Navigating the Nuances of Executive Compensation and Talent Management in Challenging Times

Compete more effectively in a tight market for executive talent.

Featured in the July 2024 edition of The Governance Institute’s E-Briefings

By Bruce Greenblatt, Managing Director and Executive Workforce Practice Leader, SullivanCotter

Healthcare continues to evolve—and some organizations are struggling to keep pace. With complexity at an all-time high and the supply of talent limited, the need to recruit, retain, and engage leadership talent is greater than ever. Designing executive pay programs that are market-competitive and drive organizational performance while also aligning with the overall talent strategy is complicated. Moreover, healthcare boards and their compensation committees are tasked with ensuring executive compensation is fair and reasonable and reflects the mission and values of their organizations—all amidst changing market pressures and growing demands.

Does your organization know how to move forward? With these challenges in mind, this article outlines four important priorities for compensation committees to consider as they oversee the organization’s approach to executive compensation, performance, and talent management.

Pay Competitiveness

In a competitive talent market, effectively attracting and retaining key leaders is more pressing than ever. As some leaders continue to step away and as operations become more complex, there is a critical gap in expertise. The skills required to lead through such change are evolving, and greater value is being placed on those able to lead transformation efforts, drive integration, and operate in a volatile environment.

Moreover, demand continues to outstrip supply as the pool of qualified executive talent is increasingly limited. According to SullivanCotter’s Executive Compensation Pulse Survey conducted in May 2024, 87 percent of health systems are either increasing executive recruitment efforts or undertaking the same level of activity as compared to 2023. All of this is putting upward pressure on total compensation—particularly via higher base salaries.

Compensation committees must ensure that compensation is competitive enough for external candidates and existing high-performing leaders who may be attractive to competitors. Since financial resources are limited, compensation decisions should be measured and strategic, focusing foremost on the most impactful roles. Rewards must be differentiated in a dynamic marketplace to ensure the total spend is optimized—some roles may be appropriately compensated in the mid-market, while others may warrant a compensation premium based on their criticality and impact.

Talent Strategy and Organization Design

Considering evolving talent needs and the limited talent supply, compensation committees and leadership should pay particular attention to the executive talent strategy and succession planning process. Increasingly, an organization’s best source of talent for key leadership roles is found internally. Having a deliberate and ongoing process in place to identify talent requirements, assess availability and needs, mitigate any flight risks, and define and execute development plans is key. Compensation committees should be appraised at least annually of any related succession planning initiatives, including leadership performance, emergency successor readiness, and long-term pipeline development. Given the high demand and changing needs for CEO talent, boards and compensation committees should be especially diligent in developing and monitoring succession plans for this position.

In addition to assessing talent strategy for individual positions, it also is important for compensation committees and leadership to assess the overall organization structure to ensure it is optimized and aligned with strategic objectives. With upward pressure on individual compensation, organizations are assessing whether their total leadership headcount and spend is optimal. In SullivanCotter’s recent Executive Compensation Pulse Survey, 88 percent of health system participants indicated that they have recently or plan to assess the effectiveness of their organizational structure. These actions include reviewing the headcount, spans of control and management layers, reducing or freezing hiring, and developing titling/leveling/career architecture guidelines. Health systems are focused not only on cost optimization but also on talent development by clarifying leadership role definitions and creating clearly defined pathways for career progression through the organization.

Revisiting Incentives

While the initial disruption of the pandemic has subsided, several market pressures are still changing the way executive performance is measured and rewarded. Compensation committees should ensure that incentive performance measures align with operating and strategic priorities as they evolve and that goals have been calibrated appropriately. With financial and operational volatility as the backdrop, goal calibration for executive incentive plans poses a significant challenge. SullivanCotter’s research indicates that nearly half of healthcare organizations have revisited their goal calibration for 2024 incentives.

Changes include the following:

- Evaluating both relative performance compared to peers and absolute scoring results for indicators such as workforce or patient engagement, as an example.

- Widening the range between threshold and target and target and maximum goals to account for volatility and uncertainty in forecasting.

- Setting goals based on expected improvement levels rather than simply absolute scores.

- Seeking third-party assessment of the performance objectives to provide validation around the goals.

In addition to calibrating performance goals, compensation committees should also evaluate incentive program circuit breakers to ensure they remain appropriate. Circuit breaker provisions reduce or eliminate incentive payouts if minimum financial performance is unmet and act as a fail-safe if affordability becomes an issue. Given the volatility of performance in the market and the challenging economic environment, circuit breakers must be meaningful and reasonable. They should balance the need for financial stewardship while also recognizing that other mission-related performance priorities should be rewarded, including delivering high-quality care, ensuring greater patient access, engaging the workforce, and providing exemplary patient service.

Pre-pandemic, a typical circuit breaker would reduce or eliminate incentive awards for performance below 75 to 85 percent of the budgeted operating margin. Such standards may not be appropriate today, with margins hovering, on average, at 1 percent or below. Thus, consideration can be given to setting absolute dollar thresholds for the circuit breaker and/or using a tiered method to reduce awards in pre-defined stages based on actual results. Alternatively, the circuit breaker could be eliminated while a greater weight is placed on financial performance in the organization’s scorecard to ensure an appropriate focus on fiscal stewardship.

Board Governance

With the heightened scrutiny of executive pay levels within tax-exempt healthcare organizations, it is increasingly important for compensation committees to ensure they take a broader view of the compensation program beyond just market competitiveness. As adjustments are considered for the compensation program and individual pay decisions, considerations should also include other essential factors such as pay equity, mission, performance, talent strategy, and more. By adopting a more holistic approach to these decisions, boards and compensation committees can ensure that executive reward programs remain highly defensible and beyond reproach as market conditions evolve, new risks emerge, and organizational dynamics shift.

Conclusion

In the current environment, compensation committees must remain diligent in their oversight and governance. Take a broad view as your organization navigates the nuances of developing a competitive compensation program. Doing so can help compensation committees be confident that their approach will meet organizational objectives in a fiscally prudent manner while supporting recruitment, retention, performance, and talent needs in challenging times.

Key Board Takeaways

Is your executive compensation and talent strategy optimized in today’s environment?

Financial, operational, and workforce challenges within the healthcare industry are at an all-time high. The executive talent market is extremely competitive as the demand for talent continues to outstrip supply. Attracting, retaining, and rewarding leadership is critical.

Boards should consider the following priorities as they reassess their organization’s approach to executive compensation, performance, and talent management:

- With upward pressure on total compensation and unabating financial challenges, explore opportunities to optimize compensation spend. Strategies include differentiating compensation for direct rewards to the most critical talent. At the same time, prepare for highly competitive offers when recruiting externally.

- Ensure critical talent is retained and seek opportunities to build from within. Assess talent risk and direct interventions to critical positions that may be at risk. Focus on succession planning and leadership development.

- Optimize the organization structure by focusing not only on headcount, spans of control, and management layers, but also on titling and career architecture to support talent development.

- Revisit incentive plans to ensure performance goals are properly calibrated and that circuit breakers balance financial sustainability with rewards for advancing the mission.

- Ensure a holistic review of executive compensation beyond just market competitiveness, including consideration of pay equity, mission alignment, performance, and talent strategy.

Beyond Compliance: Get More from Your Annual FMV Assessments

Utilizing Physician FMV Assessments to Guide Strategic Workforce Decision-Making

It’s more that just a ‘box-checking’ exercise!

Originally published by the American Association of Provider Compensation Professionals

Written by Dave Hesselink – Managing Principal, SullivanCotter and Clara Hurtt – Principal, SullivanCotter

Health care continues to grow more complex as organizations respond to ongoing operational, financial, and workforce challenges. To help aid in recruitment and retention, advance key value-based goals, support a variety of physician-hospital affiliation relationships, and often a dynamic combination of several factors – physician compensation is evolving in kind. Moreover, as clinical workforce shortages loom large, the need for competitive compensation arrangements in a tight market for talent is greater now than ever before.

As pay practices change and priorities shift, it’s important to review physician compensation regularly. Most organizations conduct an annual or biannual Fair Market Value (FMV) market assessment to satisfy an internal governance or oversight requirement. The value of conducting an annual FMV review, however, goes well beyond a compliance ‘box-checking’ exercise. Results and observations from these assessments can act as a catalyst to jumpstart strategic workforce conversations, validate investments made in the physician workforce, and ensure an organization is aligned with market-leading practices.

