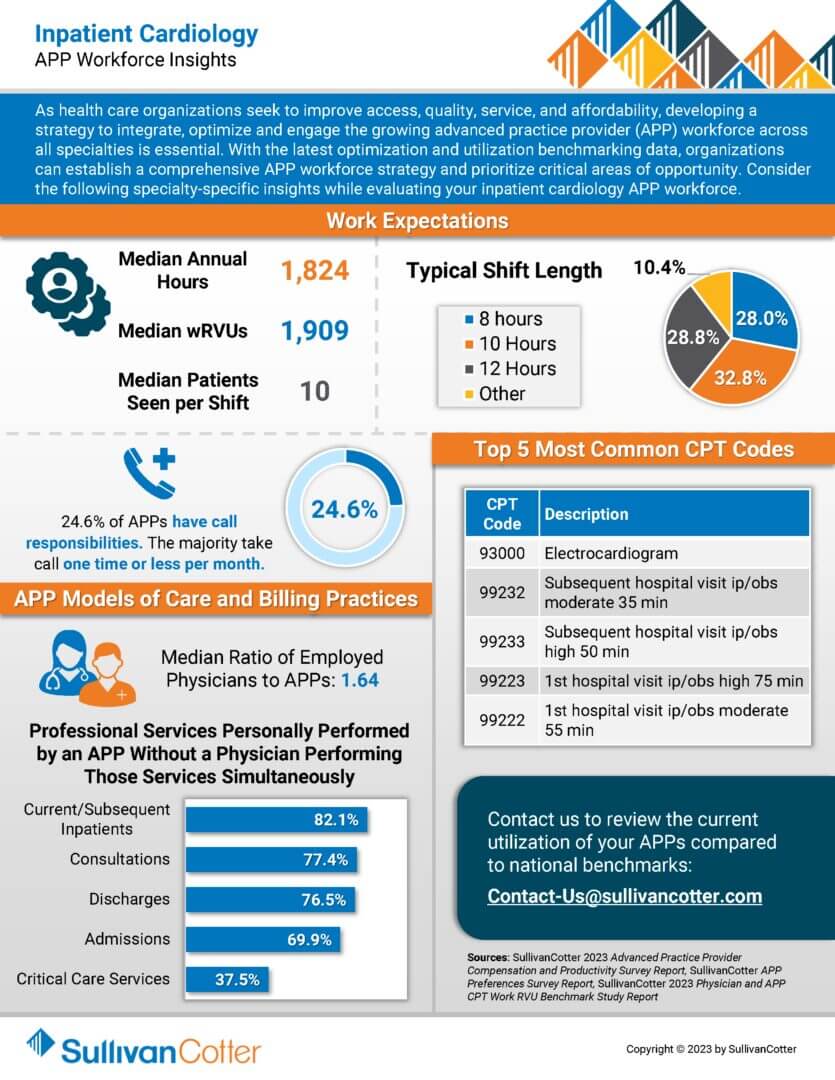

INFOGRAPHIC | APP Workforce Insights – Inpatient Cardiology

Learn more about specialty-specific work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential. With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights while evaluating your inpatient cardiology APP workforce.

