Is the U.S. Health System Status Quo Sustainable?

Several key factors impact the financial sustainability of hospitals and health systems

How is your healthcare organization addressing this issue?

This provocative byline from the January 15th edition of The Keckley Report and updates from J.P. Morgan’s 2024 Healthcare Conference underscore the importance of financial sustainability for not-for-profit health systems. While health financial performance seems to have stabilized in recent months for many hospitals and health systems, ongoing sustainability is still an issue that looms large.

Financial recovery efforts have been underway since 2022 with most health care systems stabilizing the core of their enterprises by focusing primarily on surgical and procedural services. Many are also addressing staffing shortages and escalating costs, dealing with unionization in some markets, managing decreased volume in certain specialties, optimizing operational performance, and negotiating improved reimbursement where possible. As these efforts continue, right-sizing service portfolios, sites of care, and workforce composition will better enable organizations to define and focus on their core services while exiting unnecessary or underperforming ones.

Midway through 2024, multiple industry reports indicate that surgical and procedural volumes have increased back to pre-pandemic levels – placing additional pressure on staffing supply, costs, and the need to increase revenue to keep pace with expenses. With greater stabilization and markets and service portfolios being rationalized, efforts can be focused on improving retained services, assets, and the workforce required to support patient access. In parallel, organizations can then consider opportunities for select programmatic growth within their core business and in new areas to diversify revenue.

A key factor in health system sustainability is the investment in its clinician ecosystem – including employed physicians and APPs and various forms of clinician affiliations and relationships with independent clinicians. Health systems are eager to understand and optimize the appropriate level of investment more broadly across their physician enterprise, medical group, specific service lines, and the clinical workforce.

Integral to this effort is continuous performance improvement in three critical areas:

- Aligned enterprise performance metrics and incentives

- Effective relationships with a critical mass of aligned clinicians

- Enhanced performance management

Aligned Metrics and Incentives

Designing organizational performance metrics and incentives that are aligned across the enterprise is critical to achieving and sustaining desired results. The entire enterprise must be interconnected to drive greater performance. This includes shared accountability as it relates to the most impactful measures with a greater understanding of how individual, team and departmental contributions support organization-wide success.

Objectives set at the system level may not translate to the medical group, which can potentially lead to disparate and isolated priorities during the goal-setting process. Vertical alignment in KPIs across both employed and affiliated clinicians will help improve service line delivery and achieve pay-for-performance metrics in payer contracts. In addition, unified scorecards create an opportunity to align performance with the executive level, medical group leadership, practices, and clinicians.

Effective Relationships with Clinicians

As health systems continue to rationalize their core services and drive select programmatic growth, defining the critical mass of clinicians needed within the organization is critical to ensuring success. This includes understanding the workforce requirements of employed and/or affiliated physicians and APPs by specialty and geographic location.

Next, understanding how to align and engage these clinicians is critical to developing effective relationships and ensuring the clinical workforce is working to identify areas for continuous improvement and achieve strategic objectives.

These efforts can be supported in several ways:

- Optimizing staffing models to drive greater patient access, improve clinician satisfaction, and address burnout and turnover

- Developing the right physician-hospital affiliation relationships to accommodate various evolving workforce requirements and needs

- Empowering clinicians through leadership positions or other decision-making roles

- Structuring compensation arrangements to include measurable incentives that drive clinician behaviors and performance in a way that aligns with organizational goals

Optimized Performance Management

Several key factors impact the financial sustainability of hospitals and health systems. These include patient access, utilization, reimbursement, providers and staff composition, effective models of care, and efficient use of resources. Understanding and measuring current performance levels within each of these areas is essential. A close evaluation of productivity, referral and out-migration patterns, compensation, staffing ratios, and investment per provider full-time equivalent can help organizations leverage their strengths more effectively as well as identify opportunities for improvement. Health systems should continually monitor their medical group’s performance and periodically reassess to consider evolving goals and circumstances. Optimizing the overall performance of affiliated clinicians is equally important and can be achieved by assessing each affiliate agreement to ensure incentives are aligned.

Conclusion

As hospitals and health systems continue to address dynamic market, workforce, and operational challenges, ensuring financial sustainability is necessary. For many organizations, this will likely be found in the orchestrated confluence of strategically aligned and rationalized service portfolios, performance metric and incentive alignment, clinical workforce design, and performance optimization.

Continuous performance improvement in these areas will help yield year-over-year financial improvements that will meaningfully influence health system sustainability in these critical years to come.

Long-term sustainability requires all hands on deck.

SullivanCotter’s Provider Affiliation and Optimization team partners with organizations to identify, quantify, and optimize physician and advanced practice provider (APP) relationships and performance to improve productivity, engagement, financial results, staffing ratios, and more.

INFOGRAPHIC | APP Workforce Insights: Hematology Oncology

Learn more about work expectations, models of care, billing practices and more within Hematology Oncology.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Hematology Oncology when evaluating your APP workforce.

ON-DEMAND WEBINAR | Struggling to recruit and retain your nursing workforce?

Maximizing the Employee Value Proposition

A Holistic Approach to Nursing Recruitment and Retention

Hosted by the American Hospital Association/Health Forum

How is your organization addressing ongoing nursing shortages? Many hospitals and health systems are reassessing various nursing workforce strategies in order to stay competitive and support recruitment and retention in a financially sustainable way. While this often consists of reviewing broader employee total rewards programs, it also includes a careful analysis of current workforce structures. View our recent webinar on-demand to learn how to:

- Design an effective total rewards strategy amidst workforce shortages

- Adjust nursing pay programs to account for differences in cost of living, geography and care settings

- Analyze span of control, headcount, nursing job architecture and career frameworks to help identify areas for improvement

Fill out the form below to view the webinar recording!

PRESS RELEASE | Sullivan Cotter Holdings, Inc. Acquires Lotis Blue Consulting

Sullivan Cotter Holdings, Inc., Adds Health Care Organizational Design and Strategy Execution Services to Portfolio

—

June 20, 2024 – CHICAGO – Sullivan Cotter Holdings, Inc., the nation’s leading human capital information management holding company for health care and not-for-profit/tax-exempt organizations, has acquired Chicago-based Lotis Blue Consulting.

Formed in 2005, Lotis Blue (previously Axiom Consulting Partners) works with organizations in multiple industries to develop solutions to their most complex and difficult problems related to organization, teams, workforce, and leadership. Having served over 450 clients since their founding, they have built a reputation for delivering business impact through strategy-led organization design, talent management, and improving the performance of executive teams and leaders. The firm’s robust and proprietary approach to combining data and behavioral science to elevate workforce, leadership, and organizational performance in service of strategy execution is uniquely positioned in the market and credited with realizing sustained client results. In 2024, Forbes recognized the firm as one of America’s best management consulting firms.

Lotis Blue will continue to serve clients across all industries as it expands more deeply into the health care industry. Existing and prospective health care and not-for-profit/tax-exempt clients of Lotis Blue and the individual brands within Sullivan Cotter Holdings, Inc. – SullivanCotter, Clinician Nexus and C3 Nonprofit Consulting Group – will specifically benefit from expanded services and related offerings.

“When we offer Lotis Blue services in conjunction with our portfolio of companies, we create synergistic services for health care and other not-for-profits that support business transformation at all levels,” said Ted Chien, President and CEO of Sullivan Cotter Holdings, Inc. “Health care is in a transformative period that requires careful consideration of structure with the ability to execute real organizational change. This acquisition allows us to leverage talent and experience within the general industry that can be critical to transforming health care.”