Market Assessment Benefits

Instead of limiting an FMV assessment to compliance purposes only or deciding an assessment is not necessary, organizations should consider several additional benefits:

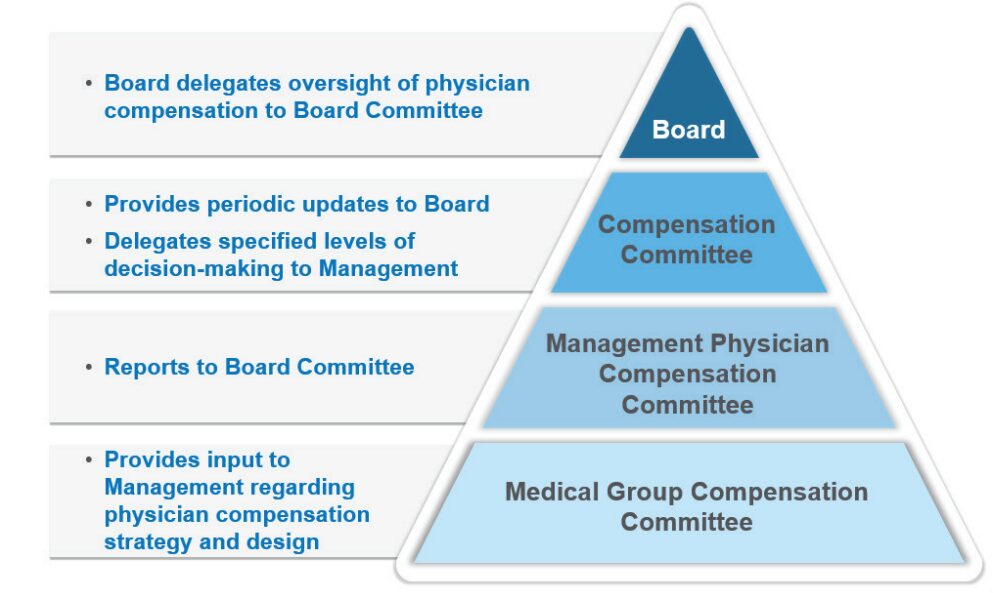

- Opening or enhancing the lines of communication with governance groups: Many organizations have specified Board or Board Committee-level oversight of physician compensation to ensure an understanding of associated compliance risks (see Figure 1 below). With this level of oversight, Boards will better appreciate ongoing recruitment and retention challenges the organization is facing – resulting in a broader discussion of physician compensation from a strategic perspective. This includes physician affiliation and employment and the resulting financial tradeoffs that may be necessary. Board-level engagement in physician compensation is also important from an accountability perspective to ensure management decisions are consistent with an organization’s values and long-term interests. Determine clinician demand, population demographics and payor mix by ZIP code.

FIGURE 1: Typical Physician Compensation Governance Structure

- Illustrating overall market positioning of physician compensation and productivity: Many organizations use regular FMV assessments to track market positioning over time. This serves as a useful gauge of the compensation program’s competitiveness and effectiveness for employed physicians.

- Serving as an important tool for physician workforce planning: A regular FMV assessment identifies physicians who are clinically productive beyond what is sustainable in the long run. These physicians may be highly compensated for their work effort but have a higher potential for burnout – presenting an organizational risk that must be mitigated. It also highlights specialties that are more or less productive than others, pinpoints areas experiencing workforce shortages as indicated by unsustainable productivity levels and helps to determine which specialties may have misaligned work effort expectations – such as an annual clinical work hours expectation that falls short of the market norm.

- Illuminating the effectiveness of the organization’s recruitment programs: Sign-on bonuses, student loan repayment programs, and temporary or long-term housing assistance are all considered economic benefits that must be included when evaluating FMV. The effectiveness of these programs is often reflected by their prevalence and can be evaluated in combination with physician retention rates once these recruitment incentives run their course.

- Identifying outdated compensation rates or pay practices that are no longer necessary: Often these rates or pay practices were adopted to address a particular staffing challenge. For example, the pandemic required extra shift rates to maintain appropriate levels of staffing during an unprecedented industry crisis. Temporary rates were supported from an FMV perspective during this period but are likely not viable long-term. In some cases, unwinding these temporary rates may not have been a priority. An annual FMV assessment can bring these rates to the forefront for review and potential sunsetting.

- Utilizing data collected as part of the FMV assessment to help evaluate pay equity within the physician workforce. Adding ethnicity, gender, and age as required fields within the data collection process can help to flag potential pay inequities. Conducting an effective pay equity assessment requires advanced statistical testing techniques that are not normally included as part of a standard FMV assessment. While an FMV assessment on its own does not satisfy the requirements of a comprehensive and defendable pay equity assessment, it can serve as a catalyst.

The following case study illustrates a practical application of the benefits as outlined above.

Case Study

Health System ABC is a $2.5 billion revenue organization that employs approximately 650 physicians – 65% on an academic track and 35% on a clinical track. Health System ABC conducts an annual retrospective market assessment to satisfy internal compliance and policy requirements. While this annual assessment helps to ensure that compensation aligns with FMV prior to paying year-end incentives, the organization has realized several additional benefits.

1. Determining market competitiveness of compensation

Annual review of aggregate market positioning by specialty highlighted a need to increase pay levels for some specialties to align with the organization’s overall compensation philosophy. In addition, comparing market positioning from year to year demonstrated market movement or more fundamental changes within the workforce.

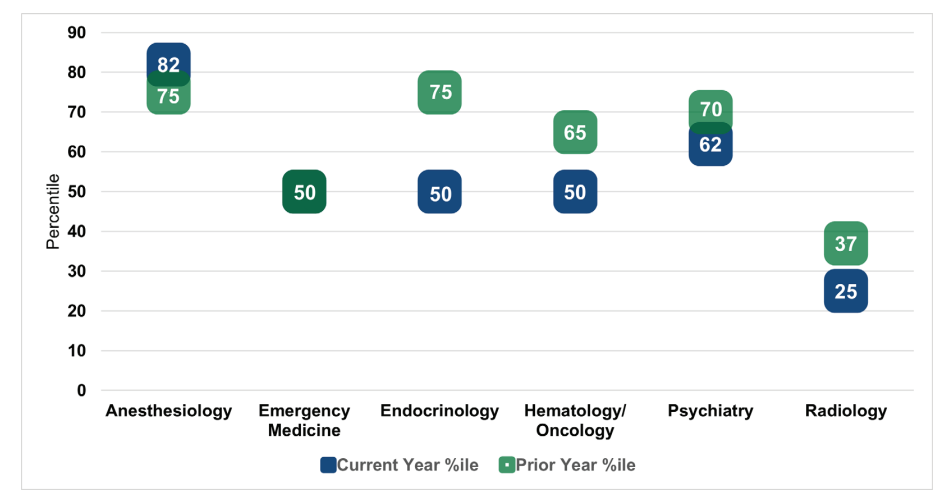

Figure 2: Comparison of Aggregate Compensation Market Positioning by Specialty

(Current Year versus Prior year)

As shown in Figure 2, market positioning for anesthesiology outpaced the prior year by seven percentile points. Upon further research, Health System ABC determined that this finding was a result of short-staffed anesthesiologists picking up extra shifts at premium rates. This validated the need to ramp up the organization’s recruitment strategy for this specialty.

By contrast, current year market positioning for emergency medicine was consistent with the prior year. While Health System ABC had made an important investment into physician compensation within this department, the annual FMV assessment demonstrated that the investment was only just

keeping pace with market movement. Current year positioning for endocrinology, hematology and oncology, psychiatry, and radiology fell below the prior year. After reviewing new hires, terminations, and incentive payouts in each of the specialties, Health System ABC recognized that additional

investments in physician compensation were needed to maintain pace with the market.

Radiology, in particular, fell well below the organization’s target compensation range as defined by the physician compensation philosophy. As a result of their annual FMV assessment and recent recruitment experience, Health System ABC made a strategic decision to invest in this specialty to ward off potential shortages and retention issues.

2. Measuring compensation plan effectiveness

The annual FMV assessment identified several individual physicians whose compensation outpaced productivity. Health System ABC observed that the department distribution methodology for the incentive pool within certain specialties had little to no relation to individual physician performance (e.g., shared equally among the physicians, prorated based on total FTE). This observation provided the organization’s leadership team with a reason to limit the number of distribution methodologies to those that factor in individual physician performance. This made the plan easier to administer and aligned incentives more closely with individual performance and contributions.

3. Eliminating temporary critical staffing rates

Health System ABC’s FMV assessment found that a particular COVID-19 shift coverage rate, which paid hospitalists above the 90th percentile, was still in place 12 to 18 months post-pandemic. While the rate was necessary during the pandemic, it was no longer necessary under current circumstances. After the continued use of this rate was brought to light, Health System ABC worked quickly to assess and eliminate high shift rates. This helped to decrease costs and align rates more closely with the market.

4. Redefining the definition of clinical full-time equivalent (FTE)

As part of the annual FMV assessment, Health System ABC collected data on hours worked in hospital-based specialties. When comparing hours worked for a 1.0 FTE Emergency Medicine physician to the market definition, Health System ABC learned that its FTE requirement was approximately 300 hours less. While the organization couldn’t close the 300-hour gap overnight, this observation led to additional workforce planning discussions with the Department Chair.

5. Aligning leadership rates to the market

Historically, Health System ABC had paid a single hourly rate across all specialties for entry-level leadership roles. By using this approach, the organization was inadvertently disincentivizing physicians in highly paid specialties to accept leadership roles as they could earn more on an equivalent time basis in their clinical roles. With the help of an annual FMV review, Health System ABC implemented specialty-specific leadership rates to more appropriately align leadership pay to the market.

