Fundraising Talent Strategy in 2018 and Beyond

Attract and retain high-performing fundraising professionals

As the saying goes, you need money to have a mission. Whether through in-kind donations or the receipt of funds from public or private sources, most not-for-profit organizations rely to some degree on philanthropy to obtain the funds needed to sustain their mission.

For some not-for-profits, the fundraising professionals vital to this process are considered the lifeblood of the organization, and the loss of key talent could mean a loss of momentum and/or continuity in donor relationships. In today’s environment, these organizations are also faced with the decline of both governmental and non-governmental funding sources and, in the wake of the Tax Cuts and Jobs Act (which doubled the standard deduction and will result in fewer itemized returns through which tax-deductible donations are claimed), a reduced incentive to donate. Attracting and retaining people with the critical skill set to perform fundraising successfully has become arduous as not-for-profit organizations face these realities, along with costs of replacing talent as high as 100% of salary in as often as every 18 months.

In developing a fundraising talent strategy for this year and beyond, consider proactive strategies to attract and retain high-performing and high-potential professionals, while also enhancing the capabilities of existing staff. Immediate efforts should focus on:

Auditing the skills and capabilities of the existing team

Complete a skills assessment to ensure the development office includes the types and number of staff necessary to achieve its goals. These types of assessments often reveal the need for:

- Different or additional leadership with the ability to cultivate meaningful relationships among donors and the leadership skills to grow and develop talent. Accomplished fundraising professionals will be drawn to and remain at an organization where leadership in this area is strongest.

- Innovative donor research capabilities and advanced donor analytics to ensure effective data mining. These skill sets can be developed in-house or outsourced.

- Advanced social media expertise. Branding and marketing in the era of social media presents increasingly sophisticated and unique ways to share the organization’s mission with potential donors. Ensure the right resources are in place to keep pace with the market.

Evaluating and expanding recruiting practices

Changes may not be needed for organizations that have identified proven strategies to attract top fundraising talent who stay for more than three years. However, it is worth considering that a tighter labor market for fundraising professionals may require a different approach to sourcing talent:

- For larger organizations, the market for top fundraising executives is primarily national in scope. Other fundraising positions are commonly recruited locally or regionally, though the market segments from which talent are drawn appears to be evolving.

- Universities that have historically looked only to higher education to draw talent are now recruiting fundraising staff from large health systems. Large health systems, in turn, are now including universities and other organizations—such as large charities—in the search for talent.

Evaluating the effectiveness of the compensation program

This is an important consideration, particularly in an environment where certain organizations have become increasingly aggressive in their efforts to recruit and retain high-caliber fundraising professionals.

An important first step in the evaluation of the program is to identify a compensation strategy that will support the organization’s current and anticipated recruitment, retention and performance objectives. Advanced compensation vehicles such as retention plans and/or deferred compensation arrangements may be needed to maintain a competitive edge in today’s market. Implementing such changes may represent a shift in culture and practice that will need additional socialization and buy-in from key stakeholders.

Providing performance-based pay in the form of incentives is legally permissible and more prevalent than ever. Organizations that offer incentives find that these programs can help to:

- Motivate people and teams to meet or exceed fundraising targets. This often requires a “both/and” approach of increasing revenue through effective fundraising strategies and operating more efficiently to reduce costs.

- Improve teamwork and collaboration. In some cases, the introduction of incentives brings a new discipline around fundraising that engages more staff in the development of strategies for securing new donors.

- Limit the amount of fixed costs. Since incentives are paid only when goals are met or exceeded, including incentives in the mix of pay provides a self-funding feature. From an optics perspective, the organization promotes a performance-based culture and demonstrates the sound management of fixed costs. Incentives are no longer considered lavish or unusual. Rather, they are a necessary component of a well-designed compensation strategy.

- Reinforce a culture of performance and accountability. The plan will be most effective when all team members are held to rigorous goals, develop strategies and operating plans by which to meet them, and work together to accomplish results.

- Address gaps in performance areas. After conducting a performance benchmarking study to identify gaps that may exist with respect to various fundraising targets (e.g., total funds raised, number of donors, transformational gifts received, cost per dollar raised), incentives can redirect efforts to fill those gaps.

Increase the focus on — and funding of — talent development strategies

Many organizations provide only basic opportunities for growth and limit talent development budgets in the spirit of cost-saving. By increasing the dollars allocated to skills building and the professional development of fundraising talent, the return on investment can be multifold and differentiate an organization in the minds of prospective and current development staff.

A thoughtful and disciplined approach to the activities outlined above can lead to dramatically improved attraction and retention in a highly-competitive market for fundraising talent. When deploying any new strategy, the key to a successful outcome lies in the design, implementation and communication efforts surrounding the strategy. In advance of proposing modifications to a current approach, traditional wisdom applies: include key stakeholders in the process, consider both current- and future-state needs as plans are developed, and assess the impact of any anticipated program changes. Ultimately, a program that successfully attracts and retains fundraising talent is one that is marketcompetitive, cost-effective, engaging and reinforced as a strategic differentiator for talent both inside and outside of the organization.

PODCAST | Governing Health - Executive Compensation Trends Update

With the new provisions set forth by the Tax Cuts and Jobs Act and recent trends associated with pay equity, the use of clawbacks and the expansion of incentive compensation goals and objectives, the governance of executive compensation remains a critical boardroom concern.