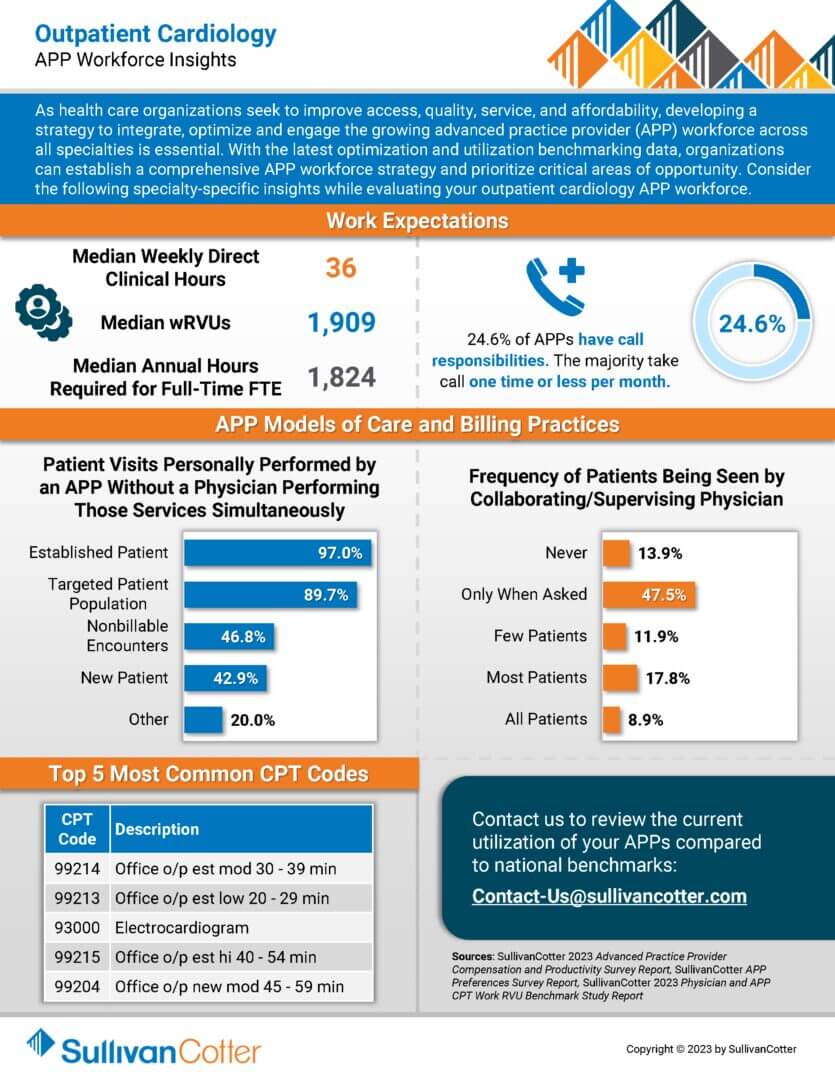

INFOGRAPHIC | APP Workforce Insights – Outpatient Cardiology

Learn more about specialty-specific work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential. With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights while evaluating your outpatient cardiology APP workforce.

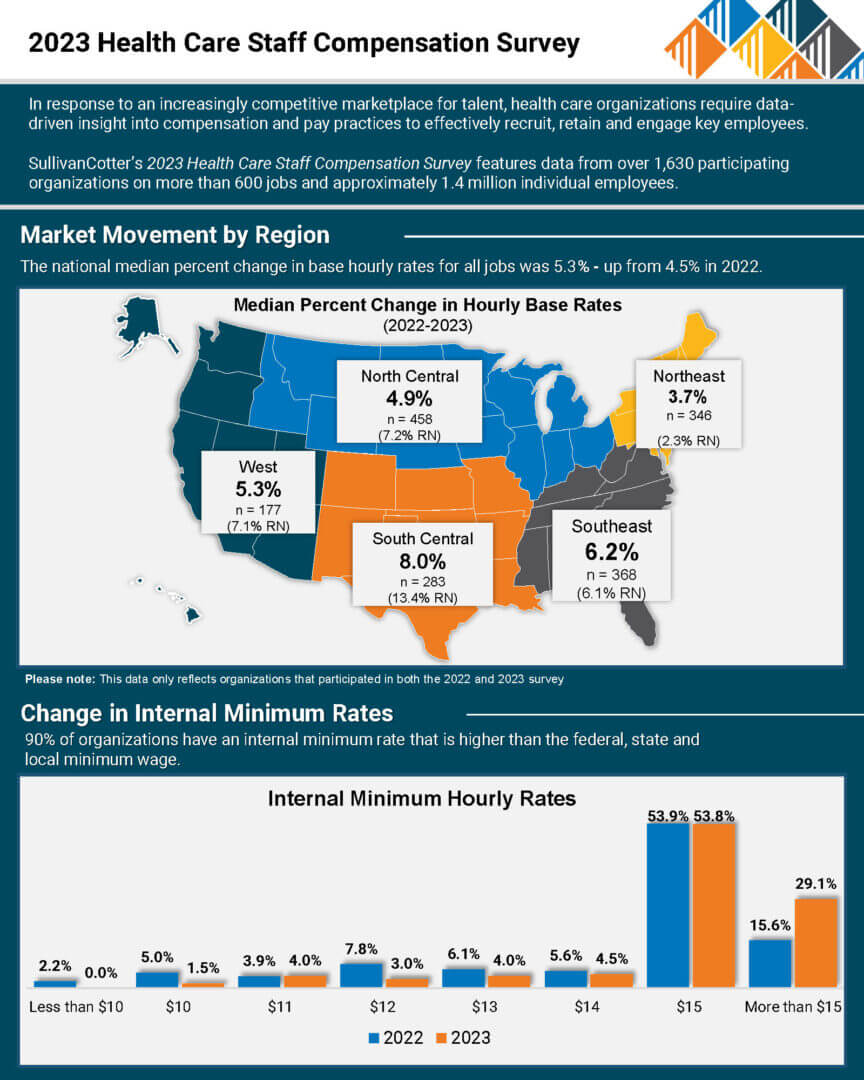

INFOGRAPHIC | 2023 Health Care Staff Compensation Survey

Median base hourly rates for health care staff increased by more than 5% nationally

In response to an increasingly competitive marketplace for talent, health care organizations require data-driven insight into compensation and pay practices to effectively recruit, retain and engage key employees.

SullivanCotter’s 2023 Health Care Staff Compensation Survey features data from over 1,630 participating organizations on more than 600 jobs and approximately 1.4 million individual employees.

ARTICLE | Assessing Pay Equity

Build and Sustain Value-Based Workplaces

Originally published by the American Association of Provider Compensation Professionals

READ FULL ARTICLE

Fairness is a universal value that we acquire early in life. Children are quick to point out the injustices they encounter in their lives with the oft-repeated expression, “That’s not fair!” Over time, our concept of fairness expands to the concept of equity, which translates individual experiences to those at the group identity level (such as men versus women).

As adults, we have perceptions of what is equitable and what is not, including when it comes to compensation. When compensation is not perceived to be equitable, an emotional reaction may be elicited in response. Sometimes, this response is useful and other times, it can

be destructive.

How, then, do we effectively monitor, measure, and achieve pay equity in our health care organizations to encourage calm waters?

In this article, SullivanCotter provides insight into:

- Important factors impacting pay equity such hiring and selection regime, supporting staff resources, training and career opportunities, quality of leadership and mentoring, and more

- The driving forces behind pay equity studies

- A defined process for completing a pay equity study to ensure it yields optimal benefits

- Practical application of pay equity study results including both preventative measures and remediation actions