While the ultimate objective of Health System ABC’s annual FMV assessment was to satisfy a compliance obligation, the observations and information obtained throughout the review helped the organization to understand whether workforce decisions and investments continued to align with organizational needs and market-leading practices.

Conclusion

As health care organizations look to design, evaluate, and administer physician compensation in an increasingly complex marketplace, they require a comprehensive governance and oversight process to help support ongoing compliance and mitigate regulatory risk. While many conduct an annual or biannual FMV assessment to satisfy legal obligations, there are additional benefits for organizations to consider as they undertake these evaluations.

These include creating clearer lines of communication with the Board’s Compensation Committee, quantifying market competitiveness, supplementing workforce planning efforts, understanding the effectiveness of recruitment and retention programs, refining or removing outdated pay practices, and providing a baseline for a physician pay equity assessment. Regular FMV reviews are not only an essential component of an organization’s physician compensation strategy, but they can also help to support a more holistic and well-rounded understanding of your physician workforce.

Forbes | How Health Care is Evolving to Combat Labor Shortages

Organizational Design Matters: How Health Care is Evolving to Combat Labor Shortages

The demand for health care is at an all-time high. Can the industry keep up?

With the health care workforce crisis in full swing, the industry requires more agile and innovative solutions if it hopes to forge a sustainable path forward.

Ongoing labor shortages remain a primary concern for many health care organizations nationwide – especially as patient demand increases. Those unable to adjust may struggle with rising costs, lower quality of care, and patient access.

Recently featured in Forbes, SullivanCotter’s President and CEO, Ted Chien, highlights how true transformation requires the industry to:

- Modernize clinical staffing models through a greater understanding of patient population needs

- Optimize organization design with insight into the size, shape, and cost of the employee population

- Modify our vision of talent to prioritize upskilling in preventative health, build the nursing pipeline, and nurture non-traditional pathways to clinical employment

Is the U.S. Health System Status Quo Sustainable?

Several key factors impact the financial sustainability of hospitals and health systems

How is your organization addressing this issue?

This provocative byline from the January 15th edition of The Keckley Report and updates from J.P. Morgan’s 2024 Healthcare Conference underscore the importance of financial sustainability for not-for-profit health systems. While health financial performance seems to have stabilized in recent months for many hospitals and health systems, ongoing sustainability is still an issue that looms large.

Financial recovery efforts have been underway since 2022 with most health care systems stabilizing the core of their enterprises by focusing primarily on surgical and procedural services. Many are also addressing staffing shortages and escalating costs, dealing with unionization in some markets, managing decreased volume in certain specialties, optimizing operational performance, and negotiating improved reimbursement where possible. As these efforts continue, right-sizing service portfolios, sites of care, and workforce composition will better enable organizations to define and focus on their core services while exiting unnecessary or underperforming ones.

Midway through 2024, multiple industry reports indicate that surgical and procedural volumes have increased back to pre-pandemic levels – placing additional pressure on staffing supply, costs, and the need to increase revenue to keep pace with expenses. With greater stabilization and markets and service portfolios being rationalized, efforts can be focused on improving retained services, assets, and the workforce required to support patient access. In parallel, organizations can then consider opportunities for select programmatic growth within their core business and in new areas to diversify revenue.

A key factor in health system sustainability is the investment in its clinician ecosystem – including employed physicians and APPs and various forms of clinician affiliations and relationships with independent clinicians. Health systems are eager to understand and optimize the appropriate level of investment more broadly across their physician enterprise, medical group, specific service lines, and the clinical workforce.

Integral to this effort is continuous performance improvement in three critical areas:

- Aligned enterprise performance metrics and incentives

- Effective relationships with a critical mass of aligned clinicians

- Enhanced performance management

Aligned Metrics and Incentives

Designing organizational performance metrics and incentives that are aligned across the enterprise is critical to achieving and sustaining desired results. The entire enterprise must be interconnected to drive greater performance. This includes shared accountability as it relates to the most impactful measures with a greater understanding of how individual, team and departmental contributions support organization-wide success.

Objectives set at the system level may not translate to the medical group, which can potentially lead to disparate and isolated priorities during the goal-setting process. Vertical alignment in KPIs across both employed and affiliated clinicians will help improve service line delivery and achieve pay-for-performance metrics in payer contracts. In addition, unified scorecards create an opportunity to align performance with the executive level, medical group leadership, practices, and clinicians.

Effective Relationships with Clinicians

As health systems continue to rationalize their core services and drive select programmatic growth, defining the critical mass of clinicians needed within the organization is critical to ensuring success. This includes understanding the workforce requirements of employed and/or affiliated physicians and APPs by specialty and geographic location.

Next, understanding how to align and engage these clinicians is critical to developing effective relationships and ensuring the clinical workforce is working to identify areas for continuous improvement and achieve strategic objectives.

These efforts can be supported in several ways:

- Optimizing staffing models to drive greater patient access, improve clinician satisfaction, and address burnout and turnover

- Developing the right physician-hospital affiliation relationships to accommodate various evolving workforce requirements and needs

- Empowering clinicians through leadership positions or other decision-making roles

- Structuring compensation arrangements to include measurable incentives that drive clinician behaviors and performance in a way that aligns with organizational goals

Optimized Performance Management

Several key factors impact the financial sustainability of hospitals and health systems. These include patient access, utilization, reimbursement, providers and staff composition, effective models of care, and efficient use of resources. Understanding and measuring current performance levels within each of these areas is essential. A close evaluation of productivity, referral and out-migration patterns, compensation, staffing ratios, and investment per provider full-time equivalent can help organizations leverage their strengths more effectively as well as identify opportunities for improvement. Health systems should continually monitor their medical group’s performance and periodically reassess to consider evolving goals and circumstances. Optimizing the overall performance of affiliated clinicians is equally important and can be achieved by assessing each affiliate agreement to ensure incentives are aligned.

Conclusion

As hospitals and health systems continue to address dynamic market, workforce, and operational challenges, ensuring financial sustainability is necessary. For many organizations, this will likely be found in the orchestrated confluence of strategically aligned and rationalized service portfolios, performance metric and incentive alignment, clinical workforce design, and performance optimization.

Continuous performance improvement in these areas will help yield year-over-year financial improvements that will meaningfully influence health system sustainability in these critical years to come.

Long-term sustainability requires all hands on deck.

SullivanCotter’s Provider Affiliation and Optimization team partners with organizations to identify, quantify, and optimize physician and advanced practice provider (APP) relationships and performance to improve productivity, engagement, financial results, staffing ratios, and more.

INFOGRAPHIC | APP Workforce Insights: Hematology Oncology

Learn more about work expectations, models of care, billing practices and more within Hematology Oncology.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Hematology Oncology when evaluating your APP workforce.

ON-DEMAND WEBINAR | Struggling to recruit and retain your nursing workforce?

Maximizing the Employee Value Proposition

A Holistic Approach to Nursing Recruitment and Retention

Hosted by the American Hospital Association/Health Forum

How is your organization addressing ongoing nursing shortages? Many hospitals and health systems are reassessing various nursing workforce strategies in order to stay competitive and support recruitment and retention in a financially sustainable way. While this often consists of reviewing broader employee total rewards programs, it also includes a careful analysis of current workforce structures. View our recent webinar on-demand to learn how to:

- Design an effective total rewards strategy amidst workforce shortages

- Adjust nursing pay programs to account for differences in cost of living, geography and care settings

- Analyze span of control, headcount, nursing job architecture and career frameworks to help identify areas for improvement

Fill out the form below to view the webinar recording!

PRESS RELEASE | Sullivan Cotter Holdings, Inc. Acquires Lotis Blue Consulting

Sullivan Cotter Holdings, Inc., Adds Health Care Organizational Design and Strategy Execution Services to Portfolio

—

June 20, 2024 – CHICAGO – Sullivan Cotter Holdings, Inc., the nation’s leading human capital information management holding company for health care and not-for-profit/tax-exempt organizations, has acquired Chicago-based Lotis Blue Consulting.

Formed in 2005, Lotis Blue (previously Axiom Consulting Partners) works with organizations in multiple industries to develop solutions to their most complex and difficult problems related to organization, teams, workforce, and leadership. Having served over 450 clients since their founding, they have built a reputation for delivering business impact through strategy-led organization design, talent management, and improving the performance of executive teams and leaders. The firm’s robust and proprietary approach to combining data and behavioral science to elevate workforce, leadership, and organizational performance in service of strategy execution is uniquely positioned in the market and credited with realizing sustained client results. In 2024, Forbes recognized the firm as one of America’s best management consulting firms.

Lotis Blue will continue to serve clients across all industries as it expands more deeply into the health care industry. Existing and prospective health care and not-for-profit/tax-exempt clients of Lotis Blue and the individual brands within Sullivan Cotter Holdings, Inc. – SullivanCotter, Clinician Nexus and C3 Nonprofit Consulting Group – will specifically benefit from expanded services and related offerings.

“When we offer Lotis Blue services in conjunction with our portfolio of companies, we create synergistic services for health care and other not-for-profits that support business transformation at all levels,” said Ted Chien, President and CEO of Sullivan Cotter Holdings, Inc. “Health care is in a transformative period that requires careful consideration of structure with the ability to execute real organizational change. This acquisition allows us to leverage talent and experience within the general industry that can be critical to transforming health care.”

