PRESS RELEASE | SullivanCotter Welcomes Health Care Industry Consultant Russell L. Wilson

Leveraging more than 12 years of industry insight and first-hand knowledge of the evolving health care environment

March 17, 2020 – Chicago – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs and workforce solutions for the health care industry and not-for-profit sector, welcomes new Principal Russell L. Wilson to the firm’s Executive Workforce Practice.

Russell is an industry expert with ove r 12 years of experience in advising leading health care organizations on key issues in talent management and total rewards. Leveraging this deep insight and first-hand knowledge of the evolving health care environment, Russell leads a number of client consulting teams in the development of executive compensation strategies designed to drive performance and enhance organizational outcomes.

r 12 years of experience in advising leading health care organizations on key issues in talent management and total rewards. Leveraging this deep insight and first-hand knowledge of the evolving health care environment, Russell leads a number of client consulting teams in the development of executive compensation strategies designed to drive performance and enhance organizational outcomes.

“The role of the health care executive in today’s operating environment is changing as the principles of value-based care continue to take shape. To help advance key system-wide objectives, leadership is now tasked with developing targeted approaches to improving quality, outcomes and performance across the entire care continuum. Designing integrated talent management and total rewards strategies to support these goals is critical, and Russell will play a vital role as a trusted advisor in helping our clients to implement customized programs aligned with their mission, vision and values,” said Ted Chien, President and CEO, SullivanCotter.

As a member of the firm’s Executive Workforce Practice, Russell works closely with hospitals, health systems and medical groups nationwide to develop long-standing relationships and understand organizational needs and objectives in the ever-changing marketplace. He specializes in aligning executive pay and performance, including short- and long-term incentive plans, with an organization’s strategic initiatives and advises on implementation to help ensure the delivery of competitive and sustainable workforce solutions. Russell also works directly with boards and compensation committees to provide education on best practices for effective and compliant executive compensation approaches, decision-making processes and governance procedures.

Prior to joining SullivanCotter, Russell served as a senior director at global consulting firm where he led talent and rewards for the Health Care Provider National Industry Team.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights and expertise to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

Health Care Executives: 2020 Actions for the Board Compensation Committee

Take time in 2020 to reexamine your executive compensation program

The health care sector continues to undergo unprecedented transformation, and the challenges faced by not-for-profit hospitals and health systems are not abating. As organizations look to navigate these changes, the board compensation committee is well served to evaluate the impact of this rapidly evolving environment on the executive compensation program and related committee practices.

Periodic assessment is critical to ensure compensation programs and talent strategies remain aligned with organizational goals and objectives.

Featured in the March edition of the American Hospital Association's Trustee Insights, SullivanCotter highlights a number of important considerations for the compensation committee to focus on in today's complex operating environment.

READ FULL ARTICLE

Physicians: 2021 Evaluation and Management CPT Codes

Part I: Understanding the Impact on Physician Compensation

DOWNLOAD FULL ARTICLE

Updated: February 2021

RELATED CONTENT:

PART II: 2021 E&M CPT Code Changes: Addressing the Impact on Advanced Practice Providers

INFOGRAPHIC | Considerations for Addressing the 2021 E&M Work RVU Changes

ARTICLE | Navigating Change: Implications of the 2021 Physician Fee Schedule

SullivanCotter's CPT Advisory Services and Technology Solutions

Every year, the Centers for Medicare and Medicaid Services (CMS) evaluates the recommendations of the American Medical Association’s (AMA) Relative Value System Update Committee (RUC) and conducts its own review of the Work Relative Value Unit (wRVU) values associated with each Current Procedural Terminology (CPT) code to determine if wRVU revisions are needed based on the time, skill, training and intensity necessary to perform each service.

The degree of change varies from year to year, and the impact on individual specialties depends on which codes are modified and the extent to which the values are adjusted. CMS has issued the 2021 Physician Fee Schedule final rule and has significantly overhauled the Evaluation and Management (E&M) code documentation requirements, time-effort recognition, and wRVU values for face-to-face new and established patient office visits. These changes were effective as of January 1, 2021.

Many physicians provide office-based E&M services and, when broad changes such as this occur, the resulting impact can be significant. This article will address:

- CMS efforts to recognize increased work effort for office visits as well as a summary of the 2021 changes to E&M codes.

- The reimbursement impact on Medicare physician services as well as the likely downstream effect on commercial payer physician reimbursement.

- The potential impact on physician and advanced practice provider (APP) reported productivity levels for various specialties.

