Pay Equity: Ensuring a High-Quality Analysis

Pay Equity: Ensuring a High-Quality Analysis

Authored by SullivanCotter’s Michael O’Malley – Principal, Nanci Hibschman – Managing Principal and Not-for-Profit Practice Leader, and Amanda Wethington – Principal

Most people responsible for pay equity studies within their organizations have only a superficial knowledge of statistics. Yet, as the primary underwriters and overseers of the work who are ultimately accountable for the overall quality, how can they ensure the analysis is reliable?

Understanding the Complexity of a Pay Equity Analysis

To help organizations better understand the complexities of a pay equity analysis and to ensure the delivery of high-quality results, SullivanCotter has a three-part approach to working with clients:

Listen and Ask

Statistical analysis is simply a way of summarizing the reality to which everyone has access. We encourage clients to be active participants in the project by soliciting their observations and gaining insight into their pay practices and internal challenges. We also mutually discuss how to assemble and operationalize the data. This is not a backroom operation from which we simply emerge with inscrutable results.

Show and Explain

Your organization does not require a deep-seated knowledge of statistics to understand what we hope to achieve through a proper pay equity analysis. These goals can be simply explained and illustrated. All of our assumptions are laid bare. All of our rationales for doing things one way versus another are carefully described and documented. We encourage clients to evaluate the technical merits of our work.

Summarize and Advise

Since our focus is on the overall well-being of the organization and its employees, it is important to consider the broader implications of the results and the ways in which clients can support fair and equitable human resources practices across the board. These recommendations are sensibly made with attention to cost in mind so that any changes deemed desirable can be easily implemented.

The quality of our work stems from a longstanding combination of technical expertise and a demonstrated sensibility to your organization’s unique issues. Communicating knowledge of our discipline, undertaking the work in the spirit of mutuality, and fostering a genuine concern for the welfare of the study’s participants make it easy to deliver reliable, accurate, and actionable results. Most importantly, we never consider our pay equity work to be a perfunctory exercise. Our work is informed by a rich understanding of the nature of your jobs and your industry so that analytical procedures proceed with full awareness of the possibilities for positive change.

DOWNLOAD PDF

Need assistance assessing pay equity with your organization?

With years of industry experience and a deeply knowledgable team of compensation experts, SullivanCotter is uniquely positioned to address your pay equity needs.

RELATED ARTICLES

RELATED SERVICES

Patient Panels and Provider Compensation

Patient Panel Management: Trends, Challenges and the Impact of Value-Based Reimbursement

Originally published by the American Association of Provider Compensation Professionals

READ FULL ARTICLE

As the market’s focus on population health intensifies, patient panel management is evolving as a core component of successful care delivery. In response, organizations are looking to improve quality, optimize care team operations, and strengthen patient and primary care physician/advanced practice provider relationships.

With risk-based contracting and value-based reimbursement top of mind, many hospitals and health systems re-evaluating their panel management and patient care delivery strategies to better support the achievement of system-wide population health goals.

In this article, SullivanCotter addresses three important areas for organizations to consider as they undertake this journey:

- Optimizing the role of the advanced practice provider

- Educating providers on appropriate coding and documentation

- Aligning provider compensation structures with population health strategies

Becker's Healthcare | Split/Shared Visits: Q&A with Zachary Hartsell

Split/Shared Visits: Zachary Hartsell discusses recent changes to the Physician Fee Schedule with Becker's Hospital Review

What does this mean for hospitals and health systems regarding the existing workflow of physicians and advanced practice providers?

Download article >

Every year, the Centers for Medicare and Medicaid Services incorporates changes in policy, regulations and requirements for billing under the Medicare Physician Fee Schedule (PFS). These changes are often adopted by commercial payers.

On Nov. 2, 2021, CMS released the final rule for the 2022 PFS. The final rule went into effect Jan. 1, 2022, and includes some important considerations related to the conditions for submitting split-shared visits for reimbursement that affect planning in 2022 and beyond.

These changes can potentially alter the existing workflow of physicians and advanced practice providers related to billing split-shared encounters. To discuss physician fee schedule changes, Becker's Hospital Review recently spoke with Zachary Hartsell, Principal and advanced practice providers (APP) growth team leader in the APP Workforce at SullivanCotter.

Note: Responses edited for length and clarity.

Question: To begin, can you outline some of the changes that went into effect in 2022 and the additional changes identified for implementation in 2023?

Zach Hartsell: Happy to discuss. Let me start by noting that the changes due for 2023 may now be postponed to 2024 based on the recently published proposed 2023 CMS PFS. I’d like to start by sharing the background on what split-shared visits consist of today, what has already changed, and what is expected to be changing in the future.

Split-shared visits are the evaluation and management services performed jointly by physicians and APPs in hospital-based practices. This includes inpatient, outpatient and emergency department settings. The rules apply to all inpatient professional Evaluation & Management (E&M) CPT codes historically, except for critical care services, procedures and time-based codes.

When physicians and APPs have used the split-shared service, the workflows are often designed so that the entire encounter can be billed under the physician assuming certain qualifications are met. Those qualifications include:

- The physician must have a face-to-face encounter,

- The physician must perform a medically necessary and substantive portion of the E&M service,

- Both the physician and the APP are employed in the same group.

These have been the longstanding rules for more than 15 years. They were initiated through a CMS transmittal and not part of the final rule process. Since they were essentially a midyear or off-cycle adjustment, I believe there has always been an interest in codifying them within the final rule.

It's also vital to note that there is something different called ‘incident-to billing’, which is only in the outpatient setting and has a separate set of governing rules and regulations. Incident-to will not be impacted by these changes.

As you mentioned, there were changes implemented on January 1, 2022, which were fairly modest, but include the ability to use the split-shared methodology to bill for critical care services. There was also a requirement that a new modifier be added to all split-shared visits, the “-FS modifier”, to differentiate split-shared visits from non-split-shared visits. Finally, in 2022 (and now 2023 with the delayed implementation), providers can use the historical E&M methodology, or they can use the new time-based billing.

Starting Jan. 1, 2024, only the time-based methodology can be used. While this change was initially supposed to be implemented in 2023, the proposed 2023 PFS released in July suggests delaying the time-based changes to 2024. With the time-based methodology, the practitioner — whether a physician or APP — who performs a majority of the visit, defined as greater than 51% of the total time, bills for a visit.

Q: How might the new time-based methodology affect physician/APP workflow and compensation?

ZH: We, at SullivanCotter, consider these changes in three different groups: financial, care team and compliance. All three groups have potential implications for provider compensation.

First, you have financial impact - which can be twofold. One potential financial impact that could affect the organization is the change in reimbursement rates. Remember that historically the split-shared visit allows the physician to bill Medicare and receive 100 percent of the physician fee schedule rate. If the billing starts going out under the APP, presumably, organizations will receive the APP reimbursement rate - which for Medicare is 85% of the physician reimbursement rate. Therefore, if an organization sees the same volume in the future, there could be a reduction in reimbursement. The best outcome here for organizations would be to increase the volume overall by having physicians continue to manage similar volumes as they have seen historically and then have APPs see select patients on their own. Even at a reduced reimbursement rate, this model can be sustainable for many organizations.

The second financial impact is related to physician compensation – specifically physicians with productivity-based compensation models. From a physician compensation standpoint, the new time-based methodology will require physicians to spend more than 50 percent of the time with a patient in order to receive the work RVU attribution for split-shared visit. Many practices that use the same workflows as today, physicians may see a decrease in the work RVUs for seeing the same volume of patients. While physicians may see a decrease in work RVUs, APPs could see an increase in their work RVUs. These potential shifts will likely require organizations to review both their physician and APP compensation plans to understand the impact that work RVU changes will have based on their current formulas and methodologies.