Health care organizations face labor shortages, market consolidation, and increased patient demands for a more integrated, value-based care experience. As a result, they are under pressure to reimagine operational models and structure – addressing everything from talent recruiting and retention to workforce development to incentives, rewards, and compensation. More so, they seek individualized data and analytics to guide potential business shifts that will drive positive change across labor, revenue, efficiency, and patient experience.

“Sullivan Cotter Holdings has an incredibly deep bench of knowledge within its brands,” said Garrett Sheridan, CEO of Lotis Blue. “We see this as an opportunity to expand our services to create a holistic, multi-disciplinary resource for organizations looking to strategically transform how they compete and serve their highly purpose-driven stakeholders in today’s ever-changing market.”

About Sullivan Cotter Holdings, Inc.

Sullivan Cotter Holdings, Inc., is the parent company of independent operating brands SullivanCotter, Clinician Nexus, Lotis Blue Consulting and C3 Nonprofit Consulting Group. This collection of complementary brands helps organizations solve complex workforce issues by enabling people, processes and technology aimed at large-scale business transformation.

For more information, email info@sullivancotter.com or call 888.739.7039.

Note to media: Additional information and interviews are available on request.

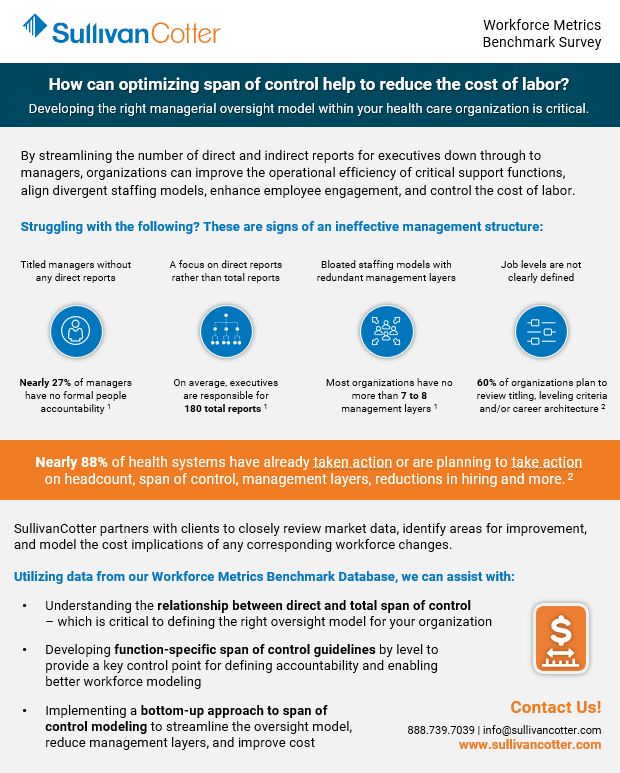

Optimize span of control to help reduce the cost of labor

Developing the right managerial oversight model within your health care organization is critical.

By streamlining the number of direct and indirect reports for executives down through to managers, organizations can improve the operational efficiency of critical support functions, align divergent staffing models, enhance employee engagement, and control the cost of labor.

Struggling with the following? These are signs of an ineffective management structure:

Titled managers without any direct reports.

A focus on direct reports rather than total reports.

Bloated staffing models with redundant management layers

Job levels are not clearly defined

Nearly 27% of managers have no formal people accountability 1

On average, executives are responsible for 180 total reports 1

Most organizations have no more than 7 to 8 management layers1

60% of organizations plan to review titling, leveling criteria and/or career architecture2

Nearly 88% of health systems have already taken action or are planning to take action on headcount, span of control, management layers, reductions in hiring and more.2

SullivanCotter partners with clients to closely review market data, identify areas for improvement, and model the cost implications of any corresponding workforce changes.

Utilizing data from our Workforce Metrics Benchmark Survey, we can assist with:

- Understanding the relationship between direct and total span of control – which is critical to defining the right oversight model for your organization

- Developing function-specific span of control guidelines by level to provide a key control point for defining accountability and enabling better workforce modeling

- Implementing a bottom-up approach to span of control modeling to streamline the oversight model, reduce management layers, and improve cost

Sources: 1. SullivanCotter Workforce Metrics Benchmark Database, 2. SullivanCotter 2024 Executive Compensation Pulse Survey

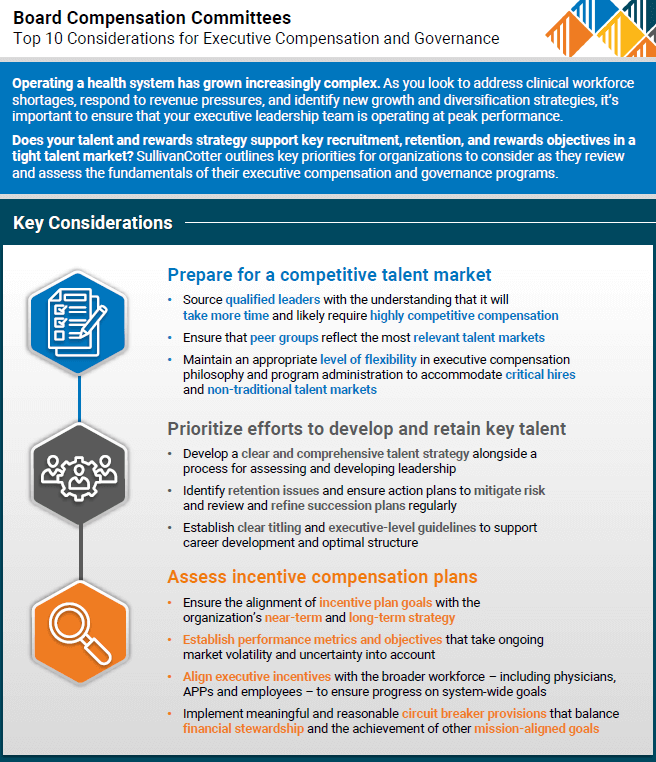

Top 10 Considerations for Executive Compensation and Governance

Does your executive compensation strategy empower and engage your organization’s leadership team?

Don’t miss out on top talent.

Operating a health system has grown increasingly complex. As you look to address clinical workforce shortages, respond to revenue pressures, and identify new growth and diversification strategies, it’s important to ensure that your executive leadership team is operating at peak performance. However, in today’s highly competitive talent market, many organizations are struggling to recruit, retain, and reward individuals in these key leadership roles.

SullivanCotter outlines key priorities for your Board’s Compensation Committee to consider as they review and assess the fundamentals of their executive compensation and governance programs.

These guidelines will help you to:

- Prepare for a competitive talent market

- Prioritize efforts to develop and retain key talent

- Assess incentive compensation plans

Forbes | The Labor Crisis is Derailing Health Care Transformation

How Can Organizations Fix the Labor Crisis that is Derailing Health Care Transformation?

Without a stable and engaged workforce, health systems are limited in their ability to truly transform

Although some organizations are making headway as new business strategies emerge and care delivery models evolve, the current labor market continues to be a major roadblock.

The industry has hit a wall. How can we fix this?

Recently featured in Forbes, SullivanCotter’s President and CEO, Ted Chien, highlights how true transformation requires the industry to:

- Redefine clinical performance in the shift to value-based health care

- Leverage technology in a way that works for clinicians – not against them

- Modernize compensation and care delivery models

- Create better pathways to employment

INFOGRAPHIC SERIES | Workforce Metrics Benchmark Survey Insights

Looking for workforce data and innovative new strategies to manage the growing cost of labor?

Discover how the size, shape and cost of your health care workforce compares to the market with data from SullivanCotter’s growing Workforce Metrics Benchmark Survey database.

Learn more from our recent series of infographics:

Workforce Structure and Cost

Evaluating your workforce structure to optimize the mix of management and staff-level employees can help to streamline performance while also reducing costs. To help address an ongoing health care workforce crisis, organizations require critical insight into the size, shape, and cost of their employee population. Optimizing your workforce structure to ensure an efficient mix of management and staff employees can help streamline performance while also managing costs.

Managerial Oversight and Span of Control

Looking to reduce the cost of labor and enhance employee autonomy, satisfaction, and engagement? As health care organizations look for better ways to optimize care delivery and improve performance, evaluating the number of direct and indirect reports can identify opportunities to streamline managerial oversight. This helps to reduce the cost of labor and can lead to improved employee autonomy, engagement, and satisfaction.

Workforce Size

Are you struggling to manage the size and complexity of your employee population? Understanding workforce growth and distribution across different job families and how this compares to the market plays a key role in effective workforce planning.

Workforce Demographics

Looking to build a more diverse and representative workforce? As important diversity, equity, and inclusion (DE&I) initiatives remain a top priority for health care organizations nationwide, many seek greater insight into the composition of their employee populations as represented across race, gender, and other demographic characteristics.

Dive deeper into the data with this year’s survey report.

Effectively managing the size, shape, and cost of your employee workforce remains a top priority in a complex marketplace.