Health care organizations face labor shortages, market consolidation, and increased patient demands for a more integrated, value-based care experience. As a result, they are under pressure to reimagine operational models and structure – addressing everything from talent recruiting and retention to workforce development to incentives, rewards, and compensation. More so, they seek individualized data and analytics to guide potential business shifts that will drive positive change across labor, revenue, efficiency, and patient experience.

“Sullivan Cotter Holdings has an incredibly deep bench of knowledge within its brands,” said Garrett Sheridan, CEO of Lotis Blue. “We see this as an opportunity to expand our services to create a holistic, multi-disciplinary resource for organizations looking to strategically transform how they compete and serve their highly purpose-driven stakeholders in today’s ever-changing market.”

About Sullivan Cotter Holdings, Inc.

Sullivan Cotter Holdings, Inc., is the parent company of independent operating brands SullivanCotter, Clinician Nexus, Lotis Blue Consulting and C3 Nonprofit Consulting Group. This collection of complementary brands helps organizations solve complex workforce issues by enabling people, processes and technology aimed at large-scale business transformation.

For more information, email info@sullivancotter.com or call 888.739.7039.

Note to media: Additional information and interviews are available on request.

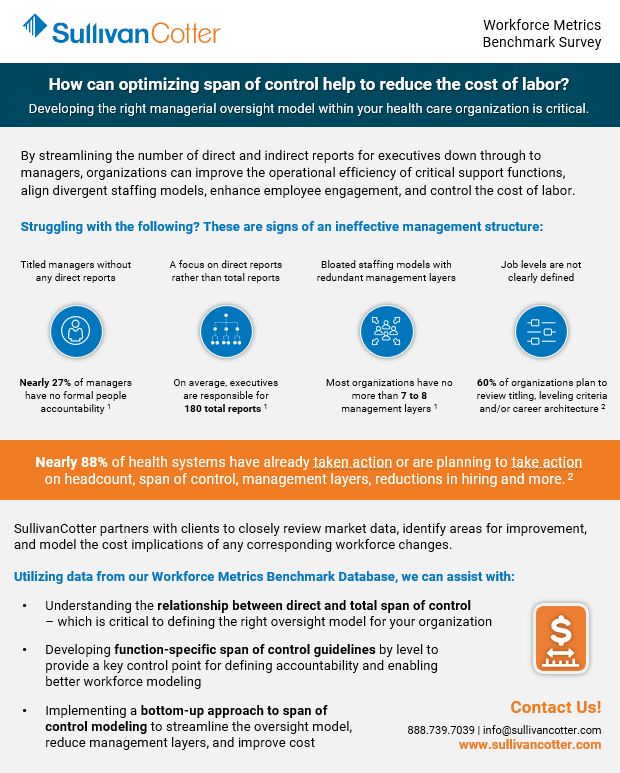

Optimize span of control to help reduce the cost of labor

Developing the right managerial oversight model within your health care organization is critical.

By streamlining the number of direct and indirect reports for executives down through to managers, organizations can improve the operational efficiency of critical support functions, align divergent staffing models, enhance employee engagement, and control the cost of labor.

Struggling with the following? These are signs of an ineffective management structure:

Titled managers without any direct reports.

A focus on direct reports rather than total reports.

Bloated staffing models with redundant management layers

Job levels are not clearly defined

Nearly 27% of managers have no formal people accountability 1

On average, executives are responsible for 180 total reports 1

Most organizations have no more than 7 to 8 management layers1

60% of organizations plan to review titling, leveling criteria and/or job architecture2

Nearly 88% of health systems have already taken action or are planning to take action on headcount, span of control, management layers, reductions in hiring and more.2

SullivanCotter partners with clients to closely review market data, identify areas for improvement, and model the cost implications of any corresponding workforce changes.

Utilizing data from our Workforce Metrics Benchmark Survey, we can assist with:

- Understanding the relationship between direct and total span of control – which is critical to defining the right oversight model for your organization

- Developing function-specific span of control guidelines by level to provide a key control point for defining accountability and enabling better workforce modeling

- Implementing a bottom-up approach to span of control modeling to streamline the oversight model, reduce management layers, and improve cost

Sources: 1. SullivanCotter Workforce Metrics Benchmark Database, 2. SullivanCotter 2024 Executive Compensation Pulse Survey

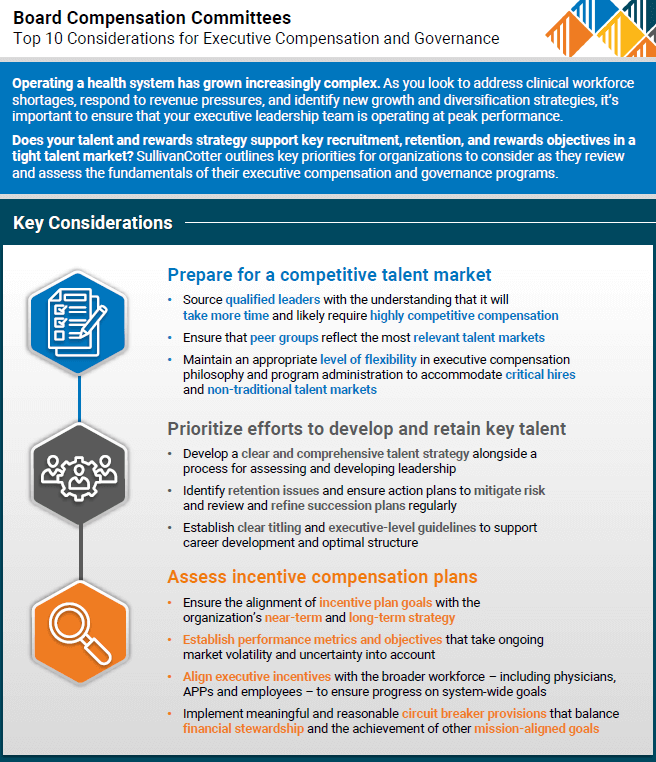

Top 10 Considerations for Executive Compensation and Governance

Does your executive compensation strategy empower and engage your organization’s leadership team?

Don’t miss out on top talent.

Operating a health system has grown increasingly complex. As you look to address clinical workforce shortages, respond to revenue pressures, and identify new growth and diversification strategies, it’s important to ensure that your executive leadership team is operating at peak performance. However, in today’s highly competitive talent market, many organizations are struggling to recruit, retain, and reward individuals in these key leadership roles.

SullivanCotter outlines key priorities for your Board’s Compensation Committee to consider as they review and assess the fundamentals of their executive compensation and governance programs.