For the care team implications, it is about looking at current APP, physician and staff workflows to identify patients that APPs can see more autonomously with indirect physician supervision. In addition, identifying activities that other care team members can perform in support of both the physician and APP visits. There will need to be intentional discussions around the workflows and responsibilities of both APPs and physicians in hospital and provider-based clinics. Also, there needs to be clear methodologies to delineate the time spent with the APP versus with the physician.

The last area of concern relates to compliance. There is a need to educate physicians and APPs about the related rule changes, the potential new workflows, and the impact on their compensation plans. Additionally, there will need to be effective auditing mechanisms in place to check time-based billing, as well as ways to identify non-compliant workarounds. Regular auditing and education will likely need to continue into 2024.

One of the things that we've heard organizations focusing on is ‘the Impossible Day’ situation. This is where an individual encounter looks okay, but the sum of a day’s work exceeds the time available in the day. For example, you have an APP and a physician working together. The APP sees a patient for 20 minutes, and then the physician comes in and adds 21 minutes of time to the encounter. The physicians time would report as having greater than 50 percent of the time and thus the encounter would be billed under the physician. The concern lies in high volume clinics where if you add up the physician time throughout the day for 30 or 40 patients, the totality of all of the physician time could make it an ‘Impossible Day’. The other element is to look for consistent patterns in coding. For example, if an APP sees every patient for a physician and the physician sees every patient one minute longer than the APP, that could appear to be an improbable pattern. The improbability of that situation could trigger auditors and potentially raise compliance concerns.

Q: Can you share a brief case-based example of this?

ZH: Yes, absolutely. I'm a PA by background and have worked primarily in hospital medicine for the last 15 years. So let's stick with that specialty. Let’s say we have a hospitalized internal medicine patient -somebody with a pneumonia diagnosis - who's being cared for on the hospital medicine team comprised of a physician and an APP. On hospital day two, the APP rounds on the patient in the morning and spends 25 minutes with the patient. During the exam, the APP detects worsening lung sounds as compared to admission the day before. As a result, the APP orders a chest X-ray to evaluate the condition of the pneumonia. Later in the day, the physician and the APP spent an additional 10 minutes together to make afternoon rounds, review the chest X-ray findings, make some modifications to treatment, and briefly meet with the patient to review the chest X-ray results. We have a total of 35 minutes spent which includes 25 minutes for the APP and 10 minutes for the physician. While the APP and the physician worked together for those 10 minutes, you can't concurrently count the time. This means that only 10 minutes can be counted for the afternoon rounds.

The hospital medicine team would bill the encounter as a 99233, which is a subsequent hospital care level 3, based on the time spent. Under the historical medical decision-making approach, this could be billed under the physician as a split-shared visit, assuming that the other criteria are met, or by the APP and reimbursed at 85 percent for Medicare patients. Under the proposed time-based methodology, the visit could only be billed under the APP as the APP provided greater than 51% of the total time of the encounter. The APP would have performed 25 of the 35 minutes, or 72 percent, of the total time spent. The challenge we see with this example is that, while the physician is involved in the care, the physician would not receive work RVU or reimbursement credit. Under this scenario, the physician would not be credited the wRVU productivity and if the physician is paid based on a wRVU productivity-based compensation model, the resulting compensation for the physician would be reduced. The APPs compensation could be positively impacted if paid on a wRVU basis.

Q: Final question, in terms of physician and APP compensation, are there any modifications that could be considered to help ensure financial stability and regulatory compliance?

ZH: Yes, we think organizations should focus their attention on a few key areas. First is a continued focus on educating providers to enhance their knowledge. Second is the review and design of intentional care models which support patient care and third is the potential modification of compensation plans to help address the changes and support care delivery.

In the short term, I think it is important for organizations to focus on educating providers about the new rules and how critical it is to ensure accurate documentation and coding - especially in a time-based environment. It is important to remember that many providers have not had experience in a time-based billing environment. It will also be helpful for organizations to focus on the intent of the rules, which is to avoid the duplication of services and provide clarity of the contributions of the APPs.

The real challenge is keeping the momentum to make the needed changes to compliance structures and educate providers on new workflows before the go live on January 1, 2024. The extra time proposed may tempt organizations to delay addressing this issue. This may be a mistake given the degree of cultural change and education required. For example, most organizations have not historically had reliable ways to document or measure how many of the visits were split-shared visits. Future compliance will require an exacting understanding of the number of split-shared visits in the organization, and while the new modifier will help, its limited existence will likely require organizations to perform deeper analytic reviews on their encounter types. In organizations with a high degree of split-shared visits, these changes could have a profound effect and require thoughtful and intentional reviews of hospital revenues and the provider compensation plans.

One final note about compensation arrangements. It will be important to review the physician and APP compensation arrangement to ensure financial sustainability with the changes. Once the impact on the care team and on the compensation, plans have been quantified, organizations may need to develop new workflows and policies to address. Examples of the types of questions we will see are: How will protections be built for work RVU decreases by the physicians? What about caps on work RVU increases by the APPs? How will those protections be handled and how will they impact regulatory compliance? At this point there will continue to be a lot of unanswered questions until organizations are able to quantify impact of these changes.

Fairness and Engagement: Where Pay Equity Fits In

Fairness and Engagement: Where Pay Equity Fits In

Authored by SullivanCotter’s Michael O’Malley – Principal, Nanci Hibschman – Managing Principal and Not-for-Profit Practice Leader, and Amanda Wethington – Principal

Enhancing an Employee’s Level of Engagement

While fairness is a core expectation of any quality relationship, there are also a number of other values that people hold in high regard in both their personal and work lives. In the workplace, employees want to feel that they belong and are involved in meaningful and stimulating work. They value learning and development, responsibility, and the ability to respectfully exercise their judgment. The combination of these different attributes can contribute greatly to an employee’s level of engagement.

Maintaining employee engagement is therefore critical and pay equity matters because it is a key component of the total impression employees form based on their lived experiences. It also influences their level of satisfaction and motivation to perform well and work productively. The importance of engagement is ubiquitous in today’s workplace – although its promise as a cure-all has not always met organizational expectations. This may be because concepts like pay equity and other core employee expectations have not been synthesized in the right way.

Historically, engagement has been defined as the sum of what employees like and do not like within the workplace. However, employee engagement may not be as dependent on what people like and dislike as much as the relative balance between their likes and dislikes. Indeed, these “positivity ratios” have been found to predict both relationship quality and durability. People with higher positive to negative experiences report better relationships and greater satisfaction both at home and at work. Studies also show that people with higher positivity ratios are more likely to ‘flourish’ – which is defined as striving toward one’s potential, withstanding normal everyday stresses, and working more productively.

In general, employees with positive to negative ratios of greater than 3:1 are more likely to thrive. The fact that more positive experiences are required to offset negative experiences is consistent with what is known as the ‘negativity bias’. Negative experiences weigh more heavily on people than corresponding positive experiences. The good things that happen to us are less potent and decay faster than negative experiences in such a way that it takes approximately three good experiences to offset a single bad one.

In the case of pay equity…

A perceived pay inequity must be counterbalanced by several other sources of satisfaction – which may be unlikely in an organization that allows inequities to persist. This attests to the weightiness of one injustice and the criticality of maintaining a fair and equitable compensation program.

Importantly, engagement conceived in this manner provides a reliable and stable reference for incentive programs and for tracking change. For example, these positivity ratios can be rolled up across employees by unit managers and used to reward leaders who are more adept at maintaining a positive and motivated workforce. Over time, these ratios can be tracked via surveys alongside other metrics and used to monitor the impact of organizational changes on employee attitudes and performance.