The 2023 Workforce Metrics Benchmark Survey includes critical data on clinical and non-clinical job families, 6 career-level categories, and important demographic groupings to help answer critical workforce planning concerns.

Fill out the form below to access the free infographics.

ARTICLE | Co-sourcing Strategic Compensation Management Initiatives

Don’t let critical compensation initiatives fall to the wayside.

Co-sourcing is an immediate solution with long-term benefits

As health care organizations continue to struggle with ongoing clinical workforce shortages, it’s important to note that other non-clinical roles and shared services departments are facing similar staffing challenges.

If in-house compensation and human resources teams are finding themselves overburdened or understaffed during such an unprecedented time, co-sourcing can provide interim support to help alleviate any constraints in timing, resources, recruitment or experience.

Featured in a recent article from the HR Daily Advisor, SullivanCotter’s Cathy Loose and Christina Miller discuss how highly-skilled consultants can collaborate with health care industry leaders and internal team members to reduce the operational burden so they can focus on patient care, managing the organization, and delivering on strategic business imperatives.

Proactive Workforce Planning: Grounded in Data

Meeting Three Essential Business Imperatives in an Ongoing Health Care Workforce Crisis

Enhancing Revenue, Reputation and Resilience

Amid an ongoing health care workforce crisis, hospital and health system leaders are confronting employee burnout, wage pressure, staff departures and other challenges while striving to deliver high-quality, affordable and accessible care.

In a recent article for Fierce Healthcare, SullivanCotter’s President and CEO, Ted Chien, describes the benefits of analyzing workforce size and shape and how robust benchmarking can inform long-term planning and provide the backbone for critical structural decisions.

He also highlights important foundational questions leaders should be asking themselves to help them better manage three critical business imperatives: Revenue, Reputation, and Resilience.

Physician-Hospital Affiliation Strategies

Physician-Hospital affiliation strategies designed to improve organizational performance

Market pressures continue to test the financial sustainability of health care organizations nationwide. To succeed in a rapidly evolving marketplace, health systems, medical groups and physicians must work together to develop a more intentional and comprehensive affiliation strategy to help drive performance and improve outcomes.

Affiliation strategies continue to evolve and new trends are emerging as organizations look to address increasingly complex challenges such as the ongoing impact of the COVID-19 pandemic, staffing shortages, changes in reimbursement, and mounting financial pressures.

These factors have accelerated the pace of change in affiliation models and resulted in several emerging trends:

Shift from Private Practice to Employment

The shift towards employment and away from private practice has accelerated following the onset of the pandemic. Data shows that over 70% of US physicians are employed by hospitals, health systems or corporate entities.1

Growth of Non-Traditional Health Care Participants

New players have entered the market and are creating more competition to recruit and retain physician talent. The presence of other physician employers in private equity, retail medicine, joint ventures, and insurance companies is threatening the ability of traditional health systems to grow and retain market share.

Expansion and Refinement of Co-Management Arrangements

In addition to refining current arrangements to focus on more meaningful performance metrics such as expanding access, encouraging greater care coordination, reducing variation of care and aligning metrics with payer reimbursement, health systems are expanding the use of these arrangements to additional service lines. There is also growth in service line governance which enables physician leadership to have a “seat at the table” and authority in service line decision-making.

Advancement of Professional Services Agreements

Professional services agreements (PSAs) continue to be highly utilized in circumstances where physicians want to retain their autonomy under an ‘employment lite’ scenario. They are also prevalent in states where regulations prohibit direct employment of physicians.

Focused Efforts on Strategic Affiliation

While health systems have historically evaluated physician affiliation alternatives on a case-by-case basis, many are now highly engaged in system-wide provider workforce planning. There is a movement toward dedicated teams or individuals to focus on strategic provider affiliation.

Affiliation to Support New Care Models

As a way to improve access for the communities they serve, many health systems are affiliating with physicians as a means to support new care models such as telehealth, hospitalist-at-home programs and other niche clinical service offerings.

1 Source: Physician Advocacy Institute. (2022). COVID-19 Impact on Acquisitions of Physician Practices and Physician Employment 2019-2021. Accessed at http://www.

physiciansadvocacyinstitute.org/Portals/0/assets/docs/PAI-Research/PAI%20Avalere%20Physician%20Employment%20Trends%20Study%202019-21%20Final.pdf

SullivanCotter partners with clients to develop affiliation frameworks that drive physician alignment, medical group performance, and financial results.

Contact us to learn more.

PRESS RELEASE | SullivanCotter Expands Advanced Practice Provider Services Team

APP Workforce Practice: SullivanCotter appoints Market Leader and welcomes strategic new consulting hires

Chicago, IL | March 14, 2023

SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for health care and not-for-profits, announces the expansion of its advanced practice provider (APP) services team to help clients navigate an increasingly dynamic talent market for nurse practitioners, physician assistants, CRNAs and more.

Zachary Hartsell, a Principal in SullivanCotter’s APP Workforce Practice, has been appointed to the new role of APP Market Leader, reflecting his unparalleled industry expertise and longstanding partnership with clients to address emerging workforce issues in APP compensation, utilization, workforce planning and more. In addition to his work as a consultant, Zachary has more than 20 years of experience as a practicing physician assistant (PA-C), clinical leader and educator.

“The demand for APPs remains high, especially in the middle of an ongoing health care workforce crisis. The challenges our clients are facing have grown increasingly niche as it relates to this critical provider group and, in response, we’ve assembled a team of highly specialized experts and industry leaders with a wealth of diverse clinical, operational and financial capabilities,” said Ted Chien, President and CEO, SullivanCotter.

Other new additions to the practice include:

- Lacey Buckler, Principal – With 20+ years as a certified nurse practitioner, Lacey is a well-rounded consulting leader that leverages specialized knowledge and first-hand experience in clinical operations and workforce management. As the former Chief Advanced Practice Officer and Chief Nurse/Service Line Leader for a large academic medical center and teaching institution, she was responsible for providing strategic leadership and oversight to more than 600 APPs and more than 700 registered nurses.

- Hadley Powless, Consulting Manager – Hadley has over 16 years of experience as a clinical PA-C with direct insight into the challenges APPs and their employers encounter on a daily basis. She is a trusted advisor committed to helping organizations optimize their growing APP workforce. Prior to joining SullivanCotter, Hadley served as the Director of Advanced Practice at a large integrated health system in the Midwest.

“In order to address a growing list of APP workforce and operational concerns — including recruitment and retention challenges, costly clinician turnover due to burnout, regulatory changes, and evolving compensation structures — health care organizations require best-in-class resources, insights, and advisory solutions. We are committed to adapting to new industry demands alongside our clients and look forward to sharing our expertise as the practice grows,” said Amy Noecker, Principal, SullivanCotter.

Additionally, the practice continues to build out its growing suite of APP research and proprietary survey data. The 2023 APP Compensation and Productivity Survey is open for participation until March 24 and includes critical market benchmarks on base salary, total cash compensation, productivity, emerging pay practices, and more. Participating organizations receive a sizable discount on the final report.

To learn more about SullivanCotter, please visit us at sullivancotter.com or contact us for more information.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and data products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

Note to media: Additional data and interviews are available on request.

PRESS RELEASE | Cost of Labor Increases Amid Ongoing Health Care Workforce Crisis

Base payroll expense, when adjusted for growth in headcount, has increased by 7.1%

Chicago, IL | February 21, 2023

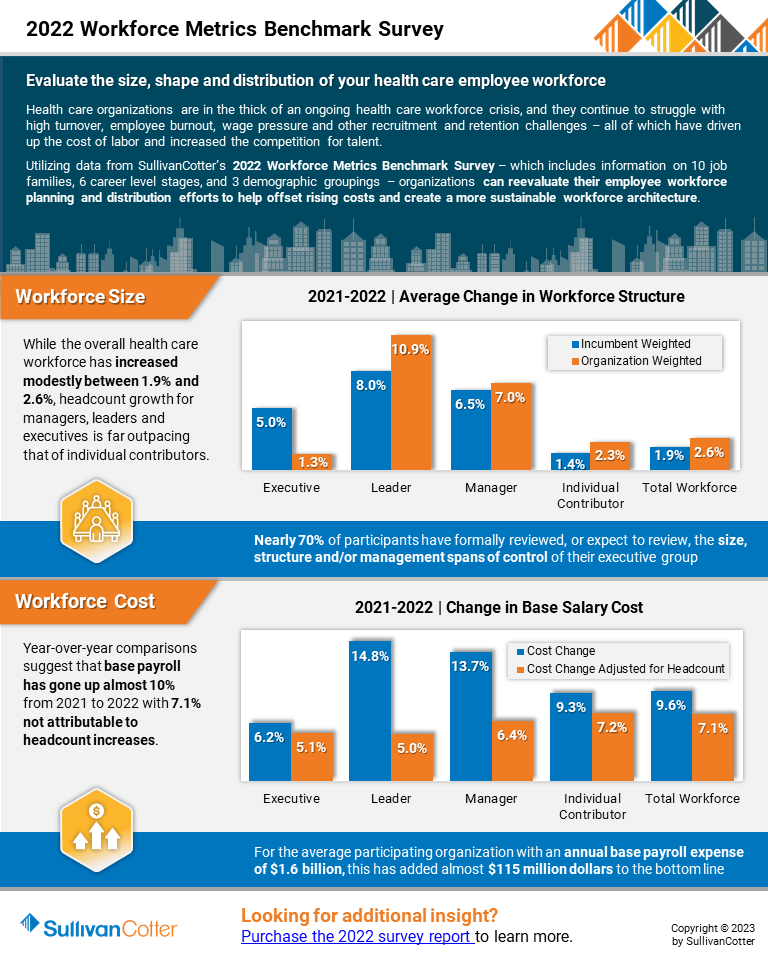

SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for health care and not-for-profits, has released findings from its 2022 Workforce Metrics Benchmark Survey.