- The potential unintended impact on compensation arrangements – especially wRVU production-based plans or salary-based plans with wRVU-based performance measures.

- Other variables that could influence the assessment of your organization’s wRVU productivity.

PHYSICIAN AND APP WORK RESPONSIBILITIES FOR E&M OFFICE PATIENT VISITS

“Patients Over Paperwork” is a CMS initiative based on the AMA’s RUC recommendations. The goal of this initiative is to reduce burdensome regulations, enhance efficiency and improve the physician experience. The E&M review and adjustments are steps towards removing regulatory obstacles that impede a clinician’s ability to spend time with patients. The first wave of this initiative includes the modification of ten E&M codes used for billing new and established office-based patient visits (codes 99201-99215). Other E&M code groupings (inpatient, skilled nursing, etc.) will be reviewed at a future date.

Several factors were considered when formulating the 2021 changes including:

- To maintain the “Patients Over Paperwork” goal, CMS kept the documentation reduction requirement for appropriate coding.

- CMS estimates that these adjustments will save 180 hours of paperwork for physicians annually.

- A time study commissioned by CMS determined that, due to the added responsibilities physicians have experienced over the last five years, an increase in wRVUs for many E&M codes is justified. These include:

- Longer patient face-to-face time during visits.

- Increased non-patient time responsibilities such as Electronic Medical Record (EMR) documentation.

- Added non-reimbursed physician time to coordinate team-based care and population management.

- To recognize the occasional extended time patient visit, CMS incorporated an add-on code (G2212) for every 15 minutes of additional work effort beyond the time expectation associated with codes 99205 and 99215.

- This extended time method is similar to anesthesiology work value measurement that credits added time units along with the base procedure.

- Implementation of another add-on code (G2211) has been deferred until January 1, 2024. At that time, an add-on code will be available to provide additional recognition (reimbursement and wRVU credit) for qualified, severe, or complex chronic patient conditions.

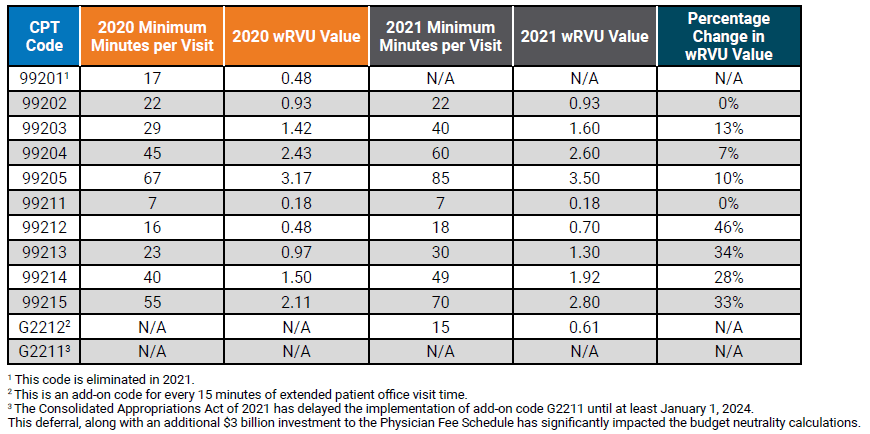

These adjustments, along with CMS quality incentive payments, signify CMS’ increased recognition of how the process of delivering high-quality health care has changed. The impact of these changes will result in material increases in reported wRVU productivity for office-based specialties. Table 1 below compares the 2020 and 2021 E&M code time allocation and wRVUs.

Table 1: Time Allocations and wRVUs Adjustments: Current versus 2021

THREE IMPORTANT POTENTIAL IMPACTS TO PHYSICIAN PRODUCTIVITY LEVELS AND RESULTING COMPENSATION AND BENCHMARK MEASUREMENTS

1. How will the 2021 wRVU changes impact the measurement of physician productivity?

This is often the first question that arises when organizations try to assess how wRVU changes will impact reported productivity internally, but also when comparing to published national survey benchmarks. To help analyze the impact, SullivanCotter utilized its proprietary database consisting of individual CPT code volumes and modifiers for approximately 20,000 physicians across 100 different specialties. We recalculated two versions of wRVU productivity for comparison: one based on the 2020 wRVU values, and one based on the new 2021 wRVU values. By keeping volumes and distribution constant, the change in reported wRVU productivity is entirely due to the 2021 wRVU adjustments.