To be effective as a measure of engagement, survey items must satisfy two necessary conditions.

- They must have an emotional tone and cannot refer purely to fact-based beliefs such as: “I understand how the performance management system works.”

- They must connect to what people want in relational exchanges including workplace policies, programs, and practices in which basic human needs for growth, fairness, inclusion, autonomy, and more are implicated.

This new understanding of engagement dramatically changes how we approach employee motivation and intervene in the workplace. It suggests that any number of changes may increase engagement and make life at work more satisfying and worthwhile. Organizations need not hunt for the one program improvement that will solve everything when any of a number of relevant incremental changes can go a long way in enhancing an employee’s experience.

DOWNLOAD PDF

Need assistance assessing pay equity with your organization?

With years of industry experience and a deeply knowledgable team of compensation experts, SullivanCotter is uniquely positioned to address your pay equity needs.

RELATED ARTICLES

RELATED SERVICES

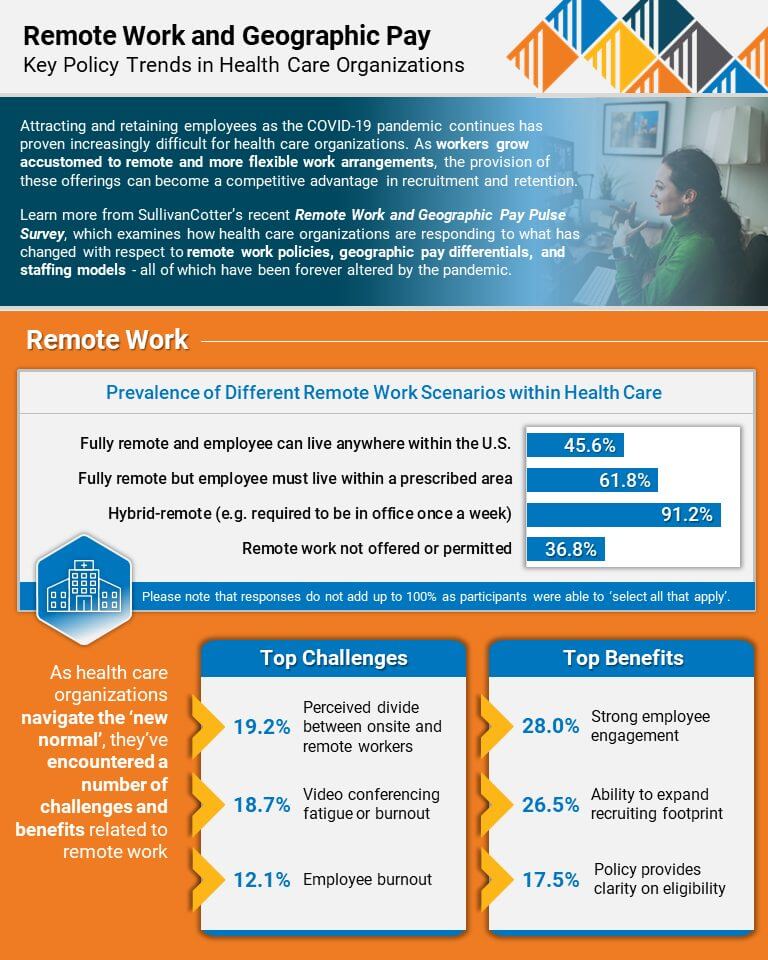

INFOGRAPHIC | Remote Work and Geographic Pay

Insight into Remote Work and Geographic Pay

Key policy trends within healthcare organizations

Attracting and retaining employees as the COVID-19 pandemic continues has proven increasingly difficult for healthcare organizations. As workers grow

accustomed to remote and more flexible work arrangements, the provision of these offerings can become a competitive advantage in recruitment and retention.

As healthcare organizations navigate the ‘new normal’, they’ve encountered a number of challenges and benefits related to remote work.

With the increase in remote work, issues regarding geographic pay have also become more complex. While national or headquarters-based compensation structures will continue to be important, considerations around geographic pay are much more nuanced as remote work is now prevalent and talent acquisition strategies extend beyond regional/local geographies.

Learn more from SullivanCotter’s recent Remote Work and Geographic Pay Pulse Survey, which examines how healthcare organizations are responding to what has changed with respect to remote work policies, geographic pay differentials, and staffing models – all of which have been forever altered by the pandemic.

Looking for additional insight? View a recording of our recent Remote Work and Geographic Pay webinar.

VIEW INFOGRAPHIC

Looking for additional workforce insights and data?

Remote Work and Geographic Pay | WEBINAR RECORDING

Attracting and Retaining Health Care Talent: Insight into Remote Work and Geographic Pay

View webinar recording >

The COVID-19 pandemic has accelerated dramatic shifts within the health care industry and has become a catalyst for changes to the way in which the workforce operates. This impacts all critical aspects of the human capital strategy – including wellbeing, staffing resources and remote work arrangements. As some organizations are transitioning back into the office, hospitals and health systems need to rethink which employees can and should work remotely, what these arrangements should look like, and how they should be paid.

With the increase in remote work, even within health care, issues around geographic pay have become a priority. Now, instead of having employees work at different, but specified geographic locations, some employees may work from anywhere. Certainly, local compensation structures will continue to be important, especially in health care, but an employer’s considerations around geographic pay have become much more nuanced, with many considering a single pay structure for some employee groups — especially general staff and remote employees.

Given all these changes, organizations may need to draft and/or update any existing policies that define their remote work and geographic pay strategy and procedures. This will help to support consistent application, communication, and understanding, and will also ensure that policies align with overall sourcing, talent, and compensation strategies. Health care organizations have unique workplace challenges, so it is prudent to look at remote work and its impact on pay and staffing models differently than in other industries.

This webinar highlights data from SullivanCotter’s 2022 Remote Work and Geographic Pay pulse survey to help address some of the top compensation issues that health care organizations are facing in today’s marketplace for talent.

Looking for additional insight? Download a copy of our Remote Work and Geographic Pay infographic.

Looking for additional workforce insights and data?

PODCAST | Shared Services Performed by Physicians and APPs

Amy Noecker, APP Workforce Practice Leader, and Zach Hartsell, Principal, featured in the Stark Integrity podcast to discuss split/shared billing compliance

Listen to podcast >

Due to recent changes to the Physician Fee Schedule regarding modifications to billing for split/shared visits, many physicians and advanced practice providers are facing significant workflow changes.

Members of SullivanCotter’s growing APP Workforce Practice recently sat down with Bob Wade, Esq., to discuss the impact of the changes and what health care organizations can do to address them.

This episode provides valuable insight into:

- The current state of split/shared billing

- How to evaluate care team composition and responsibilities by provider

- Whether compensation arrangements should be adjusted to help ensure financial sustainability and regulatory compliance

- A breakdown of the time-based methodology

- Other areas of concern that organizations should be aware of regarding split/shared visit attribution

Looking for additional insight on the changes to the Physician Fee Schedule regarding Split/Shared Visits?

We’ve recently published some content that may be of interest to you.

ARTICLE

Physician Fee Schedule: Understanding Changes to Split/Shared Visits

INFOGRAPHIC

Split/Shared Visits: Impact and Opportunity

PODCAST

Revisions to Submitting Split/Shared Visits for Reimbursement

Valuation of Management Services and Management Services Organizations

Considerations for developing effective partnerships in an evolving health care environment

Originally published by the American Association of Provider Compensation Professionals

As healthcare consumerism takes hold, technology evolves, and the industry continues to prioritize value-based care delivery, the definition of “work” for physicians has changed — and the ways in which physicians are compensated have evolved as well.