Health care organizations are in an ongoing workforce crisis, and they continue to struggle with high turnover, employee burnout, wage pressure and other recruitment and retention challenges – all of which have driven up the cost of labor, increased the competition for talent, and forced organizations to consider the relationships between workforce design, talent, compensation, and performance management.

Year-over-year comparisons indicate that annual base payroll expense, which constitutes the vast majority of an organization’s overall yearly expenditures, has gone up almost 10% from 2021 to 2022. Further analysis shows that 7.1% of this is not attributable to full-time equivalent (FTE) headcount increases which have grown only modestly between 1.9% and 2.6% for the overall health care workforce. For the average participating organization with an annual base payroll expense of $1.6 billion, this has added almost $115 million dollars to the bottom line.

Diving deeper into these findings – including data reported on multiple job families and demographic groupings throughout different career level stages – provides insight into how organizations may need to adjust their planning and distribution efforts to help offset rising costs and create a more affordable and sustainable workforce architecture.

Assessing Workforce Cost and Structure

Although this past year has seen almost double-digit growth (9.3%) in base salary expense for Individual Contributors, driven in part by minimum and living wage increases, many hospitals and health systems are experiencing potentially unsustainable growth across multiple career stages. Salaries for Managers and Directors have grown by 13.7% and 14.8%, respectively, which has added to overall cost concerns. Additionally, headcount growth for the overall leadership structure – particularly in newly identified roles such as population health, value-based care and health equity – is far outpacing that of Individual Contributors by increasing at rates between 3.5 times and 5.5 times higher.

“While the significant growth and diversity of expertise in Manager and Director ranks may produce positive results in some clinical settings, it also requires greater investment. Organizations are going to have to rebalance the size and shape of their workforce to help create a more sustainable model. For instance, we see many organizations focusing more on leadership roles in order to optimize oversight ratios, expand the span of control, and isolate areas of role and title inflation that have been occurring since 2020,” said Tim Pang, Principal, SullivanCotter. Nearly 70% of survey participants have formally reviewed, or soon expect to review, the size, structure or management spans of control of their leadership group.

Understanding workforce growth and distribution across different job families is also important and can play a key role in effective workforce planning. From 2021-2022, Nursing and Human Resources saw the most notable drops in headcount at the largest organizations (those with more than 30,000 FTEs) with decreases of 8.8% and 8.3%, respectively. Legal and Compliance, conversely, has seen large increases in their populations at smaller and mid-size organizations with 20%-25% growth.

Workforce Demographics – Gender, Race and Age

As important diversity, equity and inclusion (DE&I) initiatives remain a top priority for health care organizations nationwide, many are looking for greater insight into the diversity of their employee populations as represented across race, gender and other demographic characteristics.

Across the 10 job families included in the survey, gender representation is highly skewed with females representing 75.3% of the workforce in 2022. This is highest in Financial Services, Nursing, and Care Management – with all three job families at over 80% representation. While the three job families with the highest male populations are Facilities, Information Technology and Emergency Medical Services, these are more evenly split and range from 47.3% – 56.2% males.

When analyzing by career stage, female representation at the Manager level is strong at 72.4%, but steadily declines to just under 50% for Executive roles.

“Demographic shifts will create an opportunity to impact workforce diversity and equity. By the end of 2023, a significant number of leaders at all levels will become retirement eligible. With the added focus on broader workforce diversity in race and gender, organizations are being more deliberate in tracking and sourcing wider representation in their candidate pools as they look to support strategic DE&I initiatives,” said James Roth, Managing Principal, SullivanCotter.

Although minority representation by race from 2021 to 2022 remains stable across all career stages – including Individual Contributors (up 0.3%), Managers (up 0.7%), and Directors (no change) – year-over-year growth is highest at the Executive level with a 1.6% increase.

Planning Considerations for 2023 and Beyond

Driven by a number of competing forces, the health care talent market continues to be increasingly dynamic. Organizations looking to remain competitive should consider a number of critical workforce structure improvements to help offset rising labor costs and better define future roles and career pathways.

These considerations include:

- Address rising payroll expense by investing in technology, improving key processes, and rebalancing the size and shape of the workforce to create a more sustainable and affordable model moving forward.

- Focus on the centralization of Shared Services to help manage rising costs. Large multi-site systems that have not fully harmonized can centralize core support functions as a way to achieve standardization, reduce total delivery costs, leverage remote staffing models and offer a broader range of career pathways.

- Support greater employee engagement. Compensation interventions alone are not always adequate – culture, career growth, development, recognition, and health and well-being are also critical components of an evolving workforce strategy.

- Reconsider the utilization of remote work structures where possible to create greater work-life balance and more flexible staffing models. This will also help to expand the labor pool and improve cost management.

- Remain committed to critical DE&I initiatives. While racial representation at the executive level has improved, stagnation at the Director-level and an across-the-board reversal on gender representation can be improved with regular benchmarking, the establishment of more formalized targets, and a greater focus on talent acquisition and talent management planning.

“It is important to note that while there is value to be gained by reassessing workforce design to leverage cost savings and build a more effective leadership structure, managing the size and shape of the workforce alone will not transform the organization. Understanding how workforce design, talent management, and compensation strategy work together to influence system-wide performance is critical in today’s environment,” said Ted Chien, President and Chief Executive Officer, SullivanCotter.

SullivanCotter’s 2022 Workforce Metrics Benchmark Survey includes critical benchmarking data across 10 job families, 6 career-level categories, and 3 demographic groupings to provide insight into the following metrics:

- SIZE: Number of FTE headcount

- SHAPE: Career stage distribution of FTE headcount

- COST: Annualized base payroll expense of FTE headcount

- DEMOGRAPHICS: Gender, racial and generational representation

- OVERSIGHT: Management direct span of control

For more information on SullivanCotter’s surveys, please visit our website at www.sullivancotter.com, or contact us via email or by phone at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and data products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

Note to media: Additional data and interviews are available on request.

Utilizing Physician Compensation and Productivity Benchmarks

Struggling to understand the effect of recent Physician Fee Schedule changes on the 2022 provider compensation and productivity survey benchmarks?

This year’s survey benchmarks for physician compensation and productivity have been materially impacted by recent modifications to the Physician Fee Schedule. The changes, which were made effective on January 1, 2021, by the Centers for Medicare and Medicaid Services (CMS), significantly altered the work Relative Value Unit (wRVU) weights applied to common Evaluation and Management (E&M) billing codes. Specifically, E&M wRVU weights were increased to benefit Primary Care and other specialties that most often provide these services. As a result, year-over-year comparisons of survey benchmarks require special review and must be carefully considered when incorporating insights into workforce planning and compensation decision-making.

To help organizations properly address the ongoing impact of these changes, SullivanCotter’s 2022 Physician Compensation and Productivity Survey requested that respondents supply data based on wRVU values from both the 2020 and 2021 Physician Fee Schedules. Utilizing this information, SullivanCotter conducted an analysis of the subset of survey participants that reported data under both the 2020 and 2021 PFS wRVU values – a “same-store” approach. Several useful findings emerged that provide organizations with data-driven insights for future changes to compensation programs.

Both the aggregate survey results and the same-store analysis are discussed in this article along with considerations and implications for health care organizations as they move forward with planning for 2023 and beyond.

Changes in Survey Data from 2020-2022

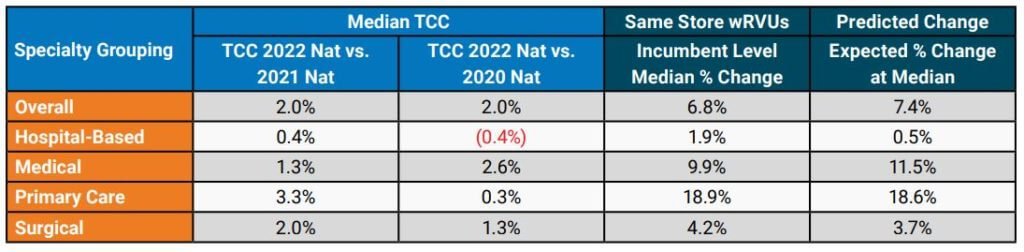

Results from SullivanCotter’s 2022 Physician Compensation and Productivity Survey Report indicate that median total cash compensation (TCC) across all specialties increased by approximately 2% over results reported in 2021 and 2020, respectively, as shown in the Overall grouping for Median TCC in Table A.1 In some recent years, we have seen slightly larger year-over-year increases due to inflation. As COVID-19 impacted some specialties in different ways, we believe the overall increases were muted.