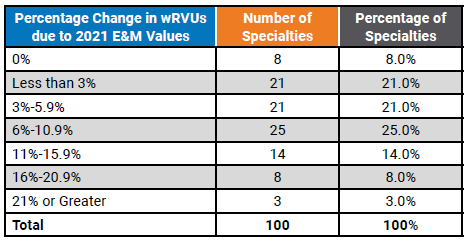

Summary findings indicate that of the 100 specialties reviewed, wRVU benchmarks for 46 specialties increased between 3% and 11%. The modeling shows that wRVU benchmarks for an additional 25 specialties increased by greater than 11%. Table 2 below shows the resulting impact on reported wRVUs by number of specialties. This represents a significant change to wRVU benchmarks, and it will be important for organizations to understand the impact on physician compensation and physician practice economics.

Table 2: Overall Specialty Impact of 2021 E&M Code Changes

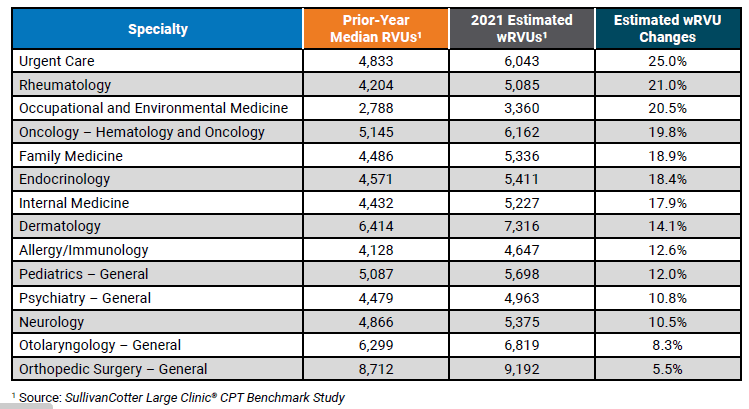

Table 3 below illustrates a sample of some of the individual specialties with notable increases to reported wRVUs.

Table 3: Median wRVU Impact of 2021 E&M wRVU Changes

2. How will wRVU changes impact physician compensation benchmarks?

The answer to this question depends on the structure of an organization’s compensation program. If a plan is based heavily on historical compensation per wRVU benchmarks, there will be, all this being equal, an immediate increase in the amount of compensation paid to physicians as a result of the change in wRVU values. According to SullivanCotter’s 2020 Physician Compensation and Productivity Survey, nearly 3/4 of organizations indicated that wRVU productivity drives more than 50% of physician total cash compensation. Conversely, physicians with salary-based plans linked to national compensation benchmarks will not experience an immediate increase in compensation but may experience a change over time as benchmarks evolve.

Over 95% of the organizations participating in the survey utilize national benchmarks to determine annual salaries and/or compensation per wRVU rates. Understanding how to use these benchmarks appropriately is/will be important during the 2021 and 2022 transition years.

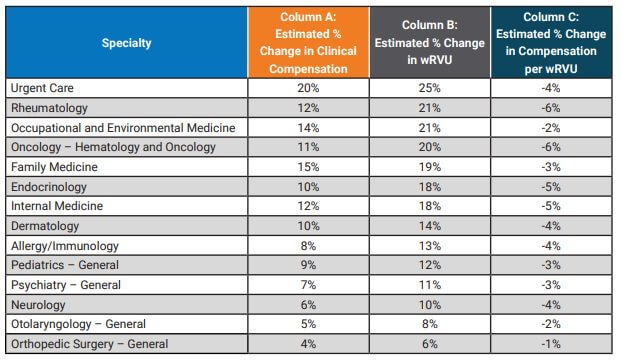

SullivanCotter reviewed several different compensation methodologies to estimate the potential impact to survey benchmarks. Considering the E&M code wRVU changes and assuming no modifications are made to compensation plan methodologies we estimate average clinical compensation will increase by approximately 6% assuming no changes in compensation rates is made. This analysis does not include implications from other market factors such as demand, inflation, cost-of-living, changes in productivity and more. As with reported wRVUs, this impact will vary significantly by specialty. Table 4 below highlights the estimated changes to survey benchmarks. See Column A to find the estimated change in compensation.

If an organization utilizes wRVU productivity targets to determine compensation using the 2020 survey data while calculating wRVUs using the 2021 wRVU schedule, this will result in higher compensation as physicians meet or exceed the production targets at an increased rate.