In the most recent edition of the Governing Health Podcast Series, Michael Peregrine, Partner, of law firm McDermott Will & Emery, welcomes two of the leading voices on executive compensation trends and practices in health care: Ralph DeJong, Partner, McDermott Will & Emery and Tim Cotter, Chairman and Managing Director, SullivanCotter.

CMS Star Ratings Highlight Need to Compare Performance by Hospital Type

Understanding what drives performance

As the marketplace for health care grows increasingly complex, organizations must develop a greater understanding of what drives performance to remain competitive.

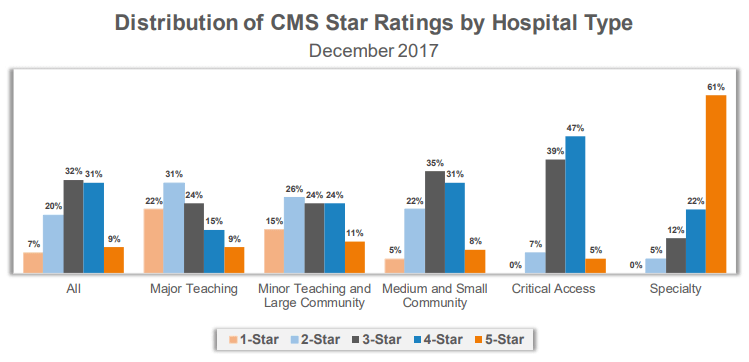

The Centers for Medicare and Medicaid Services (CMS) recently published its newest Star Ratings, designed to measure and report hospital quality. These ratings have provoked a number of questions and concerns as more than 3,600 hospitals - regardless of size, breadth of services, or geographic location - are benchmarked against a collective average.

SullivanCotter was recently featured in a Modern Healthcare article which addresses these differences. As organizations use these ratings to help drive improvement efforts, it is important to consider the following:

- Using national benchmarks like the CMS Star Ratings can be a great way for hospitals nationwide to help drive quality improvement, but only if they understand the nuances and complexities in the data and how to best analyze it.

- Not all hospitals are the same. To truly identify areas of meaningful improvement, hospitals must be compared to like hospitals.

- Organizations cannot improve what they cannot measure, and the new CMS Star Ratings continue to provide transparency in health care quality and performance as the industry shifts from volume to value.

- To drive improvement efforts and help organizations more effectively benchmark performance against their direct peers, the market requires a standard set of national quality metrics that is stratified by hospital type.

READ THE FULL ARTICLE

Using CMS Star Ratings to Drive Improvement at Specialty Hospitals

Using national benchmarks to drive quality performance

DOWNLOAD FULL ARTICLE

In order to remain competitive in an increasingly complex marketplace, health care organizations must develop a greater understanding of what drives performance and improves outcomes in the transition from volume to value. Although the overall aim to enhance patient satisfaction, improve quality and reduce the cost of care is the same, specialty hospitals, academic medical centers, community hospitals, and major and minor teaching hospitals each operate under very distinct circumstances.

The conditions they treat are as different as the populations they serve and it cannot be assumed that patient experience at one type of hospital will be commensurate with the other. The Centers for Medicare and Medicaid Services (CMS) published its most recent Star Ratings in December 2017. While designed to measure and report hospital quality, these ratings have provoked a number of questions and concerns as more than 3,600 hospitals - regardless of size, breadth of services, or geographic location - are benchmarked against a collective average. The complexities and nuances of the new ratings can make it difficult for hospitals to truly understand how they compare to their peers and where there are still opportunities for improvement.

CMS defines specialty hospitals as those that are primarily or exclusively engaged in the care and treatment of patients with a cardiac condition; patients with an orthopedic condition; or patients receiving a surgical procedure. While CMS bases these ratings on 57 different quality measures across seven areas of performance, specialty hospitals only reported an average of 27.2 of the 57 measures. For example, 97% of specialty hospitals reported patient experience metrics. On the other hand, only 5% of specialty hospitals reported data on acute ischemic stroke 30-day mortality and 30-day readmissions because they do not typically treat this condition.

The same is true for patients with complex medical conditions such as pneumonia, coronary artery bypass graft, chronic obstructive pulmonary disease and acute myocardial infarction. Only 20-25% of specialty hospitals that were rated included measures for mortality and/or readmissions for this patient population. Additionally, less than 25% of specialty hospitals reported data for the majority of the NHSN infection rates in the Safety of Care measure group, excluding C. Difficile. The CMS ratings require additional stratification by hospital type in order to paint a more accurate picture regarding how organizations are performing in relation to their direct peers.

However, the impact of further stratification could be significant for specialty hospitals as 83% of the 74 specialty hospitals included received a four- or five-star rating. With a small number of metrics to report, specialty hospitals have fewer variables to address to help improve their scores within this ranking system and, more importantly, the care delivered to patients that can be benchmarked with publicly-reported data. All hospitals, including specialty hospitals, need to understand their variation to national benchmarks as well as the variation to their peers.