Table A: Median TCC and Same-Store wRVU Impact by Specialty Grouping

1Note that median TCC in 2021 was fairly flat overall due to the impact of the COVID-19 pandemic.

Although the year-over-year increase in TCC was modest overall, some specialty groupings showed more significant increases. Primary Care (including Internal Medicine and Family Medicine) median TCC increased by 3.3% from the 2021 to 2022 surveys, which was likely driven in part by the changes to the Physician Fee Schedule. The change for Hospital-Based specialties, such as Hospitalists, yielded an increase of only 0.4% over the same time period. This limited change may be related to the common market practice of compensating Hospitalists on an hourly or shift basis instead of a predominantly wRVU-based formula.

For the subset of organizations included in the same-store analysis, SullivanCotter conducted an evaluation of wRVU changes. The Same-Store wRVUs column in Table A shows the median change in wRVUs using data at the incumbent level. Although all specialty categories yielded increases, some were more significant than others. As expected, Primary Care (+18.9%) and Medical (+9.9%) specialties had the most significant increases. At the same time, smaller changes occurred in Surgical (+4.2%) and Hospital-Based (+1.9%) specialties, which tend to use proportionately fewer E&M codes.

These results aligned fairly closely with the anticipated changes based on wRVU coding profiles for each specialty as reported in the Predicted Change column in Table A. The predicted changes are based on an analysis by SullivanCotter that included CPT-level detail that used CMS tables to estimate the impact of the PFS changes before the most recent survey data became available.

While the same-store wRVU analysis illustrates the impact of the 2021 PFS changes, other market forces – such as the lingering effects of the pandemic and expanded use of telemedicine services – also impacted reported wRVU information.

Organizations are still relatively split in regard to their approach to measuring wRVU productivity moving forward. SullivanCotter recently surveyed 40 large, integrated health care organizations and learned that approximately 40% were still maintaining the 2020 PFS to calculate physician compensation and another 50% were moving to or had already started utilizing either the 2021 or 2022 PFS.

Specialty-Specific Same-Store Analysis

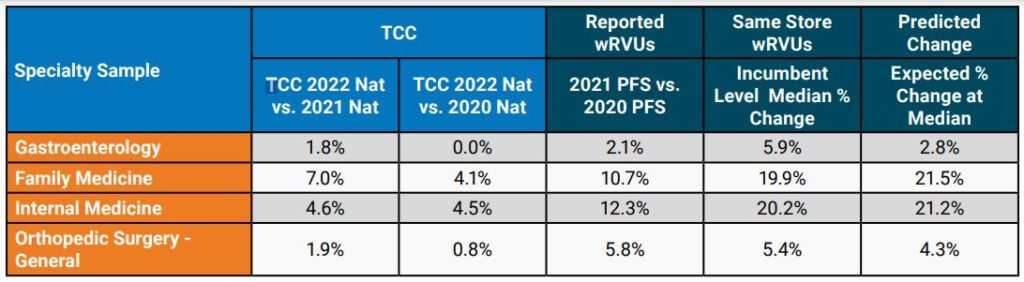

To illustrate the impact of the changes to wRVU values at the individual specialty level, a sampling of specialty-specific information is provided in Table B. This data highlights the reported increases in median TCC as well as the corresponding wRVU changes. Notable changes in TCC for Family Medicine and Internal Medicine can be seen in SullivanCotter’s 2022 survey data. Gastroenterology and Orthopedic Surgery – General showed more modest increases in TCC in the most recent year.

Table B: Analysis of Selected Specialties

When limiting the analysis to the same-store incumbents, the median wRVU percent change increased noticeably for the specialties highlighted in Table B. The impact of the PFS changes can vary substantially from one specialty to another and, as organizations evaluate their physician compensation programs, understanding how to properly evaluate the market data will help inform more effective decision-making.

Considerations and Implications for Health Care Organizations

The impacts on this year’s survey benchmarks present a number of issues for consideration:

- It is imperative that organizations understand the full extent of wRVU value changes and decide how to move forward. Physicians and administrators must know which version of the PFS their group is using for internal wRVU productivity and compensation calculations and how that data compares to currently-published survey data.

- Benchmarking to market survey data without appropriate adjustments may yield inaccurate

results. For example, if an organization adopts the 2021 PFS wRVU values but continues to use compensation per wRVU conversion factors that were in effect under the 2020 PFS, the group risks substantially overpaying certain specialties. These payments could potentially invoke fair market value (FMV) and commercial reasonableness concerns. Recall that the overall increases in TCC have been modest at approximately 2% overall in recent years. - Not all third-party payors have adopted the 2021 PFS adjustments. As a result, an organization may be in a situation whereby maintaining historical conversion factors but using updated wRVU values would lead to significant financial strain as there may not be additional reimbursement to cover increased wRVUs. Many health care organizations have neutralized the cost impact of the wRVU changes with compensation formula/conversion factor adjustments (effectively lowering the compensation per wRVU on a specialty-specific basis). Notably, CMS attempted to neutralize the impact of the wRVU changes on cost through a decrease in its reimbursement conversion factor for professional services — which was subject to additional action by Congress.

Implications to Future State Compensation Planning

When deciding how to move forward to mitigate the impact of the PFS changes on compensation structures, there are several responses to consider. Table C summarizes some approaches that can be employed. Please note that a combination of these approaches may be necessary to accommodate various production-based and shift-based compensation models.

Table C: Options to Consider

| Across-the Board TCC Increases (e.g., 2.0%) | Determine funds available for annual compensation increases and adjust compensation formulas to achieve this result. Can be applied across-the-board or adjusted to achieve overall budgeted level. |

| Conversion Factor Adjustments with Guard Rails | Adjust conversion factors (compensation per wRVU) by specialty and incorporate guard rails to guide TCC changes so that no specialty would have an unsustainable increase/decrease year-over-year. |

| Compound Annual Growth Rate (CAGR) Approach | Determine the percentage change in compensation per wRVU over a number of years prior to the PFS changes (e.g., 3-year period) by specialty. Determine the average annual growth rate and apply it to 2021 actual PFS-adjusted conversion factors on a go-forward basis. |

| Full-Scale Compensation Plan Redesign | Instead of making adjustments to adapt to certain PFS changes, reconsider the compensation philosophy for the group and build flexibility into the compensation plan for current and future reimbursement/regulatory changes. |

In some cases, planning modest across-the-board increases in TCC for salaried or shift-based specialties while using more tailored conversion factor adjustments for production-based specialties may work well. Consider these changes on a specialty-specific basis as the PFS changes affected specialties differently as earlier illustrated in Table B.

The incorporation of guard rails may help to ensure that adjustments at the conversion-factor level do not result in TCC that is not desirable from an FMV perspective or is not financially sustainable. For example, an organization may decide that no specialty will see an increase greater than 5% in its conversion factor over a single year or that the change in the conversion factor would not result in TCC increasing by more than 3% for the same amount of services delivered (e.g., aggregate frequencies by CPT code do not change significantly). Be clear which version of the PFS wRVU values you are using so that conversion factors are appropriate – and recognize future market survey data will be based on the current version of the PFS (i.e., 2021 CMS PFS or later).

A more tailored approach to consider is a Compound Annual Growth Rate (CAGR) analysis. The analysis begins by taking historical compensation per wRVU data at a certain level – such as the median – for a number of years prior to the 2021 PFS changes. Using this data, the average annual growth rate is determined by specialty. This rate is then applied to the 2021 PFS-adjusted rates on a go-forward basis. Be sure to evaluate the results in terms of cost to the organization and other considerations such as FMV and commercial reasonableness.

For some health care organizations, it may also be an appropriate time to reconsider provider compensation overall. The recent PFS changes are substantial and additional modifications are

planned for the future. A revised compensation philosophy can assist in setting a new approach for compensation plan administration that evolves alongside changes in the market. A total compensation plan redesign also provides an opportunity for groups to better align physician and advanced practice provider (APP) incentives where the opportunity exists. This approach can also be used to reset compensation formulas where temporary plans were implemented to address pandemic-related needs. Some organizations may require or prefer a comprehensive compensation plan redesign over piece-meal adjustments by specialty.

One option for consideration is salary-based compensation with clearly defined performance expectations. These expectations may include production targets as well as clinical/value-based measures. If such an option is adopted, a carefully considered scorecard approach to compensation administration is recommended.

Through all of this work, it is important to provide ongoing education and communication to leaders, physicians and APPs. As decisions are made to adapt to the PFS changes and/or incorporate 2022 market data, providers should understand the impetus for change, how it impacts the specialty compensation plan and performance goals, and the benefits and limitations of these actions.

SullivanCotter offers advisory support and solutions to help you navigate the impact of Physician Fee Schedule changes.