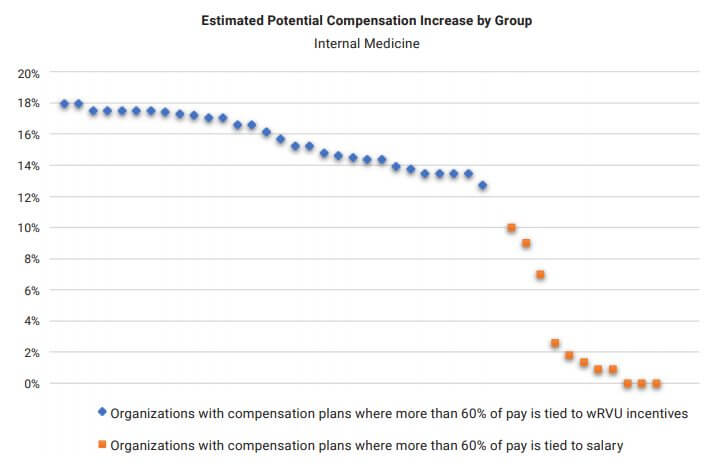

Similarly, if an organization uses the 2020 compensation per wRVU survey benchmark while using the CMS 2021 values to calculate physician productivity, clinical compensation will increase as a result of using compensation per wRVU rates calculated on the older (lower) wRVU values. Using Internal Medicine as an example, the following graph represents the potential unintended consequences for organizations using a variety of compensation plan designs assuming no change in compensation plan methodology. The potential impact varies significantly depending on whether an organization primarily utilizes a wRVU incentive plan versus a salary-based plan.

To avoid these pitfalls, organizations should conduct a strategic review of the 2021 Physician Fee Schedule changes to determine the impact on their physician compensation plans. Considerations include awareness, appropriateness, affordability and feasibility of modifications as well as physician expectations regarding any potential change in compensation.

3. If organizations utilize compensation per wRVU benchmarks, what should they expect with regard to the 2021 survey benchmarks?

As mentioned above, nearly 75% of organizations in the SullivanCotter 2020 Physician Compensation and Productivity Survey utilize the compensation per wRVU benchmark in determining physician compensation. For any organization using the 2021 wRVU values in their compensation plan, a fundamental understanding of how market benchmarks will change is important.

In this article, we reviewed estimated increases to both wRVUs and clinical compensation. However, because the expected change in wRVU values exceeds the expected change in clinical compensation, compensation per wRVU ratios are expected to decrease in future surveys. See Column C in Table 4 for the estimated impact on specific specialties. Overall, our study indicated a 3% decrease in the TCC per wRVU rate, but with significant variability by specialty.

OTHER FACTORS TO CONSIDER WHEN ANALYZING COMPENSATION IMPACTS

As organizations continue to evaluate the impact of the final rule during this industry transition, there are several other factors to consider. These include:

- Will moving forward with historical compensation per wRVU rates and 2021 wRVU values unintentionally create Fair Market Value (FMV) and Commercial Reasonableness (CR) risks due to the resulting higher compensation payments?

- Do compensation incentive plans include supervisory payments to physicians based on APP productivity levels? The 2021 wRVU value changes will also affect codes utilized by APPs.

- For specialties that are paid shift rates, are there additional incentive opportunities based on wRVU productivity?

- Does the organization pay for physician virtual care visits by tying them to office visit E&M values? This could result in unintended higher pay for virtual care.

- CMS has added G2212 as an add-on code intended to be used with 99205 and 99215 for each additional 15 minutes above 70 minutes of documented time associated with an individual patient visit. The assumptions and analysis above do not account for changes in the distribution of E&M coding or increases in reported wRVU productivity due to this new code. A wRVU increase does not automatically equate to an equal reimbursement increase.

- CMS also applied an annual budget neutrality factor which caps overall physician fee schedule reimbursement to avoid a significant increase in CMS payments. The reduction in the CMS conversion factor, in combination with significant increases in wRVUs for cognitive specialties, may result in additional compensation paid to physicians. However, revenue increases are unlikely to offset the more significant increases in wRVU-based compensation if 2021 E&M code values and historical compensation per wRVU rates are utilized going forward.

The published 2021 Physician Fee Schedule final rule reduced the Medicare conversion factor by 10.2% to maintain statutorily required budget neutrality. However, on December 27, 2020, the Consolidated Appropriations Act of 2021 – including provisions that temporarily mitigate a portion of the conversion factor reduction – was signed into law. The CMS final rule tables were later published with the 2021 Medicare conversion factor set at $34.89. This is a reduction of 3.3% from 2020. However, expected Medicare revenue increases resulting from the combination of higher RVU values and a higher than anticipated conversion factor rate, are unlikely to offset the more significant increases in wRVU-based physician compensation absent any change in compensation plan rates going forward.