These guidelines will help you to:

- Prepare for a competitive talent market

- Prioritize efforts to develop and retain key talent

- Assess incentive compensation plans

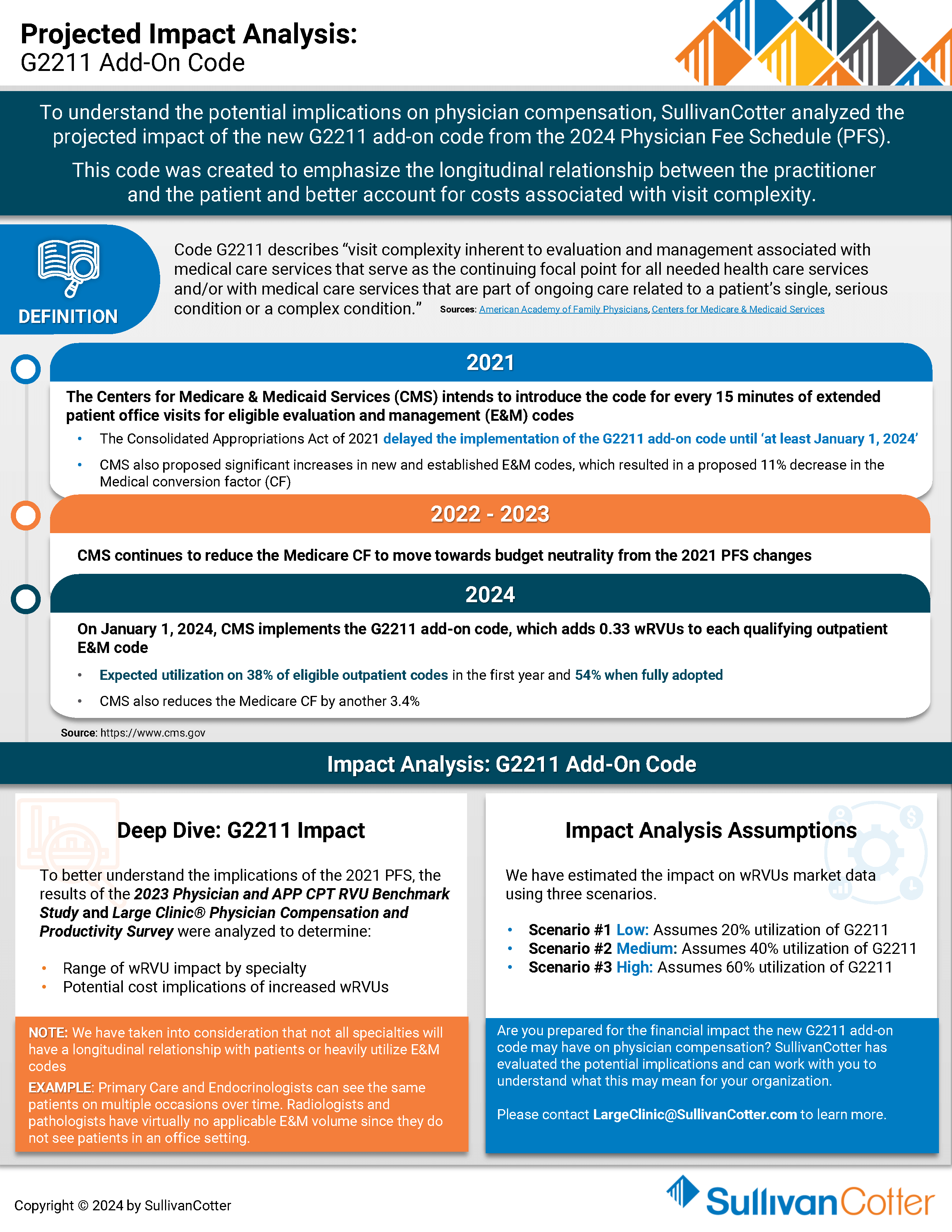

INFOGRAPHIC | Projected Impact Analysis: G2211 Add-On Code

How will the new G2211 add-on code impact your physicians?

Explore three different utilization scenarios with us!

SullivanCotter recently analyzed the projected impact of the new G2211 add-on code from the 2024 Physician Fee Schedule – which was created to emphasize the longitudinal relationship between the practitioner and the patient and better account for costs associated with visit complexity.

It’s crucial to carefully evaluate the cost implications of the new code and how it may affect your physician compensation structure. Otherwise, your organization may struggle to set effective wRVU targets, TCC per wRVU rates, and salary budgets.

Discover the potential impact on physician compensation and learn how to prepare your organization!

Key Considerations:

- As patient volume increases, governmental reimbursement decreases and most commercial payors continue to lag

- Market surveys will not reflect the 2024 PFS until the 2025 survey cycle – making annual budgeting decisions more challenging

- Organizations with wRVU-based compensation structures must carefully evaluate the impact of the G2211 add-on code to determine wRVU targets and TCC/wRVU rates

- For those using predominantly salary-based models, understanding the financial impact of this code change will be an important consideration for setting salary budgets

- Organizations should remain flexible in evaluating rewards programs in an ever-changing market

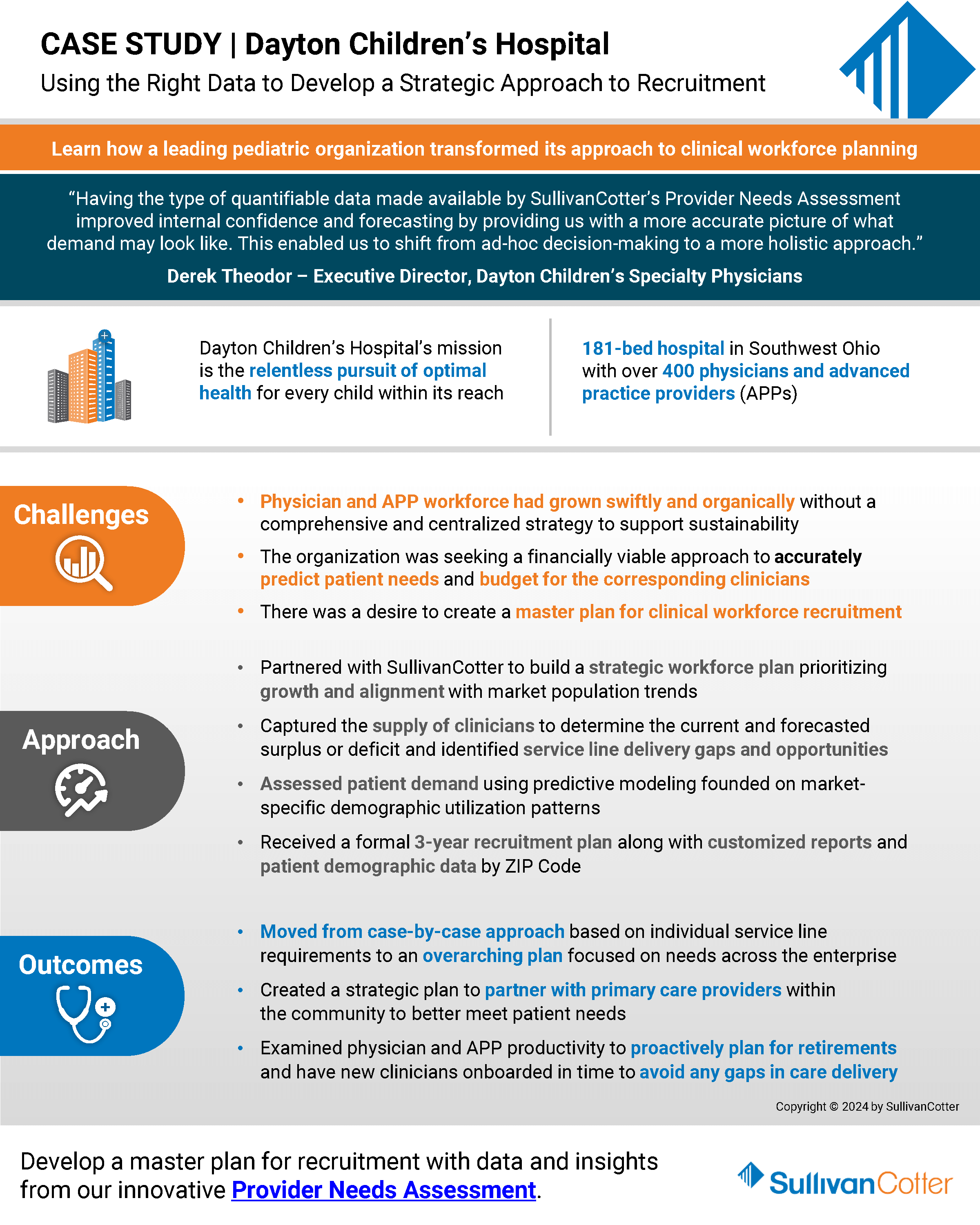

How Dayton Children's Hospital Transformed Its Approach to Clinical Workforce Planning