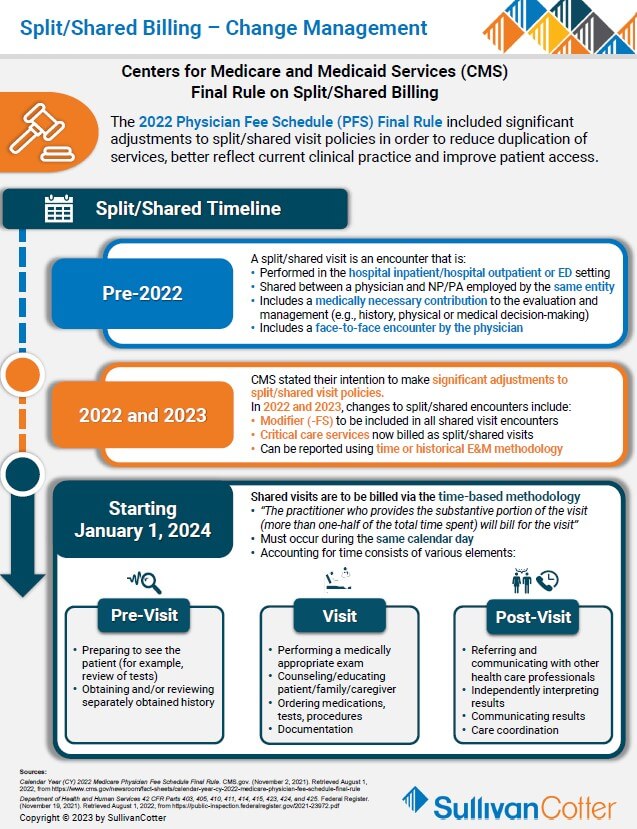

INFOGRAPHIC | Split/Shared Billing - Change Management

Addressing the Physician Fee Schedule – Final Rule on Split/Shared Billing

Struggling to understand the recent changes on split/shared billing and how it will affect physician and advanced practice provider workflow?

The 2022 Physician Fee Schedule (PFS) Final Rule included significant adjustments to split/shared visit policies in order to:

- Better reflect clinical practice

- Recognize APPs as members of the care team

- Reduce duplication of services (create access)

- Clarify payment conditions

Organizations must understand the timeline of past and upcoming changes in order to properly address and plan for the pending modifications:

Pre-2022

- A split/shared visit is an encounter performed in the hospital inpatient/hospital outpatient setting that is shared between a physician and an APP from the same group practice. Must include a medically necessary contribution to the evaluation and management (e.g., history, physical or medical decision-making) by the physician and a face-to-face encounter by the physician (excludes critical care codes).

2022 and 2023

- Modifier (-FS) to be included in all shared visit encounters

- Critical care services now billed as split/shared visits

- Can be reported using time-based or historical E&M methodology

Starting January 1, 2024

- Shared visits are to be billed via the time-based methodology

- “The practitioner who provides the substantive portion of the visit (more than one-half of the total time spent) will bill for the visit”

- Accounting for time consists of various elements

INFOGRAPHIC | 2022 Workforce Metrics Benchmark Survey

Evaluate the size, shape and distribution of your health care employee workforce

Hospitals and health systems are in the midst of an ongoing workforce crisis

Health care organizations continue to struggle with high turnover, employee burnout, wage pressure and other recruitment and retention challenges – all of which have driven up the cost of labor and increased the competition for talent.

Utilizing data from SullivanCotter’s 2022 Workforce Metrics Benchmark Survey – which includes information on 10 job families, 6 career level stages, and 3 demographic groupings – organizations can reevaluate their employee workforce planning and distribution efforts to help offset rising costs and create a more sustainable workforce architecture.

View a highlight of this year’s results, including insight into:

Workforce Size

- While the overall health care workforce has increased modestly between 1.9% and 2.6%, headcount growth for managers, leaders and executives is far outpacing that of individual contributors.

- Nearly 70% of participants have formally reviewed, or expect to review, the size, structure and/or management spans of control of their executive groups

Workforce Cost

- Year-over-year comparisons suggest that base payroll has gone up almost 10% from 2021 to 2022 with 7.1% not attributable to headcount increases.

- For the average participating organization with an annual base payroll expense of $1.6 billion, this has added almost $115 million dollars to the bottom.

Looking for more? The 2022 survey report is available for purchase.

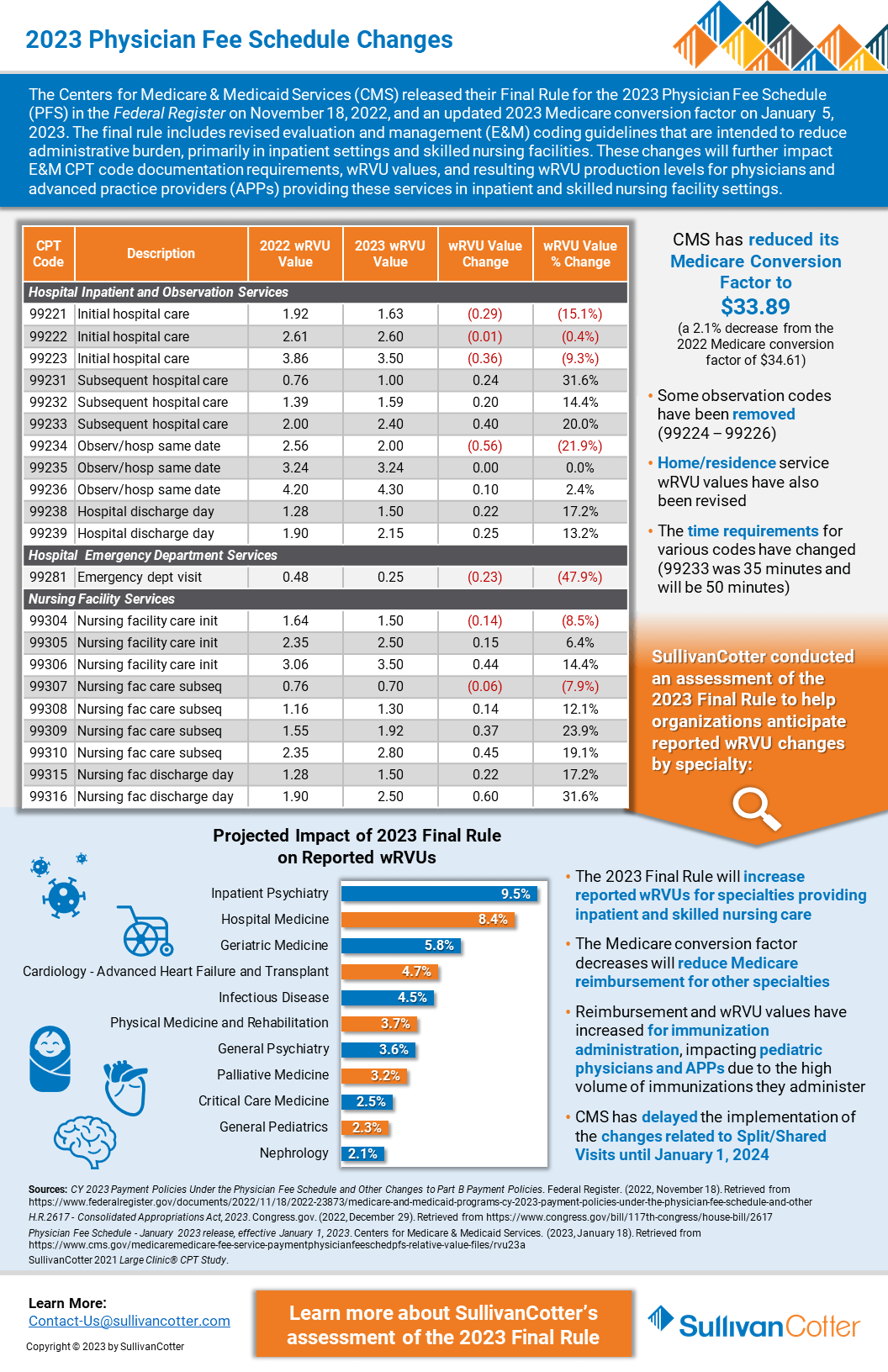

INFOGRAPHIC | 2023 Physician Fee Schedule Changes

The Centers for Medicare and Medicaid Services recently reduced its Conversion Factor by 2.1% for 2023.

Does your organization understand how this may affect wRVU productivity in different specialties and settings – including hospital inpatient and observation, emergency services and skilled nursing facilities?

The Centers for Medicare & Medicaid Services (CMS) released their Final Rule for the 2023 Physician Fee Schedule (PFS) in the Federal Register on November 18, 2022, and an updated 2023 Medicare conversion factor on January 5, 2023.

The final rule includes revised evaluation and management (E&M) coding guidelines that are intended to reduce administrative burden, primarily in inpatient settings and skilled nursing facilities.

These changes will further impact E&M CPT code documentation requirements, wRVU values, and resulting wRVU production levels for physicians and advanced practice providers providing these services in inpatient and skilled nursing facility settings.

Looking for additional details on the changes?

SullivanCotter recently published an article with the American Association of Provider Compensation Professionals.