Specialty hospitals using CMS Star Ratings to drive improvement efforts should focus on the following steps:

DEFINE YOUR PEER GROUP

In addition to reviewing benchmarks for like hospitals, specialty hospitals must also consider how their ratings compare to other relevant local and regional competitors. Patient experience scores, for example, can vary widely by region. As the highest weighted measure in the CMS Patient Experience group, “Overall Rating of Hospital” had a national average of 89.01 in the December 2017 Star Ratings. On average, Nevada hospitals show a linear score of 86.90 while Wisconsin hospitals show a linear score of 90.78 - a 4.5% difference between the two states. Regional differences are important to consider when evaluating performance compared to a set of benchmarks.

BENCHMARK YOUR PERFORMANCE AGAINST PEERS

Do not underestimate the importance of peer group selection. Not all hospitals are the same – and to truly identify areas of meaningful improvement, hospitals must be compared to like hospitals. Hospitals will often have more than one peer group. For example, a specialty orthopedic hospital will want to benchmark itself against other orthopedic hospitals. However, it might also want to benchmark specific metrics like patient experience against other local hospitals that offer orthopedic services.

IDENTIFY AREAS FOR IMPROVEMENT

It is critical that organizations develop a better understanding of their variation to the CMS benchmarks. If a specialty hospital is performing above or below average, the key is to identify ‘how’ and ‘why’. Individual metrics that have a negative variance to peer group benchmarks highlight potential opportunities for improvement. Additionally, identifying areas that are important to patient outcomes and the mission of your organization will resonate most with staff and have a higher likelihood for improvement.

ALIGN REWARDS WITH TARGETED IMPROVEMENTS

Once an organization selects a specific area to target in improvement efforts, it is important to determine how employees can be motivated or incentivized to engage in these activities. As organizations shift from volume to value, quality metrics are becoming more prevalent in provider compensation plans. For example, according to SullivanCotter’s Physician Compensation and Productivity Survey, quality incentive compensation for physicians increased in 2017 from an average of 5.9% to 7.4% of total cash compensation. Aligning quality improvement efforts with compensation is an effective approach to driving change and helping to reach overall organizational goals.

REEVALUATE REGULARLY

While it is difficult to generate significant progress on one metric in a single year, organizations should not overlook the need to review these benchmarks in aggregate on a periodic basis. If there is a noticeable shift in the data, changing direction and adjusting improvement efforts accordingly is important.

CMS Star Ratings continue to provide transparency in health care quality and performance as the industry maintains its focus on value-based care. Perhaps the adage that best applies is “you can’t improve what you can’t measure” - and these ratings are certainly a step in the right direction. Despite the myriad of differences in the 3,600+ hospitals included in the CMS ratings, all share a common goal of advancing the overall quality of health care. However, to truly drive improvement and help organizations more effectively benchmark performance, the market requires a standard set of national quality metrics that is stratified by hospital type.

Organizations like the National Quality Forum and others are helping to establish these national benchmarks. Standardizing the process would help to facilitate more meaningful comparisons, allowing specialty hospitals to focus more on individual opportunities for improvement and less on their variance from the collective national average.

INFOGRAPHIC: 2017 Hospital-Based Physician Compensation and Work Effort Survey

Benchmarking hospital-based specialties

With the demand for hospital-based physicians on the rise, organizations must understand emerging trends in compensation and clinical work effort standards that are unique to this practice setting.

Learn more and view highlights from our 2017 Hospital-Based Physician Compensation and Work Effort Survey, which includes data on 13 specialties from more than 30 different health care organizations.

DOWNLOAD INFOGRAPHIC

INFOGRAPHIC: 2017 Advanced Practice Provider Compensation and Pay Practices Survey

The role of the advanced practice provider (APP) is changing to reflect increasing specialization and variation by practice setting as care models evolve. Hospital-based roles continue to grow, primary care practitioners are starting to function more independently, and roles in medical and surgical specialties are helping to improve patient access and efficiency of service lines.

This diversity of roles means a 'one size fits all' compensation model is no longer effective and can create obstacles to delivering high-quality and effective care.

As the demand for APPs continues to grow, compensation strategies should be tailored to align with overall provider optimization and organization strategies.

Learn more and view highlights from the 2017 Advanced Practice Provider Compensation and Pay Practices Survey.

Alex Barker, Principal, Joins SullivanCotter's Employee Workforce Practice

Jan. 18, 2018 – Minneapolis – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, welcomes Alex Barker, Principal, to the firm’s Employee Workforce Practice.

Jan. 18, 2018 – Minneapolis – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, welcomes Alex Barker, Principal, to the firm’s Employee Workforce Practice.

Alex is an innovative industry leader with more than 20 years of experience in the strategic management of health care operations. Having held leadership positions at some of the nation’s largest hospitals and health systems, Alex is well-positioned to help clients navigate the rapidly changing health care environment as payment models evolve and organizations take on more risk. With direct insight into how large and operationally complex organizations are aligning their compensation and benefits programs as the industry continues its shift from volume to value, Alex specializes in the development of integrated total reward programs for employees at all levels.

“With strategic, value-based goals such as improved quality, access, service and affordability, organizations must look beyond physicians as the only drivers of clinical performance. Understanding how to better support key organizational goals across all segments of the health care workforce is critical. Alex’s unique combination of experience in the executive, provider and employee workforces is rare, and will be a great asset to our clients as they look to implement a more holistic approach to aligning compensation and performance across the board,” said Ted Chien, President and CEO, SullivanCotter.