There are many forms this can take - such as direct cash compensation, base salary, quality incentives, call pay and more. An often-overlooked form of physician compensation, however, is the benefits received through Management Services Organizations (MSOs) and Management Services Agreements (MSAs).

Learn more about these agreements as your organization explores new partnerships, including information on different financial approaches and service arrangements, a better understanding of the regulatory requirements, and insight into the potential benefits.

READ FULL ARTICLE

PRESS RELEASE | SullivanCotter Acquires Clinician Nexus

SullivanCotter Announces Formation of New Clinical Workforce Technology Company

Chicago, IL | June 8, 2022

SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for the healthcare industry and not-for-profit sector, is pleased to announce the acquisition of Clinician Nexus – a clinical experience management technology company located in Minneapolis, MN.

Clinician Nexus is the creator of a powerful and collaborative platform that enables participating hospitals, health systems, and educational institutions to co-manage medical, nursing, and allied health students as they obtain clinical experience. Founded by Katrina Anderson, Bob Bryan, and Tim Schottler in 2016, Clinician Nexus has been successfully connecting healthcare organizations with students to drive meaningful clinical experiences with the intent to build a well-trained clinical workforce for tomorrow.

The acquisition of Clinician Nexus deepens the firm’s technology talent and enables the creation of two separate entities focused on serving different needs within the healthcare industry and not-for-profit sector. SullivanCotter will continue to offer market-leading consulting and advisory services while Clinician Nexus will provide workforce and compensation management technology as well as automated workflow solutions designed to support each stage of the clinical workforce lifecycle ꟷ from planning and training to measuring, rewarding, and driving performance. SullivanCotter’s Provider Performance Management Technology™ and Benchmarks360™ Pro and Plus platforms will now be delivered through Clinician Nexus.

“Powered by an industry-leading suite of workforce data, advanced automation capabilities, and a commitment to assisting clients in shaping the future of health care, we are excited to go to market with cutting-edge technology solutions to help them plan, build and enhance their clinical workforce strategies,” said David Schwietz, Chief Information Officer, Clinician Nexus.

With the ultimate goal of supporting the delivery of best-in-class patient care, Clinician Nexus connects organizations with the critical technology, data, tools, and resources required to drive innovative clinical workforce strategies.

“Together with Clinician Nexus, we’ll be able to leverage SullivanCotter’s consulting experience and expertise to develop innovative software solutions, data products, and analytics services for healthcare organizations nationwide. This will enable us to better support our clients by effectively and efficiently addressing current and future workforce needs as the industry continues to experience dramatic cultural and operational shifts,” said Ted Chien, President and CEO, SullivanCotter.

SullivanCotter will continue to provide advisory services and a comprehensive collection of proprietary benchmarking surveys, administered by Clinician Nexus, to health care and other not-for-profit organizations under its own brand.

For more information on Clinician Nexus and its growing suite of clinical workforce technology products, please visit www.cliniciannexus.com or contact us at 888.739.7039.

About Clinician Nexus

Clinician Nexus enables healthcare organizations to build thriving clinician teams with industry-leading technology products, workforce and compensation analytics, and automated workflow solutions. Backed by extensive technical expertise and industry-leading data, we deliver innovative approaches to help clients to plan, educate, and engage their clinical workforce at every stage of the lifecycle. We are committed to providing our clients with outstanding guidance and support as they focus on shaping the future of health care.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and solutions to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision, and values.

READ ON PR NEWSWIRE

Pay Equity Analysis: Understanding the Entire Story

Pay Equity Analysis: Understanding the Entire Story

Authored by SullivanCotter’s Michael O’Malley – Principal, Nanci Hibschman – Managing Principal and Not-for-Profit Practice Leader, and Amanda Wethington – Principal

Statistical outcomes do not always tell the whole story, and this is particularly true for studies on pay equity.

A statistical finding of no difference in compensation based on gender or race often prematurely ends further discourse on the matter even when the results seem incorrect and inconsistent with many people’s lived experiences. Somehow, pay equity studies do not always capture the reality of what many people are feeling. While statistical analysis is supposed to reflect the true unseen nature of things, the math seems to fail in the instance of pay equity.

The numbers themselves are not to blame. Rather, pay equity studies can be restrictive in focus. They examine whether or not certain groups are equitably paid assuming all else is equal and groups have the same values on other important variables. But often “all else” is not equal and inequalities may not show up because the analyses presume no relevant differences between the groups being evaluated. Yet, important differences can exist in a number of ways.

SullivanCotter describes three areas where differences may exist, how they avoid detection in standard pay equity assessments, and what further analyses are required to help complete a story only partially told.

Selection Bias

Pay equity analyses are conducted on the organization’s current workforce. However, if members of certain groups leave the organization at differential rates and one of the reasons for this turnover is low wages, then the current workforce does not represent those who may be underpaid. By eliminating a group of low-paid employees, the comparison to the remaining members of the workforce will appear more favorable. To understand if members of certain groups are more apt to self-select out of the organization, studies that examine the incidence of turnover and compensation levels of employees who have left are necessary.

Performance Bias

Pay equity analyses that include performance as a factor will “correct” any differences between groups based on this variable. But that approach begs the important question: Why might groups differ on performance? As it happens, there are a number of well-documented reasons for these differences – and none concern actual ability. For example, women and people of color must perform at higher levels than white males to be seen as performatively equivalent. Additionally, other performance-enhancing opportunities such as access to training, developmental assignments, guided learning projects, and mentorship may not be the same for everyone. The only way to know if this is the case is to see if differences in access to these opportunities exist.

Career Bias

Generally, women and people of color do not occupy as high of rank as white males in organizations and, on average, receive lower compensation. It is not simply that there are fewer women and people of color in leadership positions, but that they are disproportionately absent. Again, the pay equity analyses will calibrate for hierarchical disparities when comparatively examining compensation. But what happens to women and people of color during their career trajectories? Do they make slower career progress or stall at certain organizational levels? Again, the literature is replete with studies on career-family imbalances and the sacrifices working women, for example, must make to sustain the viability of both their home and work lives. Only further analyses can say if there is a price that certain groups must pay.

If your organization is looking to conduct a meaningful pay equity analysis that gets to the root of the actual issue rather than remaining content with what is being outwardly projected, you’ll need to take the time to understand the entire story and assess whether or not the pay equity that may seem so apparent is truly equitable or not.

DOWNLOAD PDF

Need assistance assessing pay equity with your organization?

With years of industry experience and a deeply knowledgable team of compensation experts, SullivanCotter is uniquely positioned to address your pay equity needs.

RELATED ARTICLES

RELATED SERVICES

PRESS RELEASE | Pay Equity Expert Mike O'Malley Joins SullivanCotter

Pay equity is an important prerequisite for fostering a fully engaged workforce

Chicago, IL | May 24, 2022

SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and technology and data products for the healthcare industry and not-for-profit sector, is pleased to announce the addition of prominent social psychologist and research-driven consultant Mike O’Malley as a Principal in the firm’s Employee Workforce Practice.

As a leader in his field, Mike has spent more than 30 years consulting and educating boards and senior executives on a myriad of human capital matters such as leadership development, compensation, succession planning, change management and more. He is also a widely published author specializing in leadership excellence and organizational design and leverages years of experience in his research-based approach with clients.

In his role at SullivanCotter, Mike partners with health care and other not-for-profit organizations to develop data-driven solutions that enhance performance and help achieve strategic goals. He assists in overseeing the firm’s pay equity analyses and advisory services. With a focus on both performance and equity, he leads critical compensation and benefits redesign initiatives to provide a more holistic and integrated approach to total rewards.

“As a fundamental element of diversity, equity and inclusion initiatives, pay equity is an important prerequisite for fostering a fully engaged workforce. These services are a pivotal component of our commitment to helping clients build stronger organizations that are diverse, inclusive and fair – and Mike’s longstanding expertise in this area will help to support these goals”, said Ted Chien, President and Chief Executive Officer, SullivanCotter.