SullivanCotter offers advisory support and technology solutions to help your organization understand and respond to the potential impact of these changes.

To learn more, contact us at 888.739.7039 or info@sullivancotter.com

Physician Compensation and Compliance: More Than Just the Individual Components

This Briefing is brought to you by the Fair Market Value Affinity Group of the American Health Lawyer's Association's Hospitals and Health Systems Practice Group.

Properly assessing the fair market value and commercial reasonableness of physician compensation arrangements in an increasingly complex regulatory environment is more critical than ever before. As the number of related health care settlements continues to grow, organizations are under increased scrutiny regarding both the physician compensation and contracting processes and must have protocols in place to help ensure compliance and mitigate risk.

As a member of AHLA's Fair Market Value Affinity Group, SullivanCotter's Kim Mobley, along with other industry experts, recently contributed to this Practice Group Briefing which includes an analysis of the current regulatory environment, insights from both an attorney's and a valuator's perspective, a step by step process for helping to support compliant compensation arrangements, and other important questions to consider.

READ FULL ARTICLE

Copyright © 2020, American Health Lawyers Association, Washington, DC. Reprint permission granted.

PODCAST | Trends in Physician Compensation

BESLER | The Hospital Finance Podcast®

LISTEN TO PODCAST

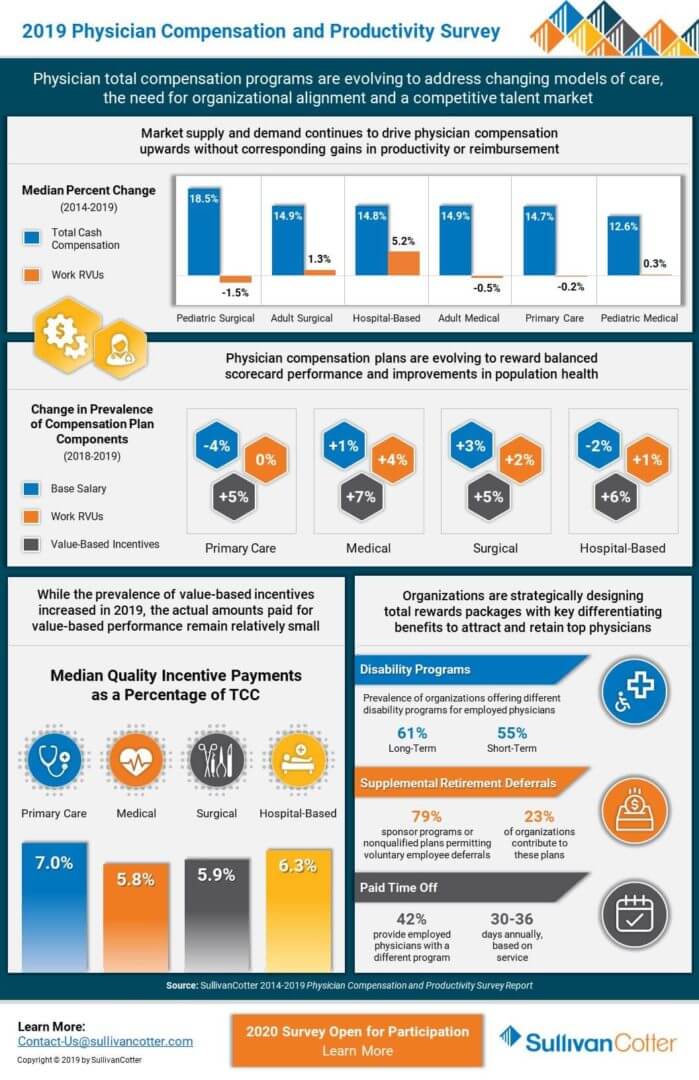

Dave Hesselink, Principal, discusses the results of SullivanCotter's 2019 Physician Compensation and Productivity Survey on a recent episode of the The Hospital Finance Podcast® with BESLER. Now in its 28th year, this survey is the largest and most comprehensive of it's kind with data reported on over 206,000 physicians, advanced practice providers and PhDs from nearly 700 participating health care organizations. It features key information on insight on physician base salary, total cash compensation and productivity data and ratios including work RVUs, collections, patient visits and panel sizes.

TRANSCRIPT

Mike Passanante: Hi, this is Mike Passanante. And welcome back to the award-winning Hospital Finance Podcast®. Consulting firm SullivanCotter recently released survey results indicating that physician compensation programs are evolving as organizations address a variety of new challenges in a rapidly changing health care environment. To discuss the study results, I’m joined by Dave Hesselink, Principal in the Physician Workforce Practice of SullivanCotter. Dave, welcome to the show.