Alex also has an impressive range of additional experience that will help him to better assist clients, including governance, operational due diligence, post-merger integration and alignment, workforce resource planning and recruitment, onboarding and retention strategy.

Alex joins the firm from his previous role as a Senior Client Partner in Korn Ferry Hay Group’s Physician Compensation and Governance Practice. Prior to this, he served as the VP of Compensation, Benefits and Physician Services at Lahey Health, where he was responsible for managing both provider and non-provider total reward programs for the entire system.

SullivanCotter Expands Physician Workforce Consulting Services

Jan. 16, 2018 – Minneapolis – SullivanCotter, the leading independent consulting firm in the assessment and development of performance-based total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the expansion of the firm’s physician workforce services with the hiring of industry leaders Ron Vance, Patty Bohney and an additional team of five talented consultants. All associates were previously with Navigant’s Healthcare Practice, and bring specialized expertise in physician compensation and workforce performance.

“In the rapidly changing health care environment, we continue to scale our services and broaden our expertise in ways that help our clients address an increasingly diverse set of strategic challenges. With extensive experience in physician alignment and compensation design, Ron and Patty’s team will be a tremendous asset in delivering long-term, sustainable value to the organizations we advise,” said Ted Chien, President and CEO, SullivanCotter.

Ron Vance joins SullivanCotter as a Managing Principal and will help to lead the firm’s client engagements in enterprise workforce alignment alongside newly-appointed Chief Medical Officer, Dr. Mark Rumans. As an attorney, consultant and certified valuation analyst with more than 30 years of experience in strategic planning, physician-hospital alignment and the development of progressive physician compensation arrangements, Ron has advised a wide variety of health care organizations — including community health systems, private physician practices and academic medical centers — through periods of transformative change.

Patty Bohney joins the firm as a Principal in the Physician Workforce Practice. She has nearly 30 years of combined industry experience as a registered nurse, in addition to a variety of operational, management and consulting roles. Leveraging this unique breadth of expertise and a deep working knowledge of the evolving provider landscape, Patty will work closely with clients on the design, implementation and management of strategic, performance-driven physician compensation programs. She is also a certified valuation analyst and will assist a growing team of consultants in determining fair market value and commercial reasonableness.

In addition to Ron and Patty, SullivanCotter welcomes Kevin Hendrickson, Jaclyn Zurawski, Tony Francis, Kaizad Daruwala and Benjamin Shamis to the firm’s Physician Workforce Practice.

INFOGRAPHIC: 2017 Physician Compensation and Productivity Insights

Physician Reward Strategies Evolving to Align with Performance Drivers and Organizational Goals

In a rapidly evolving health care environment, organizations are faced with a number of key industry trends affecting the way in which health care is delivered and accessed - including a growing interest in population health, physician alignment, continued industry consolidation and more. These activities are scaling the industry in unprecedented ways.

Understanding how these trends impact organizational strategies and their effect on the design of physician compensation programs, including fair market value and commercial reasonableness, is critical as hospitals and health systems nationwide continue to navigate the transition from volume- to value-based care.

Dr. Mark Rumans Joins SullivanCotter as Chief Medical Officer

Nov. 28, 2017 – Minneapolis – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the addition of Dr. Mark Rumans as the firm’s first Chief Medical Officer.

Nov. 28, 2017 – Minneapolis – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the addition of Dr. Mark Rumans as the firm’s first Chief Medical Officer.

With over 30 years of combined experience as a practicing Gastroenterologist and key physician leader, Dr. Rumans brings a wide breadth of both clinical and executive leadership experience to his new role at SullivanCotter. He has a unique background in leading large, multispecialty health care organizations through transformational change, and specializes in enhancing organizational performance through improved access, quality, service and affordability.

As health care continues its shift from volume to value, Dr. Rumans will help organizations align their compensation plans accordingly. He will leverage his understanding of the evolving health care marketplace, including changes in care delivery, the emerging focus on improving population health and the role of value-based reimbursement to assist clients in the development of integrated and holistic compensation and workforce performance strategies.

“In order to better align business and compensation strategy in the new value-based health care environment, organizations must understand how to support clinical performance drivers across all segments of the workforce. With deep working knowledge of current productivity-based compensation plans and direct insight into emerging quality measures and practices, Dr. Rumans will work closely with clients to develop value-based transition plans tailored to the unique needs of each organization,” said Ted Chien, President and CEO, SullivanCotter.

Prior to joining SullivanCotter, Dr. Rumans was the Chief Medical Officer for Vidant Health in North Carolina, where he was responsible for system-level strategy and implementation of physician leadership and integration, value-based care delivery and population health initiatives. He also served as the Physician in Chief for Billings Clinic, Montana’s largest health care organization with approximately 4,000 staff and a growing provider network of 400 physicians and advanced practice clinicians.

About SullivanCotter

SullivanCotter is the leading independent consulting firm in the assessment and development of performance-based total rewards programs and workforce solutions for the health care industry and not-for-profit sector. For 25 years, the firm has provided unbiased advice to executives and boards to help attract, retain and motivate executives, physicians, advanced practice clinicians and employees at all levels. Through the Center for Information, Analytics and Insights, SullivanCotter has developed the most widely recognized compensation surveys in the United States. Combining data-driven intelligence with national insights, we act with integrity to help organizations fulfill their missions, business objectives and regulatory requirements.