Facing intense competition for physicians and APPs?

Utilize the right data to develop a strategic approach to recruitment.

Amidst a complex backdrop of workforce shortages, burnout, and increased patient demand, it’s no surprise that many health care organizations are looking for a more effective way to assess changing service needs and clinical staffing requirements.

It’s time to put the wheels in motion.

Dayton Children’s Hospital recently partnered with SullivanCotter to conduct a comprehensive Provider Needs Assessment. In this case study, SullivanCotter highlights how organizations can utilize clinical supply and demand data to develop a well-informed ‘master plan’ for recruitment and hiring decisions.

Learn about the benefits of our interactive Provider Needs Assessment application to support your ongoing recruitment, retention and succession planning needs.

FLSA: Increase in Salary Threshold for Exemption Status

Department of Labor Increases Minimum Salary Level for Exempt Employees

What does the new rule mean for your organization?

On April 23, 2024, the U.S. Department of Labor (DOL) announced that the salary threshold for exemption status will increase from the $684/week ($35,586 annually) to $1,128/week ($58,656 annually).

The transition occurs in two phases:

| Effective | Minimum Weekly Pay | Annualized | Percentage Change |

|---|---|---|---|

| July 1, 2024 | $844.00 | $43,888.00 | 23.4% |

| January 1, 2025 | $1,128.00 | $58,656.00 | 33.6% |

Employers will need to ensure salaries for all exempt employees meet the new minimum levels. If not, these employees will need to be reclassified as nonexempt (eligible for overtime) by January 1, 2025. To maintain an exempt FLSA status ineligible for overtime earnings, workers must earn an annual minimum salary of $58,656 as of January 1, 2025.

To ensure compliance, organizations should start considering the impact of the rule and how to address it.

What You Need to Do:

- Identify exempt jobs and employees that may be impacted. This includes those in grades with a pay range minimum below the new FLSA minimum salary threshold and all exempt employees, including part-time employees, whose weekly earnings are less than the January 1, 2025 minimum.

- Understand your state’s requirements regarding overtime pay and advance notice of wage changes.

- Review the job duties of people and roles that may be impacted and determine whether they are paid on a salary basis and still meet at least one of the duties tests for exemption under FLSA.

- Compare cost scenarios for impacted roles, including a review of current overtime and work hours, base pay, regular rate calculations, benefits, incentives and bonus payments, and time tracking. Make exemption status changes where necessary.

- Determine your organization’s strategy for addressing any pay compression that may be caused by minimum salary threshold changes and calculate the associated costs.

- Ensure pay range minimums for exempt roles are at or above the new minimum salary thresholds and calculate the final cost of any resulting base pay increases.

- Assess final job and employee changes and determine approach for resolving other downstream effects (e.g., benefits, timekeeping, etc.).

- Develop a change management plan and communicate any changes to leaders and impacted employees.

- Determine your organization’s implementation and governance approach as the minimum salary threshold is proposed to increase every three years beginning July 1, 2027.

Need Help Navigating These Challenges?

SullivanCotter has years of experience helping not-for-profit health care organizations navigate regulatory changes such as these. We can help your organization address the DOL changes by assisting with:

- Job Description and/or Job Duty Review to assess consistency of FLSA classification across similar titles. 1

- Pay Structure and Practice Review to ensure compliance with the new minimum salary threshold.

- Detailed Cost Modeling to meet an organization’s budgetary needs while addressing any resulting pay compression.

- Strategic Roadmap Design to prepare you for future salary threshold increases.

- Communications, Training and Change Management to help leaders and staff understand overtime exemptions, duties tests, salary tests, and impacts of these changes. This includes drafting talking points, responses to frequently asked questions, and leader guides.

1SullivanCotter is not a law firm and cannot provide legal advice regarding FLSA classifications, but we can provide market prevalence and review for consistency and adherence to the exemption tests based on our expertise as Human Resources and Compensation consultants.

Industry changes require all hands on deck.

SullivanCotter can provide ad-hoc consulting or function as an extension of your team through our co-sourcing services.

We can partner with you through the FLSA changes and beyond to help support ongoing compliance and streamline program administration.

Reach out to us to learn more!

The FTC's Ban on Noncompete Clauses

The FTC’s Ban on Noncompete Clauses

Addressing the Implications for Not-For-Profit Health Care Organizations

On April 23, 2024, the Federal Trade Commission (FTC) issued its Final Non-Compete Clause Rule (“Final Rule”), which bans most post-employment noncompete clauses after the effective date. Barring any delays, the Final Rule will go into effect on September 4, 2024. This is 120 days after its initial publication in the Federal Register.1

The Final Rule is broad and covers noncompete arrangements with all workers, including employees, independent contractors and volunteers. The FTC is already facing several legal challenges asserting that the agency lacks the authority to issue the Final Rule. Further questions regarding the scope of the FTC’s purview over certain not-for-profit organizations also have arisen. Nevertheless, the Final Rule could have significant implications for employment and independent contractor arrangements with executives, physicians, advanced practice providers (APPs) and other workers. Health care organizations are well advised to understand the parameters of the Final Rule, assess its implications, and identify potential actions to take before the effective date.

This article provides some initial guidance for consideration:

OVERVIEW OF THE FTC NONCOMPETE RULE

The provisions of the Final Rule include the following:

- Prohibits all new post-employment noncompete agreements after the effective date for any worker regardless of title, job function, or compensation.

- Bans almost all existing post-employment noncompete agreements after the effective date:

-

- Formal rescission is not required; however, individual notice that agreements are no longer enforceable is required by the effective date.

- Exception for existing Senior Executive noncompete agreements – such agreements will remain enforceable even after the effective date; new Senior Executive noncompetes are prohibited.

- “Senior Executive” is defined as a worker who (a) receives annualized compensation over $151,164 and (b) is in a policy-making position for the business as a whole.

- The exception is likely to be narrow and applicable to the most senior leaders of the enterprise. For example, the FTC indicates that a hospital-employed physician who leads a surgical or internal medicine practice would not be a Senior Executive.

-

- Defines a “noncompete clause” broadly:

- Goes beyond an explicit noncompete provision and applies whether documented in a contract or policy.