Previously, Mike held leadership positions in a number of prominent global consulting firms. He currently serves as a Lecturer at the Yale University School of Medicine, where he conducts research and consults on statistics and a broad range of human resources topics.

In addition to having his expertise recognized by major media outlets such as CNBC, CBS and Fox, Mike has also been the keynote speaker at national and international events hosted by the United States Department of the Interior, the Financial Times, the London School of Economics and Political Science, and the Henry Jackson Society.

About SullivanCotter

SullivanCotter partners with healthcare and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, data and technology products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

PODCAST | Submitting Split/Shared Visits for Reimbursement

Zach Hartsell, Principal – APP Workforce Practice – featured in BESLER’s Hospital Finance Podcast to discuss changes to split/shared visit attribution

Listen to podcast >

Every year, the Centers for Medicare & Medicaid Services incorporate changes in policy, regulations, and requirements for billing under the Medicare Physician Fee Schedule (PFS). These changes are often adopted by commercial payers.

On November 2, 2021, CMS released the final rule for the 2022 PFS. The final rule went into effect on January 1, 2022, and includes some important considerations related to the conditions for submitting split-shared visits for reimbursement.

These changes have the potential to alter the existing workflow of physicians and advanced practice providers related to billing split-shared encounters.

To help explain the impact of these changes, this episode includes:

- The definition of a split/shared visit

- Insight into the 2022 changes as well as those coming in 2023

- Explanation of specific activities that CMS has identified

- Case-based examples

Looking for additional insight on the changes to the Physician Fee Schedule regarding Split/Shared Visits?

We’ve recently published some content that may be of interest to you.

ARTICLE

Physician Fee Schedule: Understanding Changes to Split/Shared Visits

INFOGRAPHIC

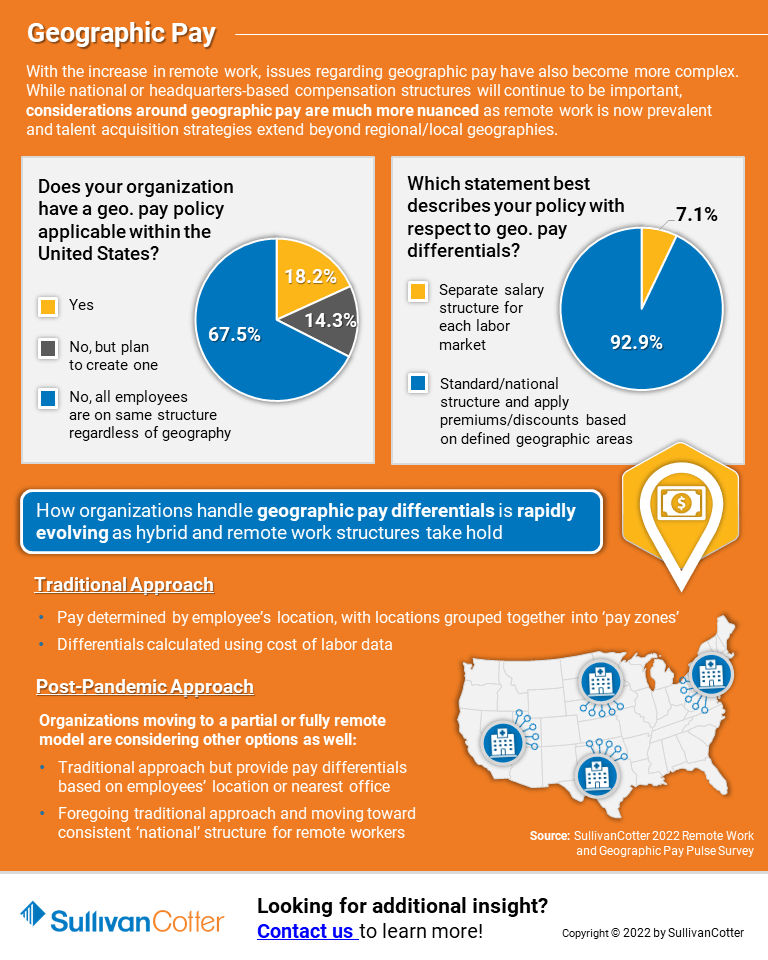

INFOGRAPHIC | Physician Workforce Trends in Pediatric Hospitals

Pediatric hospitals continue to face physician workforce recruitment and retention challenges

Due to unprecedented labor shortages, pay compression, burnout, retirements and increased competition for physician leadership talent, pediatric organizations are experiencing a number of challenges related to recruiting and retaining the right talent.

As a result, many organizations are using their limited compensation budgets to focus more strategically on hard-to-recruit specialties, high-performing physicians, and areas requiring a greater degree of alignment with organizational imperatives.

These imperatives are influenced by an evolving competitive landscape, changes in reimbursement, new modes of providing patient care in support of greater access, financial pressures and more.

Pediatric hospitals are also focused on addressing specialties impacted most by the pandemic, such as critical care medicine and behavioral health. SullivanCotter expects to see these specialties emerge with greater than average compensation increases in future survey reports.

VIEW INFOGRAPHIC

PODCAST | Executive Compensation Committee

Priorities and Trends for the Executive Compensation Committee

Episode 1 >

Episode 2 >

In a rapidly evolving health care environment, oversight of executive compensation, recruitment and retention remains a critical responsibility of the board of directors. These decisions are complex, highly regulated and require heightened executive compensation committee engagement and specialized expertise.

In this two-part edition of the Governing Health Podcast Series, SullivanCotter's Tim Cotter, Managing Director, joins McDermott Will & Emery's Michael Peregrine to discuss emerging trends and practices in health care executive compensation.

These episodes include insight into:

- The current state of salaries, increase budgets, incentive awards and more

- Emerging compensation practices

- Effective retention and transition strategies

- The evolution of annual and long-term incentive plans

- Executive and director co-investment arrangements

- For-profit compatibility data

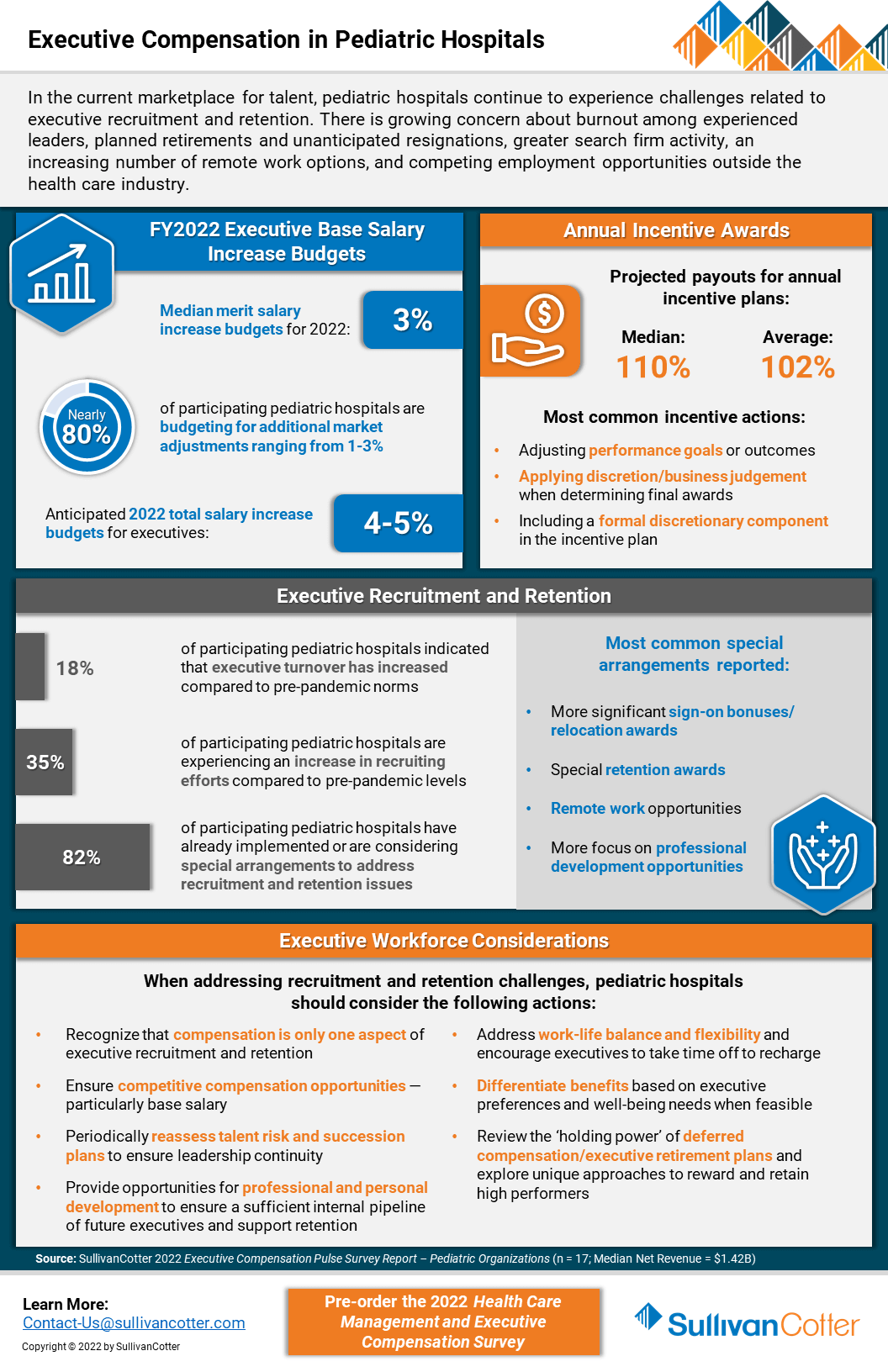

INFOGRAPHIC | Executive Compensation in Pediatric Hospitals

SullivanCotter addresses executive compensation in pediatric hospitals via a recent pulse survey

In the current marketplace for talent, executive compensation in pediatric hospitals is growing increasingly complex as recruitment and retention challenges mount. Organizations remain concerned about burnout among experienced leaders, planned and unanticipated resignations, greater search firm activity, employment opportunities outside the healthcare industry, and remote work presenting more non-traditional employment opportunities.

SullivanCotter recently conducted a pulse survey to help pediatric hospitals understand how their peers are addressing 2022 executive salary increase budgets and incentive awards for FY2021 performance.

It also highlights other actions these organizations are taking to support executive recruitment and retention.

VIEW INFOGRAPHIC

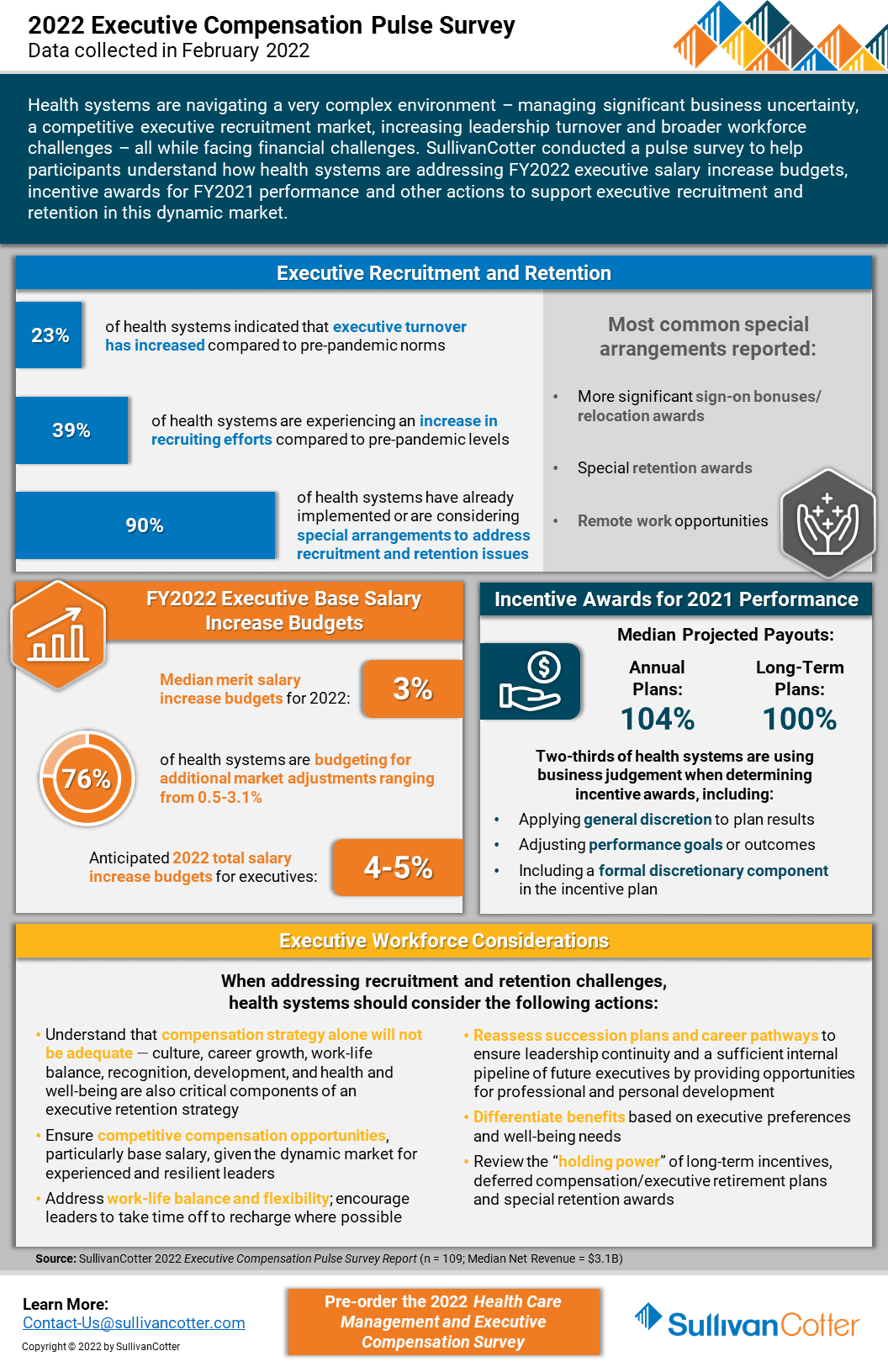

INFOGRAPHIC | 2022 Executive Compensation Pulse Survey

SullivanCotter’s recent executive compensation pulse survey provides insight into how healthcare organizations are addressing recruitment and retention challenges in an increasingly dynamic marketplace

Health systems are growing increasingly concerned about burnout among experienced leaders, planned retirements and unanticipated resignations, greater search firm activity and employment opportunities outside the healthcare industry, as well as remote work presenting more non-traditional employment opportunities.

Considering these concerns, SullivanCotter conducted an executive compensation pulse survey to help participants understand how health systems are addressing FY2022 salary increase budgets and incentive awards for FY2021 performance.

It also highlights other actions systems are taking to support executive recruitment and retention in this dynamic market.