INFOGRAPHIC: Designing Health Care Executive Compensation

Drive Performance and Engage Leadership

As health care undergoes unprecedented change and the marketplace for talent grows increasingly competitive, hospitals and health systems must design executive compensation programs that effectively support the organization's talent management strategy. The same trends impacting care delivery, such as ongoing industry consolidation and integration, the focus on population health, and the shift to value-based reimbursement, also have significant implications executive and leadership positions. Aligning compensation with organizational goals in a way that drives performance and engages leadership is critical in such a highly competitive environment and requires the proper tools and programs to help build, buy and protect key executive talent. Learn more about the right questions to ask and actions to consider to help ensure your programs properly support the executive talent strategy.

WEBINAR | A Board Imperative: Designing Executive Compensation to Drive Performance and Engage Leadership

While ensuring the stability of current executive talent is important, board members need to build a strong pipeline for future leadership. Executive roles are becoming increasingly complex as health care organizations nationwide focus on integration, care delivery redesign, value-based care and, ultimately, improving population health. Hospitals and health systems face a number of challenges when it comes to recruiting, retaining, motivating and engaging the right people.

Supporting the next wave of health care leaders through comprehensive talent management, leadership development and succession planning strategies is imperative. As health care continues to evolve, executive compensation programs are also changing to support these goals.

View a recording of this November 14 webinar, hosted by the Health Forum/American Hospital Association, where industry experts from SullivanCotter discussed how to effectively design executive compensation programs that support your organization’s leadership talent management strategy.

Key Learnings

- Understand current trends in executive compensation and emerging talent requirements based on the changing health care environment

- Insight into the specific actions and tools organizations are employing in response to ensure the development of a robust leadership pipeline

- How effective performance measurement in annual and long-term incentive programs can be used to align with organization strategies, support executive engagement and promote leadership development

- The potential implications of overlooking executive talent management, leadership development and succession planning strategies

Attracting and Retaining Physicians Through Benefits

Hospitals and health systems are increasingly employing physicians in an effort to enhance physician alignment, improve quality, grow market share and increase revenue. This labor market trend has focused attention on physician benefits, which may differ from benefits offered to other employees.

Employers of choice establish differences between themselves and competitors in key benefits, such as life insurance, disability, paid time off and retirement, as well as certain physician-specific benefits, such as continuing medical education (CME) expenses, licensing and medical malpractice. This article explores the types of benefits being used by hospitals and health systems to attract and retain employed physicians in today’s marketplace.

Findings in this article reference SullivanCotter's 2017 Physician Compensation and Productivity Survey Report and the 2017 Benefits Practices in Hospitals and Health Systems Survey Report. Survey results were supplemented with SullivanCotter’s extensive knowledge and experience with physician compensation and benefits.

THE ENVIRONMENT

The pace of hospital and health system employment of physicians has sharply increased in recent years. Three-quarters of health care organizations surveyed by SullivanCotter said they plan on increasing the number of employed physicians and advanced practice providers (APPs) by 8% to 11% within the next 12 months. This development is being driven by several notable factors:

Medicare physician reimbursement: Complex new rules implemented under the Medicare Access and CHIP Reauthorization Act (MACRA) will work to the advantage of systems that can accommodate bundled payments, adapt features of (or transition to) accountable care organizations and avoid penalties for such outcomes as preventable hospital readmissions. Hospitals view physician employment as a way to prepare for reforms shifting reimbursement from fee-for-service to reimbursement based on patient outcomes and quality of service.

The desire to capture market share, and to improve quality and efficiency. Consolidation is rapidly occurring in the marketplace, and acquisition of physician groups and practices is one way hospitals and health systems can garner a bigger share of the market. In addition, the expectation is that physician employment can facilitate quality improvement by encouraging better integration of care and communication among clinicians.

Changing market dynamics. Both private-practice physicians and hospitals and health systems are facing an environment of decreased utilization by privately-insured patients, a changing payor mix, and downward-trending reimbursement rates. At the same time, the cost to maintain a contemporary physician practice is increasing. To adjust, physicians in private practice may see more patients with loss of personal time and an increase in stress. Employment with a hospital or health system may offer a better work-life balance and relief from the burden of operating and managing a difficult business enterprise.

As the employment of physicians by hospitals and health systems increases, strategic decisions regarding physician benefits must be made. Key considerations include program costs, market competitiveness and the ability of programs to attract, motivate, reward and retain physicians.

THE STARTING POINT: A STRONG BASIC BENEFITS PACKAGE

The foundation of a competitive benefits program is a strong basic benefits package. Core physician benefits include medical and dental insurance, with competitive cost sharing, short- and long-term disability insurance, life insurance, paid time off, qualified retirement, CME/professional dues and malpractice coverage:

Medical and dental coverage. Typically, physician health care coverage is the same as the coverage provided to the general workforce (i.e., no special provisions), and generally, newly hired physicians are immediately eligible. Many organizations offer several medical plan options; PPO/POS plans are the most common, followed by HMO/EPO plans. High Deductible plans, continue to rise in usage. Most organizations require a contribution for physicians and dependents. Typical cost sharing is an 80-20 employer-employee split (70-30 split for dependents). Dental coverage is also typically provided (with typical cost sharing being a 70-30 employer-employee split or a 65-35 split for dependents). Despite health reform related changes, most surveyed hospitals and health systems say they remain committed to providing health coverage to employees.