- Defined in the Final Rule as “a term or condition of employment that prohibits a worker from, penalizes a worker for, or functions to prevent a worker from (i) seeking or accepting work in the United States with a different person where such work would begin after the conclusion of the employment that includes the term or condition; or (ii) operating a business in the United States after the conclusion of the employment that includes the term or condition.

- Other restrictive covenants (e.g., nonsolicitation, confidentiality) are not categorically banned:

- However, if they are so broad as to prevent a worker from seeking other work after their employment ends, such restrictive covenants may fall within the definition of a noncompete.

Application of the Final Rule to Tax-Exempt Health Care Organizations. Under the FTC Act, an organization must be “organized to carry on business for its own profit or that of its members” in order to fall within the purview of the FTC. The FTC takes the position that a portion of tax-exempt entities will fall within its jurisdiction and the Final Rule’s purview. In its commentary on the Final Rule, the FTC explicitly notes that tax-exempt status is one factor to be considered, but that this status is not dispositive when determining the FTC’s jurisdiction. Furthermore, the FTC referenced the negative impact of noncompetes in health care and declined to provide a blanket exemption to the industry. Thus, some tax-exempt health systems may fall within the Final Rule’s purview. In addition, at least a portion of a health system’s business could be impacted by the Final Rule by virtue of its application to employees of for-profit entities within a tax-exempt health system (e.g., health plans, joint ventures, hospital-physician organizations, for-profit subsidiaries, etc.). Based on the FTC’s position, the Final Rule’s application to tax-exempt health care organizations is likely to face legal challenges.

IMPLICATIONS AND CONSIDERATIONS FOR HEALTH CARE ORGANIZATIONS

The Final Rule could have significant implications for tax-exempt health care organizations. In addition to its potential application to health systems and their constituent businesses, the Final Rule’s application to broader for-profit organizations may impact tax-exempt health systems’ ability to effectively recruit and retain employees in a competitive marketplace for talent. When hiring a physician, for example, not-forprofit health systems will need to consider the effect a noncompete provision may have on a candidate – especially if that candidate is considering an alternative offer from a for-profit organization without noncompete restrictions. Similar considerations may apply to executives and other employees.

While the ultimate application of the Final Rule is still uncertain, tax-exempt health systems should take the following actions to be prepared:

- Inventory Current Noncompete Arrangements. Assess the existing use of noncompete agreements and other restrictive covenants for current and former executives, physicians, other employees, and contractors.

- The inventory should be broad and include the health system and medical group, as well as any for-profit businesses (e.g., health plans, for-profit subsidiaries, joint ventures, staffing companies).

- Noncompete arrangements may be found in a variety of documents, including employment contracts, deferred compensation arrangements, severance agreements, program documents and policies.

- Agreements with independent contractors (e.g., Medical Directors) also should be reviewed.

- Consider establishing a noncompete arrangement if one does not exist for any Senior Executive.

- The Final Rule bans organizations from entering into any noncompete agreements after the effective date but will preserve the enforceability of arrangements that pre-date the effective date for Senior Executives.

- Draft and plan for notification prior to the effective date to all individuals restricted by noncompetes about their unenforceability.

- The inventory should be broad and include the health system and medical group, as well as any for-profit businesses (e.g., health plans, for-profit subsidiaries, joint ventures, staffing companies).

- Assess Risks if Noncompetes are Unenforceable. Understand the potential business and retention risks if noncompetes are unenforceable. As part of this review, determine if other legal compliance issues are implicated. For example, striking a noncompete provision could impact the taxability of deferred compensation agreements that use noncompetes to establish a “substantial risk of forfeiture.”

- Once the risks are inventoried, prioritize those with the greatest impact where alternative actions may be appropriate to protect the organization.

- Work with Legal Counsel to Assess the Potential Application to Tax-Exempt Entities. The application of the Final Rule to each tax-exempt organization will require careful consideration of the individual circumstances of the entity. The conclusion will be impacted by the organization’s business model and structure, among other factors.

- Consider Alternative Restrictive Covenants and Termination Notice Provisions.

- Assess the use of nonsolicitation and confidentiality/nondisclosure restrictions as alternatives to noncompete clauses.

- Nonsolicitation restrictions may be critical in situations where physicians transitioning to competitive employment situations are likely to take patients with them.

- Ensure that such restrictions are appropriately tailored to ensure they do not fall within the definition of a noncompete provision.

- Determine if reasonable termination notice provisions can be incorporated into an agreement to allow for continued employment prior to termination.

- The Final Rule does not apply to “garden leave,” where a worker remains employed to provide limited duties while continuing to receive pay.

- Organizations may consider utilizing such notice provisions to delay departure (and thus the time when “competition” can begin).

- Assess the use of nonsolicitation and confidentiality/nondisclosure restrictions as alternatives to noncompete clauses.

- Consider Actions in the Context of the Broader Talent Strategy; Evaluate the Use of Retention and Other Pay Arrangements.

- Articulate the organizational purpose of noncompetes and the rationale for using them with certain employees (e.g., risk of trade secret disclosure, preserving investments in training/development, protecting against loss of patients, etc.).

- Identify the employees who are critical to retain and consider appropriate interventions:

- Organizations can reorient their strategies to provide a reward for remaining with the organization rather than a penalty for departure.

- Examples include compensation adjustments, retention bonuses or other deferred compensation that is contingent on continued employment, and professional development opportunities.

- Monitor the Status of Legal Challenges. Challenges to the FTC’s authority to promulgate and enforce the Final Rule may take some time to be adjudicated. Action plan timelines should be adapted as the legal challenges unfold.

CONCLUSION

The ultimate enforceability of the Final Rule is subject to significant legal challenges and may be delayed or limited. In the meantime, tax-exempt and other healthcare organizations should ensure they understand the potential implications of the Final Rule and determine actions that may be taken to protect critical business interests.

1“Employment” is defined by the FTC as “work” completed for a person. Thus, as used in this article, employment includes both employer-employee relationships and independent contractor relationships.