VIEW INFOGRAPHIC

PRESS RELEASE | Wayne Hartley Joins SullivanCotter to Help Expand Physician Workforce Advisory Services

Longstanding knowledge in health care operations, finance and human resources

Chicago, IL | March 29, 2022

SullivanCotter, the nation's leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and technology and data products for the healthcare industry and not-for-profit sector, is pleased to welcome back Wayne Hartley as a Principal in the firm's Physician Workforce Practice.

Wayne is an accomplished senior consulting leader with a distinguished history of managing high-quality medical operations and utilizes more than 20 years of direct healthcare industry experience in his work with clients. With longstanding knowledge in healthcare operations, finance and human resources, Wayne specializes in helping organizations to strengthen physician compensation program strategy, regulatory compliance and value-based outcomes.

"As healthcare organizations look for innovative ways to stay ahead of the curve in an ever-changing marketplace, our aim is to leverage a diverse and growing panel of expertise from the industry's best and brightest consultants. We're thrilled to welcome Wayne back to SullivanCotter and, with his unique skillset and insight, look forward to learning from his extensive clinical and operational leadership experience, building strategic partnerships with new and existing clients, and expanding the firm's clinical workforce advisory services," said Mark Ryberg, Physician Workforce Practice Leader, SullivanCotter.

In his new role with SullivanCotter, Wayne will work with clients to lead physician compensation design projects and develop models to support organization-wide goals as they relate to patient access, panel size, productivity, quality and more. Additionally, he will advise organizations on the fair market value and commercial reasonableness of physician transactions to enhance compliance and mitigate risk, liaise with boards and physician leaders on high-value business strategies, and introduce new methodologies to assess and improve health system readiness for risk-based reimbursement.

Wayne also serves on the firm's Large Clinic™ Group Growth Team in which he helps to direct strategy and member engagement for the 45-year-old independent affinity group comprised of the largest medical organizations in the U.S.

Prior to joining the firm, Wayne previously served in a variety of leadership positions for a number of nationally-recognized consulting firms. He also has a wealth of clinical and operational experience from his time at two of the largest health systems in Minneapolis.

About SullivanCotter

SullivanCotter partners with healthcare and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, data and technology products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

PRESS RELEASE | Enhancing PPMT™ User Experience for Physicians and APPs

Identifying opportunities to educate and engage the clinical workforce

Chicago, IL | March 23, 2022

SullivanCotter, the nation's leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and technology and data products for the healthcare industry and not-for-profit sector, announces new functionality for its growing Provider Performance Management Technology™ (PPMT™) platform that enhances ease of access and usability for physicians and advanced practice providers (APPs). PPMT™ is an industry-first, cloud-based product that engages the clinical workforce and informs leaders through transparent performance-based compensation administration, contract management, and analytical and reporting capabilities.

New functionality includes valuable upgrades to the PPMT™ portal – allowing physicians and APPs one-click access to view key performance indicators via mobile or desktop. This provides physicians and APPs with a quicker line of sight into current performance and productivity results and enhances their ability to track progress against goals on their personal landing page. PPMT's more robust reporting capabilities are also still available for clinicians who are looking to dive deeper into detailed productivity, performance, and compensation results.

The focus on physician and APP engagement is further enhanced with the addition of self-service utilization reporting for compensation administrators. Enabling administrators to easily see which physicians and APPs have been utilizing PPMT™ and what reports have been accessed helps them to identify opportunities to engage the clinical workforce. "Administrators, leaders and managers are often having conversations with individual clinicians about their compensation and these reports help them to go into these meetings better prepared with opportunities to engage and educate their colleagues," said Shelly Slowiak, Director of Product Support - PPMT™, SullivanCotter.

Designed to address a spectrum of physician, leadership and other key stakeholder needs, PPMT™ combines years of healthcare compensation insight and expertise with an intuitive and automated technology platform to help drive performance and support the transition from volume- to value-based care.

"The needs of the health care organizations we serve are dynamic and ever-changing – especially in a marketplace that has grown increasingly complex in the past two years. SullivanCotter remains dedicated to continually enhancing our technology products to drive greater value for clients by understanding these needs and evolving alongside them," said David Schwietz, Chief Information Officer, SullivanCotter.

For more information on these enhancements or our entire suite of Provider Performance Management Technology™, visit www.sullivancotter.com/PPMT or contact us at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, data and technology products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

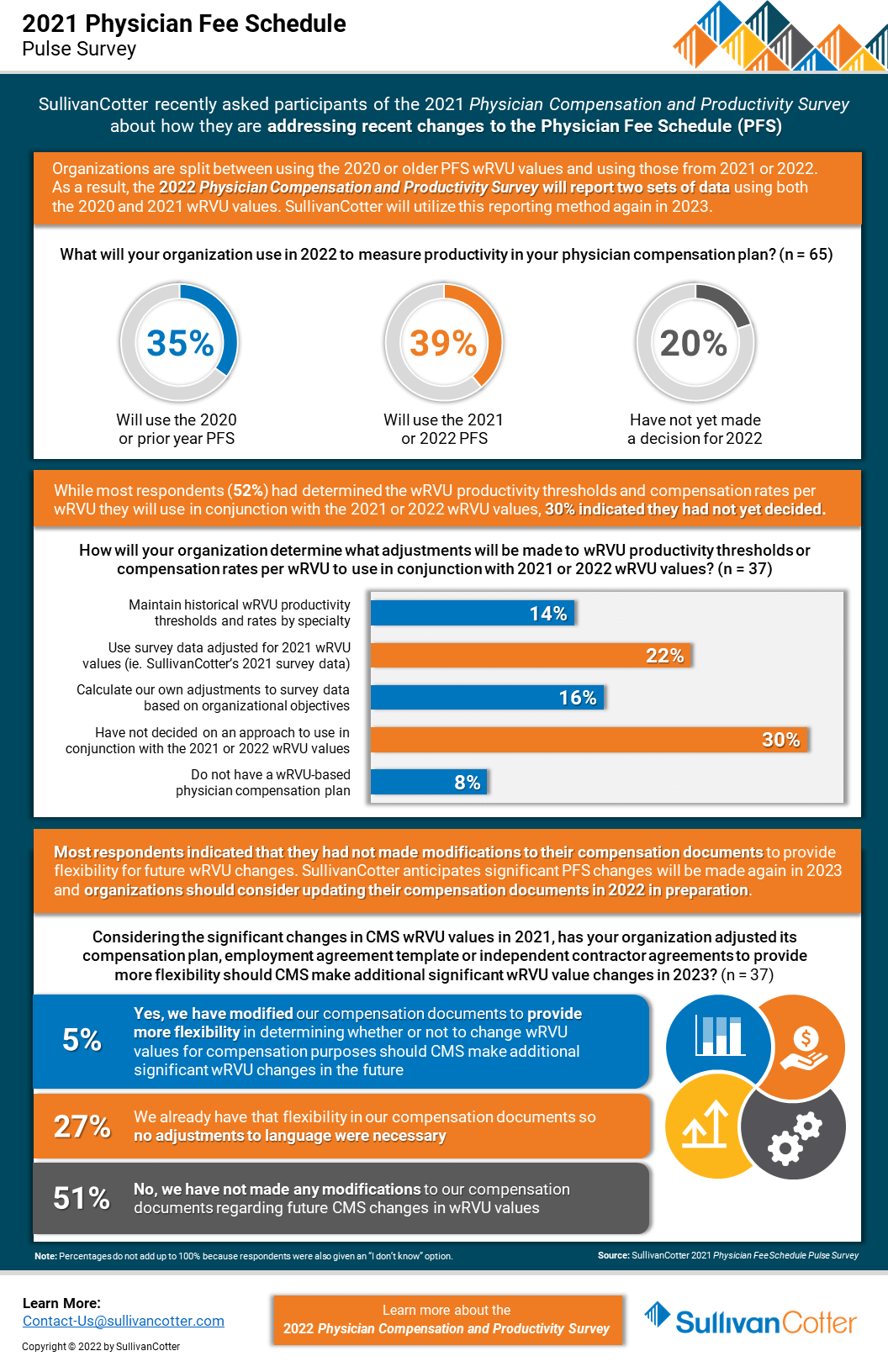

INFOGRAPHIC | Pulse Survey Results: 2021 Physician Fee Schedule Changes

How are health care organizations addressing the 2021 Physician Fee Schedule changes?