Paid leave. The market trend is to provide a single bank of paid time off (PTO) that may be used for any purpose (rather than providing separate leave for vacation, personal days, holidays, short-term sick leave and continuing medical education). Typically, annual PTO benefits provided to physicians range from 25 to 35 days, and may vary by length of service. Carryover and cash-in amounts are typically limited to control liability and ensure that time off is being appropriately used.

Short-term disability. Employer-paid coverage is typically provided in the event of short-term illness. Around half of organizations provide a different short-term disability benefit for physicians than other employees, which may include full salary continuation. The method of coverage varies by employer, and may include paid leave, separate sick leave days, short-term disability insurance or a combination of paid leave and insurance.

Life and long-term disability (LTD) coverage. Employer-paid basic group life and LTD coverage is provided to physicians by most employers. Higher levels of life insurance and LTD coverage may be needed when the basic group coverage does not adequately meet the unique coverage needs of the physicians. Employers often address physician needs through a carve-out classification in the basic group plan (if amenable to the insurance carrier). Where supplemental life and LTD coverage is provided, coverage is typically employee-paid.

Qualified retirement. A strong qualified retirement benefit can make a real difference with recruiting, and can help reduce turnover. The market norm is a defined contribution plan (e.g., 401(k) or 403(b) plan) with employer-matching and/or non-elective contributions and salary deferral opportunities. On average, contributions range from 3 percent to 7 percent of salary (limited to the pay cap, $270,000 in 2017). Although organizations are not allowed to discriminate in favor of physicians, some organizations use Social Security integration formulas to deliver a higher retirement contribution to their physician group (e.g., a contribution of 5 percent of pay, up to the Social Security taxable wage base, plus 10 percent of pay over the wage base). Defined benefits plans, which have experienced a decline in use in recent years, are still seen in the marketplace (particularly account-based programs like “cash balance” plans).

CME/professional dues. Most organizations provide an allowance and time off for continuing medical education (CME) activities. Annual allowances for CME typically range between $3,500 and $5,000, with paid time off between five and ten days. The majority of organizations pay for a portion or all professional dues and medical licensure fees (either through separate reimbursement or as part of the CME allowance).

Malpractice coverage. Employer-paid claims-made malpractice insurance is usually provided to physicians. If newly hired physicians had claims-made malpractice policies at their previous practices, they will need to pick up tail coverage to protect against potential lawsuits that may arise after leaving, which can be expensive. Although not common, employers may offer to pay for tail coverage to recruit and retain doctors; this can be an effective negotiating tool.

OTHER STRATEGIC BENEFITS CONSIDERATIONS

In addition to a strong basic benefits package, other components of a competitive physician benefits package may include the following:

Nonqualified retirement. Qualified retirement contributions for physicians are limited by the statutory pay cap ($270,000 in 2017) and qualified salary deferrals are limited to by federal limits as well ($18,000 in 2017). One way employers can address these issues and increase retention is to provide supplemental nonqualified retirement programs. Unlike qualified plans, eligibility for nonqualified retirement plans must be limited to higher-paid physicians and other highly compensated personnel. Currently around one-quarter of employers provide physicians with some form of nonqualified supplemental retirement contribution. Common approaches include a restoration plan (i.e., one that “restores” qualified benefit amounts limited by statutory caps) and a fixed-percentage contribution of salary (i.e., 3 percent, 5 percent, 7 percent). Typically, vesting requirements apply to employer supplemental contributions (i.e., future service is required before benefits are earned). In addition, most employers offer physicians the opportunity to make salary deferrals to a nonqualified plan (for not-for-profit employers, the maximum annual deferral is limited to $18,000 in 2017).

Long term care (LTC). Although LTC premium costs have risen in recent years, adding LTC coverage to the benefits package can make for a more attractive overall program. Many employers do offer access to LTC insurance, but typically coverage is only available if the employee pays. However, given the importance physicians place on retirement planning and asset protection, employers may wish to give employer-paid LTC coverage a second look. Employers can specifically target physicians with this benefit because LTC is a nonqualified benefit, and is not subject to ERISA or employee discrimination rules.

Repayment of student loans. Medical school debt is a significant problem for many physicians. However, less than 20 percent of employers offer programs to relieve student loans. Providing a loan repayment program to new hires can be a very effective recruitment and retention tool. This option can be particularly attractive in medically underserved areas; some physicians may even be willing to sacrifice a portion of salary for a structured loan-repayment system. When provided, such loan-repayment benefits typically range from $15,000 to $30,000 per year and are usually subject to a lifetime maximum amount (i.e., $100,000, $150,000). Employers may require that this benefit be repaid should the recipient leave the organization within a stipulated period (i.e., three to five years after receipt of the benefit).