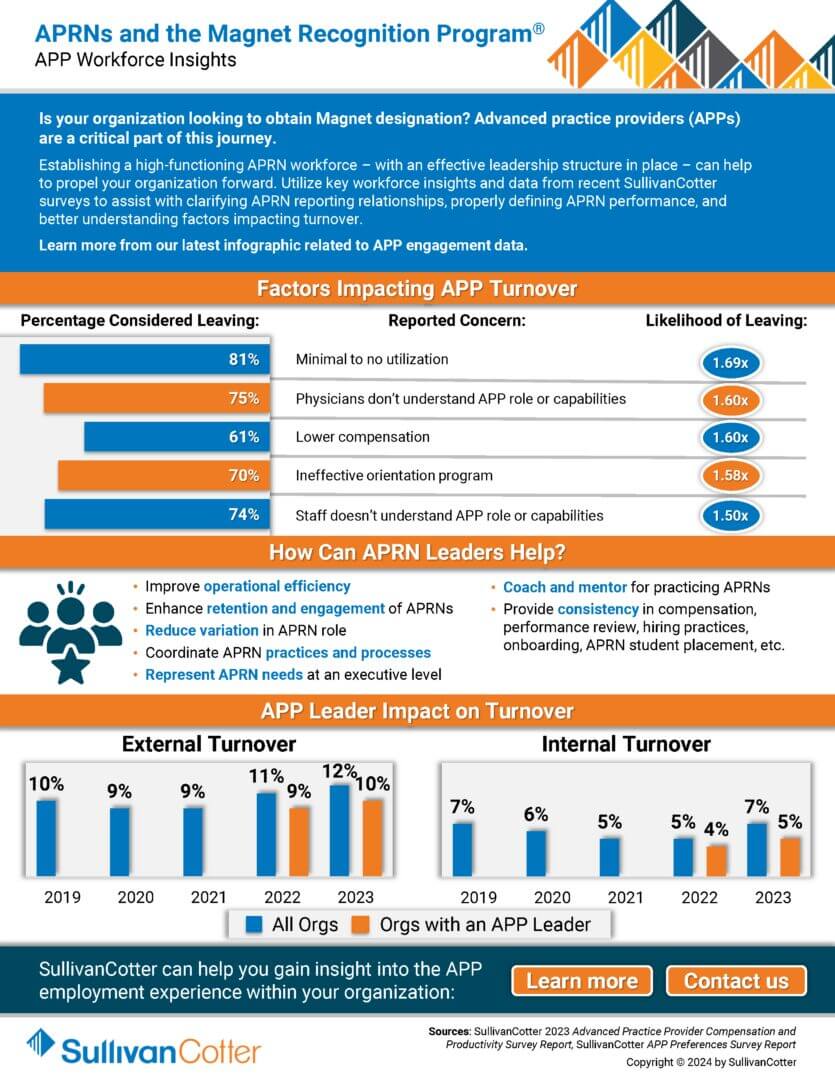

INFOGRAPHIC | APRNs and the Magnet Recognition Program®

Is your organization looking to obtain Magnet designation? Advanced practice providers (APPs)

are a critical part of this journey.

Establishing a high-functioning APRN workforce – with an effective leadership structure in place – can help to propel your organization forward. Utilize key workforce insights and data from recent SullivanCotter surveys to assist with clarifying APRN reporting relationships, properly defining APRN performance, and better understanding factors impacting turnover.

Learn more from our latest infographic related to APP engagement data.

PODCAST | Governing Health – Board Compensation

Navigating the Nuances of Board Compensation in Health Care

LISTEN TO PODCAST

Join us in unraveling the complexities of designing effective board compensation programs within not-for-profit hospitals and health systems. SullivanCotter’s Bruce Greenblatt joins Michael Peregrine of McDermott Will & Emery in a recent episode of the Governing Health podcast.

Together they explore several key design strategies, compensation options and legal considerations for organizations to address as they reexamine their approach.

If you’re a healthcare executive, board member or strategic legal advisor – you won’t want to miss this!

Revisit RN Workforce Strategies to Address Re-energized Unions Amid Worker Shortages

The stability of your RN workforce is critical.

Put the right programs in place to drive equity and engagement.

With union activity on the rise and a nursing shortage expected to worsen, hospital leaders must re-evaluate how to meet their RN workforce’s needs better.

SullivanCotter’s Cathy Loose was recently featured in Healthcare Business Today to discuss how leaders can be more proactive in ensuring the right compensation programs and rewards are in place for all nurses.

Lay the foundation for greater RN retention and performance by meeting the expectations of non-union employees while also creating an environment that is equipped to meet future union needs.

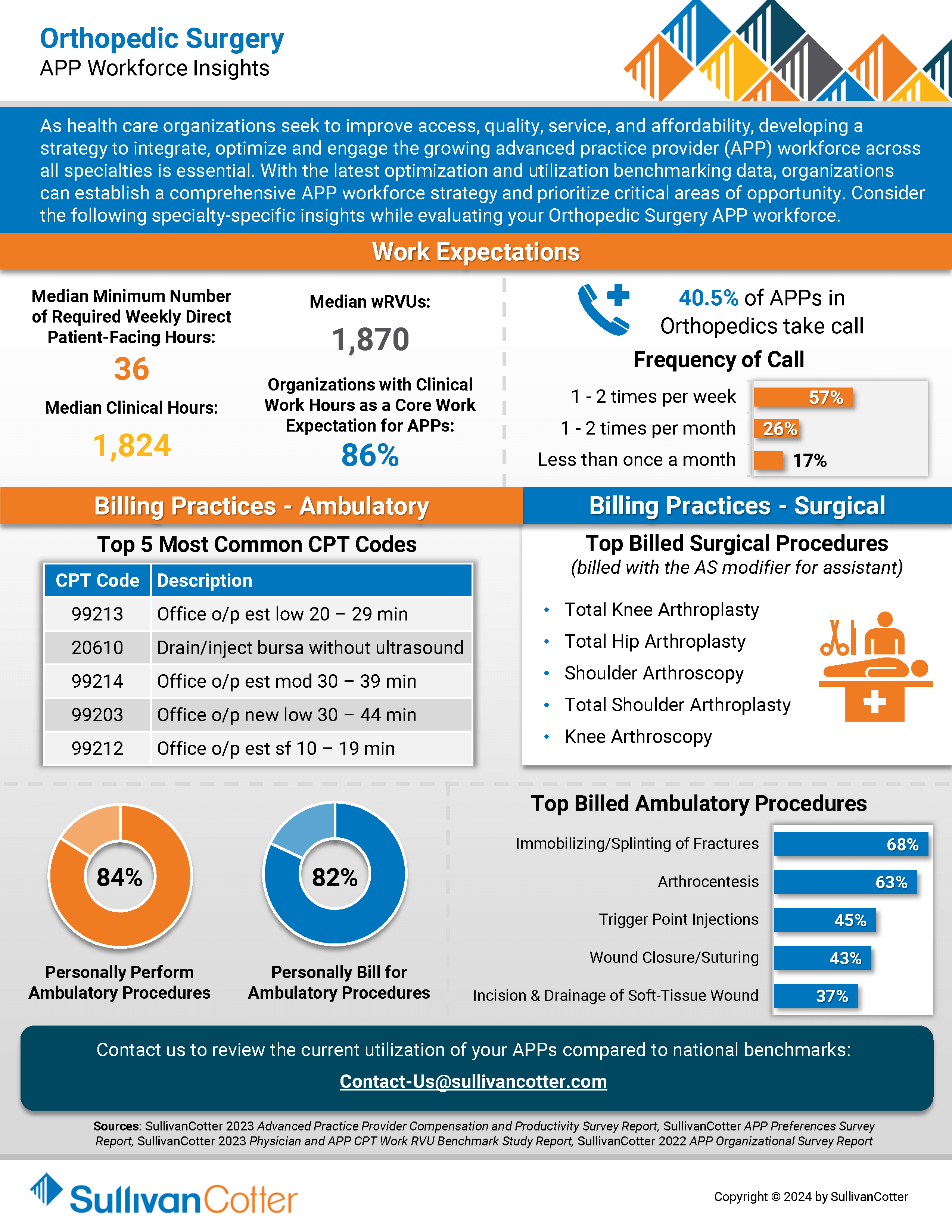

INFOGRAPHIC | APP Workforce Insights: Orthopedic Surgery

Learn more about Orthopedic Surgery work expectations, models of care, billing practices and more.

As healthcare organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Orthopedic Surgery when evaluating your APP workforce.