Dave Hesselink: Thank you very much. Appreciate being here.

Mike: So Dave, for those in our audience who may not be familiar with SullivanCotter and the work that you do, can you tell us a little about your firm?

Dave: You bet. SullivanCotter partners with health care organizations across the country and our objective is really to help drive performance and improve outcomes through the development and implementation of what we call integrated workforce strategies. The workforces that we focus on include executives, physicians, advanced practice providers, and other employees. More specifically, in the physician space, we help those health care organizations optimize performance while managing the complex regulatory risk that they face from their financial relationships with both employed and independent physicians. In that space we provide an array of services including physician compensation design, fair market value of commercial reasonable assessments, physician affiliation and needs assessments, business valuations, as well as other advisory support. And in addition to our consulting services, we also offer data and physician compensation software and benchmarking tools to help attract, retain, and engage the executive and clinical workforces.

Mike: Absolutely, and as I mentioned, we’ll be talking about the results of SullivanCotter’s 2019 Physician Compensation and Productivity Survey. So Dave, can you just explain for us what you were looking at, specifically, in the survey and who you surveyed?

Dave: You bet. This is an annual survey that we’ve actually been conducting now for over 25 years. Over that time span, it has become the largest annual physician compensation survey in the industry. This past year, we had over 200,000 incumbents included from nearly 700 participating organizations. That sample size of 200,000 represents about one-quarter of active practicing physicians in the US. We conduct that survey to evaluate trends in physician compensation, pay practices and productivity for our survey participants and the purchasers of the survey. Rather than this being an online survey where individual physicians are participating, the responses for our survey are compiled centrally at the organizational level by an individual within the organization who is knowledgeable about physician compensation and productivity. Often, this is in the HR function. We feel it is really the best approach to getting the most accurate and impartial data from the organizations that participate in our survey. Participating organizations typically include health systems, hospitals, medical groups, other organizations that employ physicians. In addition to publishing and selling our survey, we use the survey results to inform our advisory services, which I just talked about, to really help focus on aligning physician compensation not only with market benchmarks but with the overall organizational objectives as well.

Mike: Certainly, many different types of provider organizations are thinking about how to alter their physician compensation plans to bring them into alignment with some of the new models that are out there with payments. I want to talk to you a little bit about that. What would you say are some of the key environmental factors that are driving the need for new approaches to physician compensation?

Dave: I think there’s two that I’ll talk about. Probably the most significant change in health care over the past 10 years, I would say, has been the evolution in payer reimbursement from a pure fee-for-service approach to really what I’ll call, in most markets, a modified fee-for-service approach that also includes value-based incentives or value-based payments. I want to be clear for your listeners. When I say value-based payments or value-based incentives, I mean third party payments for performance in areas other than volume. Think about clinical quality, patient experience or reducing the cost of care. All of those really align with the IHI’s Triple Aim. With a greater share of health system payments based on factors other than the volume of care provided or physician productivity, physician employers have, over the past several years, shifted their reward systems to include performance in a variety of areas that reflect their payer environments. That's what I would call more of a balanced scorecard approach. In the advisory work that we do, we help physician employers evaluate their particular environment and align their physician compensation programs to be successful.

The second significant trend, I would say, that affects health care organizations is the growing physician shortage. Physicians who previously put off retirement due to a weak economy in the last decade now have already moved ahead or are starting to move ahead with those retirement plans considering the strong economy we have today. In 2018, physicians supply projections were updated and the physician shortfall is now expected to exceed 120,000 physicians by 2030 - just in the next 10 years. I’m sure your listeners can identify this because new patient waits for some specialists already can be weeks or months. To avoid potential disruption to the important goals that your listeners have around quality service and cost, we believe that implementing a creative and contemporary physician recruitment strategy will be very important for organizational success now and into the future. In addition to that, there is also a lot of interest in advanced practice provider recruitment as a supplement to those physicians, particularly with the shortage that I’ve just outlined.

Mike: Let’s dig into that a little bit because you found in the survey that market supply and demand for physicians continues to drive increases in total cash compensation. But that’s not really leading to an increase in productivity, isn’t that right?