Relocation assistance. Most organizations cover the expense of moving household goods and provide a travel allowance. Temporary housing allowances are provided by some employers in addition to relocation expense reimbursement. A few organizations offer guaranteed purchase of a home if it doesn’t sell within a certain time period. The total value of relocation assistance generally ranges from $8,000 to $15,000. The value of the relocation package is typically independent of the physician position level (although this amount does vary by position in some organizations).

Flexible work schedules. Today, new physicians are just as likely to be female as male, and more tenured physicians have postponed retirement due to the recent economic downturn. With these workforce changes have come greater interest in work-life balance and flexible, part-time employment schedules. Forward-thinking organizations recognize that they can do more to attract and retain today’s physicians by creating options for flexible work schedules.

Sabbatical. Less than 20 percent of organizations provide physicians a sabbatical benefit. However, providing a sabbatical leave can have a very positive impact on both physicians and employers, as physicians usually return revitalized and ready to provide better quality of care. Where sabbatical leave is provided, physicians are typically eligible only after several years of service to an organization (e.g., five or 10 years). Leave may range from one month up to a full year. During a leave period, compensation ranges from a percentage of salary to full salary and benefits (depending on the duration of the sabbatical).

Other benefits. Other benefits that may round out a benefits package may include insurance coverage for catastrophic medical events, prepaid legal services, wellness programs, discounts at local businesses and a physician lounge. As organizations look for ways to reduce stress and physician burn-out, physician lounges have been cited as a meaningful way to improve the work environment. Physician lounges are also great places for new practitioners to meet colleagues, and provide a place where collaboration can occur.

FINAL THOUGHTS

Providing physicians with a competitive and well-rounded benefits package can go a long way toward creating an engaged workforce. Yet, building a benefits package that is appreciated by the physician population requires informed decision-making by human resources and proper communication:

Know the needs of your physicians group. Depending on the demographics of the group, some benefit options will be more appealing than others. To understand which options physicians favor, employers may wish to consider surveying their physician group. In addition to group preferences, employers should also take the time to get to know the needs of individuals. Although many benefits offered have to be the same for all employees by policy or law, some benefits, such as CME leave, CME expenses and vacation, can be adjusted to meet individual needs.

Get the support of physician leadership. Human resources leadership should meet regularly with physician leaders to ensure benefit programs are perceived as being adequate, market competitive and meeting the needs of the physician group. Physician leaders may have insight into simple changes that can make benefits packages more effective.

Communicate the real value of your benefits program. While having a well-designed benefits program is important, programs won’t provide meaningful retention value unless they are well-communicated. It is critical that organizations carefully educate and communicate with physicians about the value of their benefits programs. An excellent way to do this is through a total compensation statement. A simple summary of a physician’s individual benefits and what they cost can be a very powerful communication device, and it can highlight the real value of the benefits that may otherwise be taken for granted.

Understand the applicable regulations. When designing a physician benefits program, employers must keep in mind that total compensation (value of benefits and cash compensation) must fall in line with physician fair market value standards. In addition, non-discrimination laws restrain employers from offering special benefits to physicians in certain areas (e.g., health coverage and qualified retirement).

As employment of physicians continues to grow, benefits programs will have an increasing impact on recruitment and retention. Well-designed and well-communicated benefits programs can give hospitals and health systems a meaningful edge in the competition for top medical talent.

Physician Compensation Software Can Help to Drive Clinical Performance

SullivanCotter launches industry-first physician compensation software to drive performance through comprehensive administration, analytical and reporting capabilities

Nov. 1, 2017 - Minneapolis - SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the launch of its Provider Performance Management Technology™ (PPMT™). Developed in cooperation with Mayo Clinic, PPMT™ is an industry-first, cloud-based physician compensation software that enables provider engagement through transparent performance-based compensation administration and analytical capabilities.

“As we began integrating value-based care measures into our physician compensation programs, we required a technology solution to help align our physicians with the new quality metrics. It was critical that physicians engage more closely with the measures, provide feedback, and use them to better understand how to improve their performance,” said Brian Bunkers, M.D., President and site CEO, Mayo Clinic Health System.

PPMT™ incorporates SullivanCotter’s industry-leading benchmarking data into three integrated modules, designed to address a spectrum of needs from leadership, physician and administrative stakeholders. Modules include Provider Performance Management, Revenue and Productivity Analytics and Compensation Management Analytics.

“Many health care organizations are struggling to achieve a set of standard quality objectives with their current productivity-based compensation programs. PPMT™ integrates years of physician compensation and health care expertise and insights with an intuitive technology platform to address a growing gap and significant need in the market - supporting the transition from volume to value through physician alignment and engagement,” said Ted Chien, President and CEO, SullivanCotter.

Mayo Clinic and Dr. Bunkers have a financial interest related to the technology referenced in this press release.

For more information on Provider Performance Management TechnologyTM, visit www.sullivancotter.com/PPMT or contact us at 888.739.7039.

About SullivanCotter

SullivanCotter is the leading independent consulting firm in the assessment and development of performance-based total rewards programs and workforce solutions for the health care industry and not-for-profit sector. For 25 years, the firm has provided unbiased advice to executives and boards to help attract, retain and motivate executives, physicians, advanced practice clinicians and employees at all levels. Through the Center for Information, Analytics and Insights, SullivanCotter has developed the most widely recognized compensation surveys in the United States. Combining data-driven intelligence with national insights, we act with integrity to help organizations fulfill their missions, business objectives and regulatory requirements.