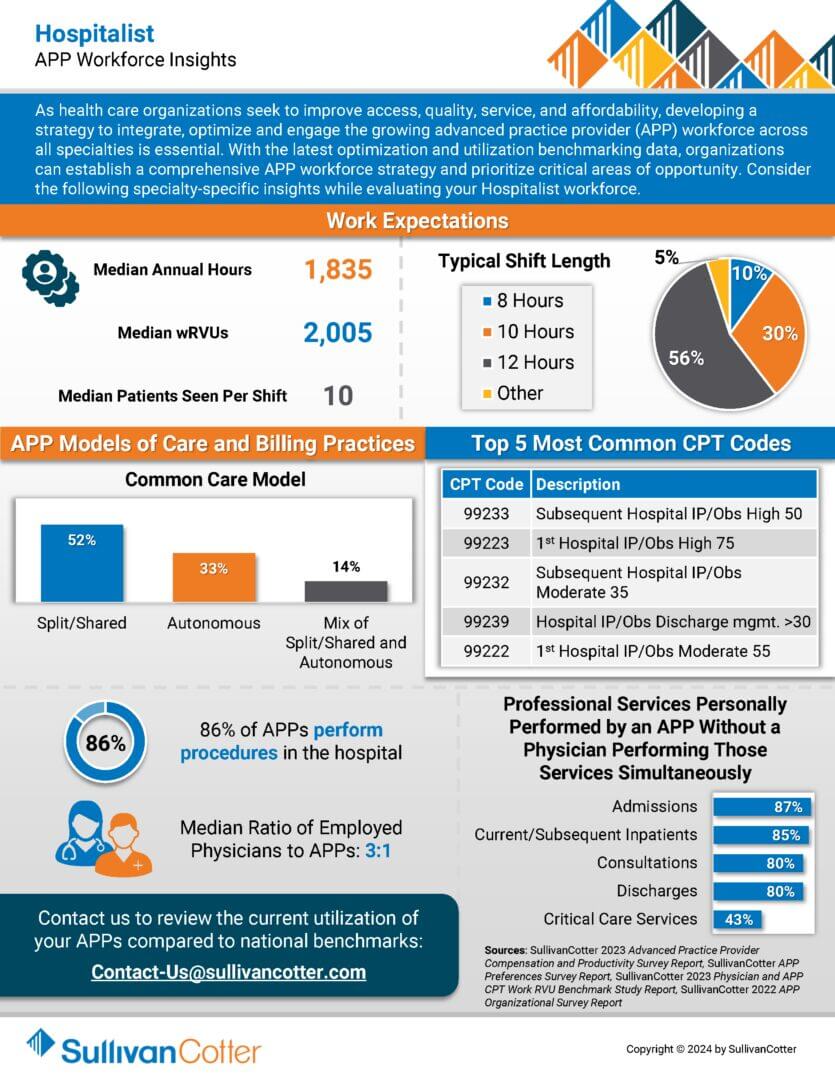

INFOGRAPHIC | APP Workforce Insights: Hospitalist

Learn more about Hospitalist work expectations, models of care, billing practices and more.

As health care organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Hospitalists when evaluating your APP workforce.

Succession Planning and the Role of a Dynamic Provider Needs Assessment

Addressing the Health Care Workforce Crisis: Succession Planning and the Role of a Dynamic Provider Needs Assessment

Originally published by the American Association of Provider Compensation Professionals

READ FULL ARTICLE

Healthcare organizations are under pressure to ensure proper staffing and continuity of care to support the communities they serve. In addition to determining the right number and type of clinicians, organizations must also monitor potential retirements and reductions in clinical productivity levels to help inform succession planning needs. As more physicians ease into retirement over the next 3-5 years, having a succession plan in place can help fill key vacancies and support an overall talent strategy.

In this article, SullivanCotter discusses:

- Addressing the imbalance in clinical supply and demand

- Assessing clinical workforce requirements and succession planning

- Deploying a dynamic Provider Needs Assessment (PNA)

- Measuring the impact of clinical talent demand on compensation

Forbes | The Labor Crisis is Derailing Health Care Transformation

How Can Organizations Fix the Labor Crisis that is Derailing Health Care Transformation?

Without a stable and engaged workforce, health systems are limited in their ability to truly transform

Although some organizations are making headway as new business strategies emerge and care delivery models evolve, the current labor market continues to be a major roadblock.

The industry has hit a wall. How can we fix this?

Recently featured in Forbes, SullivanCotter’s President and CEO, Ted Chien, highlights how true transformation requires the industry to:

- Redefine clinical performance in the shift to value-based health care

- Leverage technology in a way that works for clinicians – not against them

- Modernize compensation and care delivery models

- Create better pathways to employment

Mergers and Acquisitions: Integrating Total Rewards Strategies to Drive Value

By Cathy Loose, Employee Workforce Practice Leader, SullivanCotter and Liz Snyder, Principal, SullivanCotter

INTRODUCTION

As healthcare continues to evolve at a rapid pace, many organizations are exploring opportunities to expand and scale their operations to support long-term growth. One of these strategies includes pursuing mergers and acquisitions (M&A) – a practice that began to gain momentum again near the end of 2022 following a two-year slowdown in the wake of the COVID-19 pandemic. According to Kaufman Hall’s Hospital and Health System M&A in Review report, this momentum continued through 2023 with 65 announced transactions – a 10% increase from 2022. Sixteen of the 65 transactions were reported near the end of 2023. Two primary factors have contributed to this growth in M&A activity. Foremost, there has been an increase in the number of financially distressed organizations seeking partnerships. Transactions involving these circumstances, including smaller hospitals and health care systems, rose from 15% in 2022 to 28% in 2023. Due to financial hardship, many seek to secure partners to help ensure financial sustainability and maintain access to care delivery within their community. Reorganization in regional markets, with the realignment of both for-profit and not-for-profit health system portfolios, also contributes to the rise in M&A activity. Many organizations consider this is critical to expanding into complementary capabilities and delivering more coordinated care across a broader market.

TOTAL REWARDS: ADDRESSING COMMON INTEGRATION CHALLENGES

An essential key to success while undergoing a merger or acquiring another organization is addressing financial and operational goals and making the transition as smooth as possible for employees.

This includes the alignment of total rewards strategies – which requires critical input and information from the Chief Human Resources Officer and the Human Resources function that may influence critical decisions, timing, milestones, and integration approaches to mitigate human capital risks during implementation.

This article focuses on common total rewards challenges that many health care organizations encounter during an M&A transaction. Recognizing and addressing these opportunities early will help minimize potential risks and deal-breakers, prioritize pre- and post-merger activities, and support a successful implementation process.

- Inefficient Workforce Structure

Assessing your current workforce structure to ensure an efficient mix of management and staff to streamline performance and manage costs is critical for the integration process. The question of centralization vs. decentralization remains the key focus for the M&A process. A recent workforce survey from SullivanCotter showed that, for most support functions, centralization is a more efficient staffing model than either decentralized or hybrid structures.

- Misalignment of total rewards philosophy

Establishing a consistent total rewards philosophy should be the foundational element that governs the new organization’s pay strategy. Differing approaches between the two merging organizations on essential program elements such as market pay positioning, targeted market comparators, incentive opportunities, benefits programs, and more will lead to inconsistent rewards and pay practices. While harmonization and consistency are critical, it is also an opportunity for the new organization to reevaluate and differentiate the philosophy where appropriate. Many health care organizations have recently recognized the need to differentiate certain reward programs and practices by their specific workforce segment. As an example, SullivanCotter’s 2022 Nursing Compensation Pulse Survey reports that staff nurses are more likely to have their pay philosophy set higher than the market 50th percentile (median) as 32% of organizations target the 60th or 65th percentile and 26% of organizations target the 75th percentile. This is due to unprecedented nursing labor shortages, pressure to remain competitive with the unionized workforce, and the prioritization of recruitment and retention goals.