Following its annual review of the American Medical Association’s Relative Value System Update Committee’s recommendations, the Centers for Medicare and Medicaid Services (CMS) finalized proposed changes to the 2021 Physician Fee Schedule and has significantly overhauled the Evaluation and Management (E&M) code documentation requirements, time-effort recognition, and wRVU values for new and established patient office visits. These changes were effective as of January 1, 2021.

As organizations look to understand the impact of these changes on reported physician productivity levels, it is also important to assess the effect it will have on physician compensation arrangements, fair market value and commercial reasonableness considerations, financial sustainability and national survey benchmarks.

SullivanCotter recently conducted a pulse survey for participants in the 2021 Physician Compensation and Productivity Survey to assess how organizations are addressing these changes. View highlights from the results – including insight into expected adjustments to work RVU productivity thresholds and compensation rates per work RVU.

VIEW INFOGRAPHIC

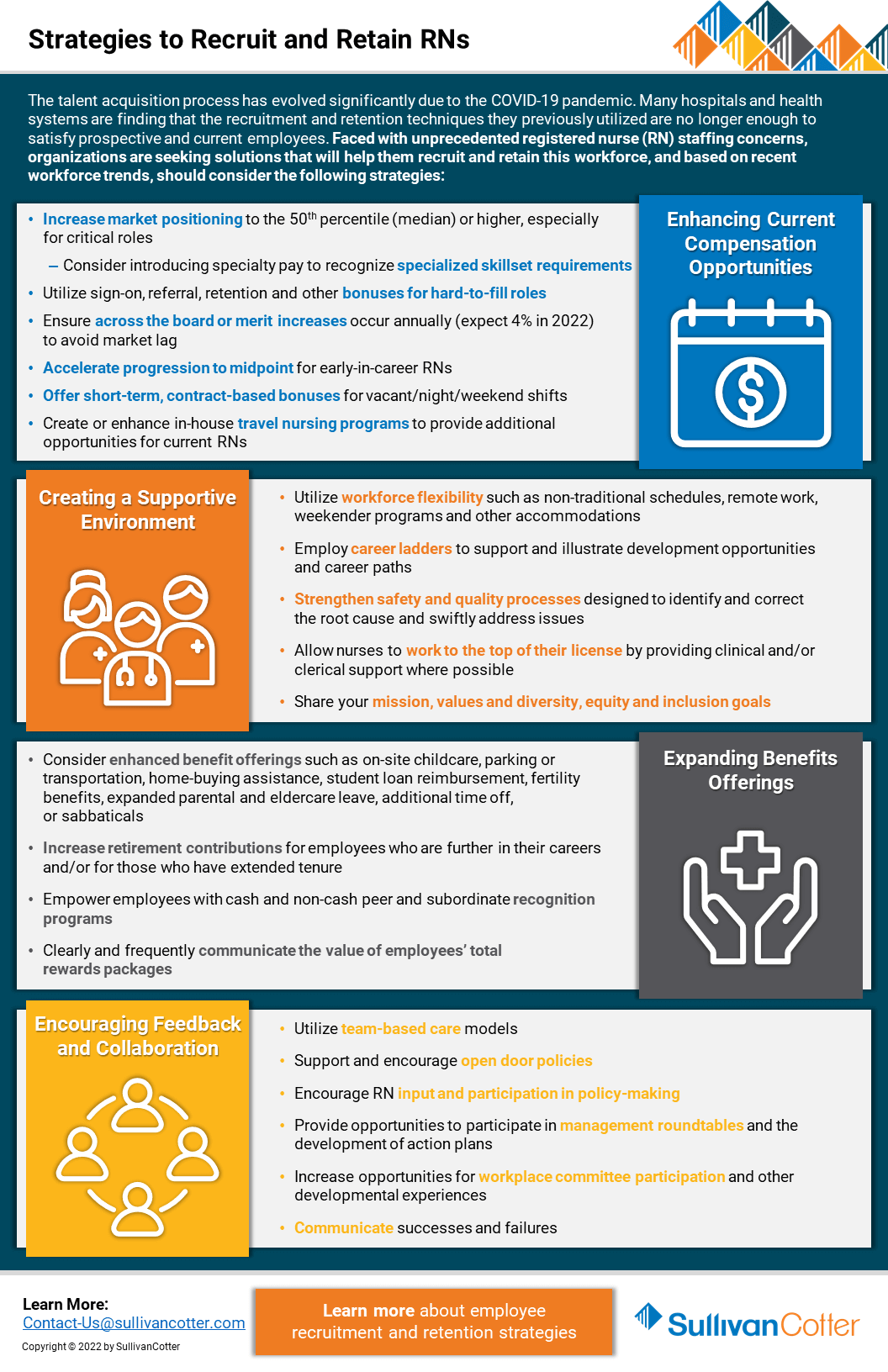

Registered Nurses | Strategies to Recruit and Retain

Looking for better strategies to recruit and retain registered nurses?

The talent acquisition process has evolved significantly due to the COVID-19 pandemic. Many hospitals and health systems are finding that the recruitment and retention techniques they previously utilized are no longer enough to satisfy prospective and current employees. Faced with unprecedented staffing concerns regarding registered nurses (RN), organizations are seeking solutions that will help them recruit and retain this workforce.

Based on recent workforce trends, hospitals and health systems should consider the following strategies:

Enhancing Current Compensation Strategies

- Increase market positioning to the 50th percentile (median) or higher, especially for critical roles

- Consider introducing specialty pay to recognize specialized skillset requirements

- Utilize sign-on, referral, retention and other bonuses for hard-to-fill roles

- Ensure across-the-board or merit increases occur annually (expect 4% in 2022) to avoid market lag

- Accelerate progression to midpoint for early-in-career RNs

- Offer short-term, contract-based bonuses for vacant/night/weekend shifts

- Create or enhance in-house travel nursing programs to provide additional opportunities for current RNs

Creating a Supportive Environment

- Utilize workforce flexibility such as non-traditional schedules, remote work, weekender programs and other accommodations

- Employ career ladders to support and illustrate development opportunities and career paths

- Strengthen safety and quality processes designed to identify and correct the root cause and swiftly address issues

- Allow nurses to work to the top of their license by providing clinical and/or clerical support where possible

- Share your mission, values and diversity, equity and inclusion goals

Expanding Benefits Offerings

- Consider enhanced benefit offerings such as on-site childcare, parking or transportation, home-buying assistance, student loan reimbursement, fertility

benefits, expanded parental and eldercare leave, additional time off, or sabbaticals - Increase retirement contributions for employees who are further in their careers and/or for those who have extended tenure

- Empower employees with cash and non-cash peer and subordinate recognition programs

- Clearly and frequently communicate the value of employees’ total rewards packages

Encouraging Feedback and Collaboration

- Utilize team-based care models

- Support and encourage open-door policies

- Encourage RN input and participation in policy-making

- Provide opportunities to participate in management roundtables and the development of action plans

- Increase opportunities for workplace committee participation and other developmental experiences

- Communicate successes and failures

Looking for additional workforce insights and data?

Contact us to learn more about employee recruitment and retention strategies