Dave: That’s correct, Mike. In fact, annual physician cash compensation continues to increase while physician productivity has been mostly unchanged over the past eight years. Our survey also provides data on physician collections and shows that collections remain pretty flat over the past several years. When you combine all of that data together, I think what this illustrates is that employers, physician employers are investing more in their physician practice organizations to attract and retain providers without reciprocal increases in productivity or reimbursement. A greater investment in that physician enterprise really puts more financial pressure on the rest of the health care organization’s performance. I’m sure your listeners can validate that in their organizations as well.

Mike: Dave, let’s talk about value-based payments and how that plays into compensation because those incentives around value-based payments are taking on a more prominent role in compensation. Can you tell us what you found there?

Dave: Yes, it’s an interesting environment right now. There is definitely greater interest in aligning physician compensation around what I would call a more balanced set of performance metrics. I mentioned a few earlier: clinical quality, patient experience, access, cost of care. However, when we look at the survey results, the amount of compensation tied to performance on these metrics has been relatively flat over the past four years, representing, what I would say, in the range of 5 to 10 percent of total cash compensation. We annually collect information about how physician compensation plans are structured, and the prevalence of those value-based incentives in compensation plan design has increased - no question about that. In 2019, approximately 60% of survey respondents reported that value-based incentives were used in their compensation plan designs, and that was up about 5% from 2018. So while the use of value-based incentives has increased, what we find is the amount of compensation tied to performance on these metrics has remained relatively constant. I think that there’s a little question mark there about that result that I think your listeners may have. There are probably two limiting factors most health care organizations face. The first one is the ability of the reporting infrastructure to keep pace with a large amount of clinical quality data that is required for good metric development and the rigorous testing of that data to ensure physician acceptance. The last thing you want to do is collect some data and send it out to physicians and find out later on that the data is not reliable or is not trusted by the physicians that you’re sending it to.

I think the second limiting factor here is really the outdated regulatory environment that is still largely focused on supporting physician compensation based on the quantity of care provided rather than the quality of care provided. As a result, hospital and health system employers in particular are a constraint to relatively small value-based incentive programs. There is some recent movement on the regulatory front, however, as CMS recently proposed changes to the regulatory framework of the Physician Self-Referral Law - or Stark Law as it is commonly referred to. That happened in October of last year. Those are still proposals at this point, but we’re hopeful that these regulatory changes could result in greater flexibility to increase value-based incentives without fear of federal intervention.

Mike: Dave, what do you think provider organizations should be doing right now to remain competitive when it comes to compensating their physicians?

Dave: Well, first of all, it is important to monitor national and regional physician compensation trends to ensure that your physician compensation programs are competitive. We believe participation in and use of benchmarking surveys like ours is the best way to do this. Secondly, I would say periodic evaluation of your physician compensation program is important to make sure it remains up to date and that it is producing the results consistent with your organizational philosophy and strategic objectives. We have a section of our survey called devoted to pay practices, and it is a great tool for conducting this periodic review. Of course, listeners can also contact us to get more in-depth evaluation of their compensation program if they like and recommendations for improvement. Finally, I think it is important for physician employers to understand the dynamic physician recruitment environment. There are a host of physician recruitment tools and practices that are being utilized today in this increasingly competitive environment. As an example, new physicians coming out training often have significant student-loan debt. A particularly attractive recruitment tool is to offer assistance with student-loan repayment in return for a commitment to practice for a predefined period of time - say three, four or five years. Your initial compensation offer might be competitive, but recruitment incentives like student-loan repayment can easily sway candidates in your favor. Our survey contains information on those practices as well: the prevalence of their use, the ranges that are in play, the retention requirements and more. Your organization’s physician recruiters will likely appreciate access to information to better understand the national recruitment environment as an adjunct to their knowledge of the local environment.

Mike: So Dave, if someone wanted to read more about the study or purchase a copy of the survey, where can they go?

Dave: Well, to obtain a copy of the 2019 Physician Compensation and Productivity Survey, listeners should go to Sullivancotter.com and click on the contact us tab. I will say that our 2020 surveys are currently open for participation through April 3rd, and we would love to have as many organizations participate as possible. Information on our individual surveys, our survey bundles – we do bundles and surveys together – pricing can be found on our website.

Mike: Excellent. Dave Hesselink, thanks so much for joining us today on The Hospital Finance podcast.

Dave: My pleasure, Mike

Navigating Commercial Reasonableness of Physician Compensation Arrangements

The Changing Health Care Environment

To stay compliant with evolving regulatory requirements, health care organizations must have the appropriate structures in place to help mitigate financial, resource and reputational risk for potential physician compensation violations related to the Stark Law, the Anti-Kickback Statute and other IRS not-for-profit regulations.