- Outdated and/or uncompetitive legacy pay structures

M&A often presents an opportunity to update the total rewards philosophy. Organizations can streamline pay structures to address internal pay equity issues and ensure market alignment. This is becoming even more critical as organizations continue to source talent outside the traditional health care market.

- Inconsistent pay practices and program administration

While ensuring consistent and equitable pay practices across the new organization is essential, organizations must first identify the most significant differences and determine the level of harmonization required. Programs and practices such as supplemental pay, premium pay, and incentives/bonuses often require the most reconciliation between two merging organizations. The annual compensation planning process – including pay increases and promotions – also tends to vary. Organizations can prepare for post-close integration by conducting program and practice audits before the deal closes.

- Conflicting and costly benefit offerings

During the M&A process, integrating benefit programs and policies is vital to ensuring a cost-effective and seamless transition that will deliver positive outcomes for the organization and its employees. A comprehensive due diligence process followed by a clearly defined integration strategy aligned with the overall goal of the transaction can reduce duplicative costs and create a more attractive total rewards package.

- Lack of a cohesive and well-defined career architecture

Addressing workforce structure, compensation and benefits programs is only half of the battle. As organizations come together, a comprehensive career architecture that optimizes the new organization’s structure and helps to identify redundancies will drive the M&A integration process. It will also ensure consistent job titling and leveling, enable better workforce reporting and analysis, and provide leaders with clear guidelines for promotion. High-performing companies continuously examine and restructure the overall career framework to promote talent mobility, enhance learning opportunities, and improve employee engagement and retention.

- The need for greater transparency

M&A is a complex business strategy that requires clear lines of communication and a high level of transparency. Despite the confidential nature of these transactions, effective communication and change management strategies are imperative to help build trust and confidence across merging entities and support employee productivity and morale. Whether combined with an overarching plan or one focused exclusively on total rewards, an ideal communications strategy allows for several ‘touchpoints’ throughout the process. Leaders, managers, and employees must be earnestly included in the transition and implementation journey to understand how the new organization will positively impact the employee rewards experience.

KEY TAKEAWAYS

It’s important to note that only some M&A transactions are successful – many struggle to achieve the strategic goals and operational efficiencies originally envisioned within the timeframe established. While effective integration of an organization’s total rewards strategy does not define a transaction’s overall success or failure, it is a critical contributing factor. Organizations should look to complete this integration in a timely manner and with as much compassion and transparency as possible.

Although these considerations are relevant during any stage of an actual transaction, they also pose important planning questions for organizations that are contemplating but have yet to pursue any M&A opportunities. Given the current environment – with a strong emphasis on cost containment, operational efficiency, and employee retention and engagement – organizations not currently considering any partnerships can benefit from a more holistic and continuous assessment of these foundational aspects to help ensure consistency and market competitiveness.

PODCAST | 2024 Priorities for the Board Compensation Committee

Tune into our expert-led podcast to elevate your executive compensation strategy!

LISTEN TO PODCAST

The complexity of operations is at an all-time high for many hospitals and health systems nationwide. As some leaders continue to step away – leaving a critical gap in expertise – the search for qualified executive talent is more pressing than ever.

Here at SullivanCotter, we understand that securing leadership capable of leading through such change while balancing ongoing financial constraints is easier said than done.

In this AHLA-sponsored podcast, we collaborate with legal expert Michael Peregrine to provide a blueprint for compensation committees to follow as they redefine their approach to executive compensation.

Tune in to hear us tackle topics such as:

- Differentiating rewards in a dynamic marketplace

- Aligning talent strategy with important recruitment and retention needs

- Assessing incentive plan effectiveness

- Implementing critical governance structures

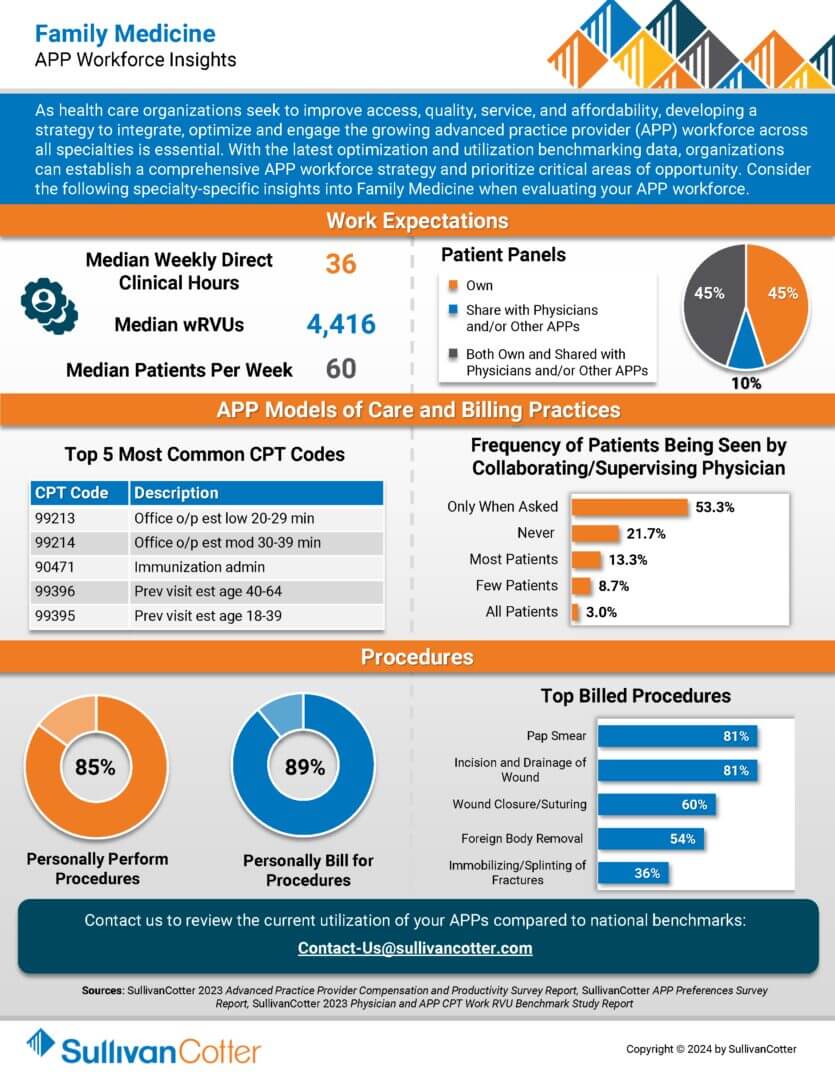

INFOGRAPHIC | APP Workforce Insights: Family Medicine

Learn more about family medicine work expectations, models of care, billing practices and more.

As healthcare organizations seek to improve access, quality, service, and affordability, developing a strategy to integrate, optimize and engage the growing advanced practice provider (APP) workforce across all specialties is essential.

With the latest optimization and utilization benchmarking data, organizations can establish a comprehensive APP workforce strategy and prioritize critical areas of opportunity. Consider the following specialty-specific insights into Family Medicine when evaluating your APP workforce.