SullivanCotter’s business valuation services support health system executives, legal counsel and business development professionals in making informed decisions on mergers, acquisitions, divestitures and joint ventures.

Our unique insight provides organizations with an in-depth understanding of the market forces, regulatory environment and operational infrastructure that drive successful transactions.

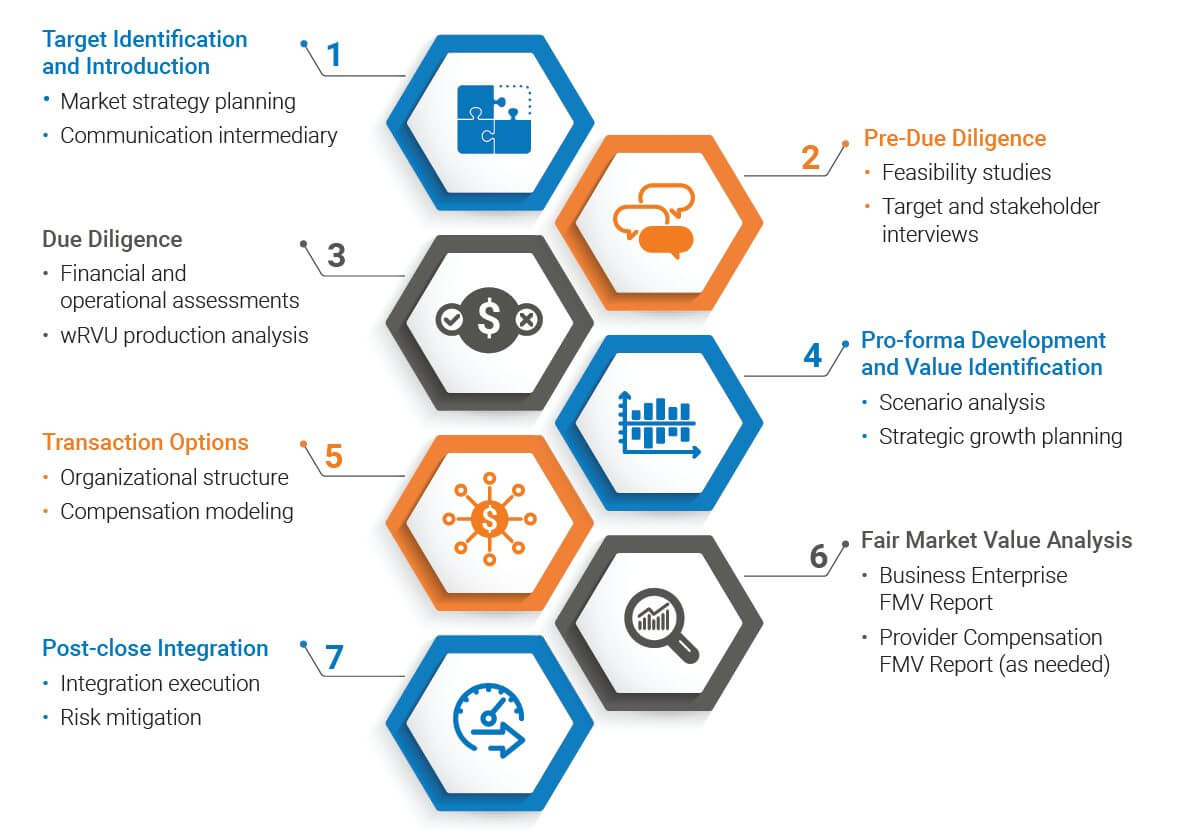

Services to Fit Your Needs

1. Target Identification and Introduction

- Market strategy planning

- Communication intermediary

3. Due Diligence

- Financial and operational assessments

- wRVU production analysis

5. Transaction Options

- Organization Structure

- Compensation modeling

7. Post-close Integration

- Integration execution

- Risk mitigation

Valuation for a Variety of Entities

Valuation Approaches

As health care organizations focus on financial sustainability in an increasingly competitive marketplace, there is a need to think strategically about mergers, acquisitions, divestitures and joint ventures. SullivanCotter’s approach integrates business valuation and physician compensation expertise, proprietary market intelligence and data as well as a fluent knowledge of the evolving regulatory environment.

Income Approach

Based on the present value of all expected future benefits from the business discounted or capitalized at a rate that represents the risk of the business

- Projection of future revenue and expenses

- Projection of future capital expenditures and working capital requirements

- Captures both the tangible and intangible value

Market Approach

Based on comparing the value of similar assets traded in a free and open market

- Derive valuation multiples from market sources

- Price to revenue

- Price to earnings before EBITDA (preferred method)

- Apply multiples to subject company

- Captures both the tangible and intangible value

Asset (Cost) Approach

Based on the principle of substitution, which assumes that a prudent buyer would pay no more for a business than it would cost to assemble all of the individual assets and liabilities that comprise the business

- Value the tangible assets

- Value the intangible asset

- Most common approach for practice acquisitions

Related Information

Learn how to make strategic and informed acquisition decisions.

Related Resources

PODCAST | Community Health Settlements: A Valuator’s Perspective

Physician compensation is facing intense scrutiny – and the $480 million settlements involving Community Health Network (CHN) are a powerful example of what’s at stake. Learn more from three valuations experts in our latest podcast!

Valuation of Management Services and Management Services Organizations

As health care consumerism takes hold, technology evolves, and the industry continues to prioritize value-based care delivery, the definition of “work” for physicians has changed — and the ways in which physicians are compensated have evolved as well. An often-overlooked form of physician compensation, however, is the benefits received through Management Services Organizations (MSOs) and Management Services Agreements (MSAs).

WEBINAR RECORDING | Physician Enterprises After COVID-19: Capturing and Assessing Opportunities

SullivanCotter joins McDermott Will & Emery to discuss how physician practices can position themselves for success in the new health care landscape.