Infographic: 2017 Health Care Executive Compensation Insights

Sustainable Rewards in an Uncertain Environment

As health care evolves and organizations look to manage changes in care delivery, there are a number of environmental trends influencing the way in which executive compensation programs are being structured. Ongoing industry consolidation, the shift towards population health, evolving talent requirements and more are having a big impact on how organizations are developing their compensation strategies to align with an increasingly dynamic marketplace.

New mission-critical executive roles are in high demand, talent market markets are expanding and total compensation is increasing as a result. Moreover, as organizations continue to adopt more performance-based pay programs, annual and long-term incentives are evolving to align with value and to help support strategic goals, stability and leadership retention.

This changing health care environment requires a 'best-fit' approach to compensation, and organizations must weigh strategic, operational and image considerations as they develop solutions.

Learn more about our Manager and Executive Compensation in Hospitals and Health Systems Survey.

Deana Kraft Joins SullivanCotter to Lead External Affairs

Aug 16, 2017 - Minneapolis - SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the hire of Deana Kraft as the Director of External Affairs.

Aug 16, 2017 - Minneapolis - SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, announces the hire of Deana Kraft as the Director of External Affairs.

“Our commitment to understanding, addressing, and anticipating our clients’ needs is the foundation for delivering market-leading advice, research and information. These unprecedented times provide an opportunity for us to evaluate new approaches and partnerships to better predict and respond to the evolving health care landscape. Deana will play an important role in identifying forums for us to connect with other industry and client leaders to uncover emerging trends and develop solutions to address the changing needs of health care organizations,” said Ted Chien, President and CEO, SullivanCotter.

Having worked for and with some of the nation’s top hospitals and health systems, Deana has direct insight into the complex challenges organizations are facing. With 20 years of business and consulting experience, Deana offers a unique perspective on integrating people, information and technology in ways that best anticipate and navigate change. In her role as Director of External Affairs, she will collaborate with clients, industry leaders and SullivanCotter experts to identify emerging trends, expand the firm’s research, and improve the development of data-driven tools, resources and strategies help advance insight into what drives client performance.

Prior to joining the firm, Deana was the Vice President, Human Resources at Cincinnati Children’s Hospital Medical Center and served as the Vice President, Total Rewards and HR Technology, for OhioHealth in Columbus, OH. She was also a Partner with a global human resources consulting firm and led the firm’s North America compensation data and technology business.

About SullivanCotter

SullivanCotter is the leading independent consulting firm in the assessment and development of performance-based total rewards programs and workforce solutions for the health care industry and not-for-profit sector. For 25 years, the firm has provided unbiased advice to executives and boards to help attract, retain and motivate executives, physicians, advanced practice clinicians and employees at all levels. Through the Center for Information, Analytics and Insights, SullivanCotter has developed the most widely recognized compensation surveys in the United States. Combining data-driven intelligence with national insights, we act with integrity to help organizations fulfill their missions, business objectives and regulatory requirements.

Executive Compensation: C-Suite Pay Raises Target Transformational Leaders

Featuring data from SullivanCotter's 2017 Manager and Executive Compensation in Hospitals and Health Systems Survey and industry insights from Tom Pavlik, Managing Principal, and Bruce Greenblatt, Managing Principal, Modern Healthcare has published its annual executive compensation analysis. In this year's article, entitled "Executive Compensation: C-Suite Pay Raises Target Transformational Leaders", author Alex Kacik explores how health care executive roles are more demanding than ever as organizations must recruit from a limited pool of uniquely qualified candidates to lead larger and more complex operations.

Infographic: Spotlight on Advanced Practice Provider Compensation

Advanced practice providers (APPs) remain one of the fastest growing workforces in health care, and their role in transforming care delivery has expanded as focus on team-based care continues to increase. Understanding trends in APP compensation and pay practices is a key step in attracting, engaging and retaining this important provider group.

Our 2017 Advanced Practice Provider Compensation and Practices Survey is currently open for participation. This survey provides critical benchmarking data on physician assistants, nurse practitioners and other certified clinicians across a number of emerging specialty areas.

Learn more about this survey and register to participate.

Infographic: Effective Governance of Executive Compensation

Elements of a Compensation Committee Handbook

As health care continues to evolve and executive leadership roles grow increasingly complex, organizations must take the necessary steps to ensure the effective governance of executive compensation.

SullivanCotter recommends developing a Compensation Committee Handbook –- a valuable resource that can be made available to all Committee members. Suggested documents to include in the handbook outlined in the infographic below.

Compliance Risk Considerations with the Integration of Advanced Practice Providers

As the focus on team-based care intensifies, advanced practice providers (APPs) remain one of the fastest growing segments of the health care workforce. The role of the APP in transforming care delivery is critical, and health care organizations nationwide continue look for better ways to meet their goals around access, quality, service and affordability.

Featured in the American Health Lawyers Association's (AHLA) Health Care Transactions Resource Guide, SullivanCotter examines three regulatory requirements that must be met to help ensure compliance and mitigate risk when integrating APPs into the care delivery team:

- Evaluation of APP competency standards

- Third-party payer policies as they relate to billing for services provided by APPs

- Appropriate attribution of APP work effort in production-based physician compensation plans