Understanding Commercial Reasonableness in the context of a rapidly changing health care environment is critical, but navigating what this requirement entails can often be challenging. In this piece, SullivanCotter highlights typical areas of focus to consider when assessing the commercial reasonableness of physician compensation arrangements.

READ FULL ARTICLE

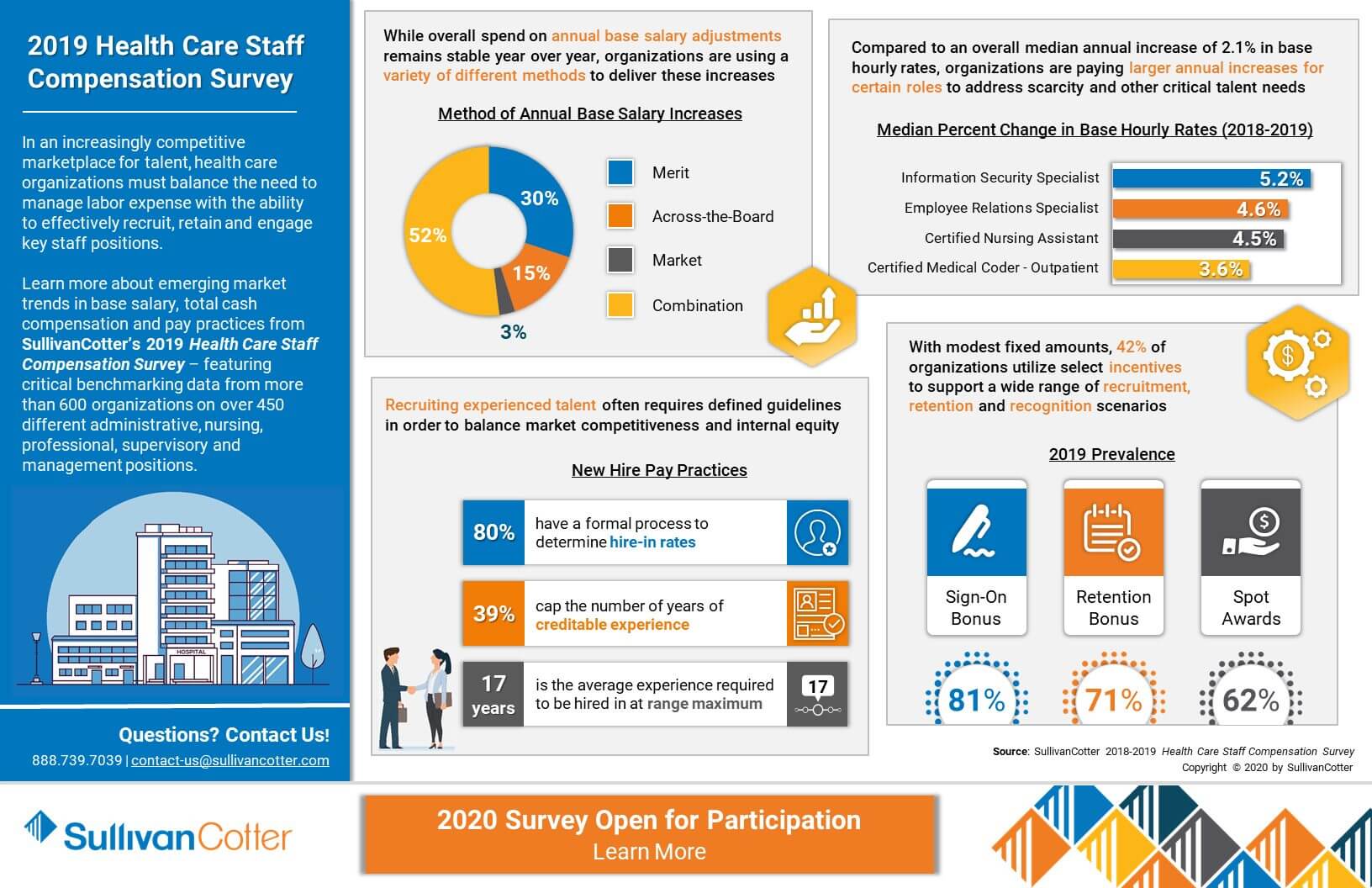

INFOGRAPHIC | 2019 Health Care Staff Compensation Survey

Insight into compensation and pay practices for key health care staff positions

In an increasingly competitive marketplace for talent, health care organizations must balance the need to manage labor expense with the ability to effectively recruit, retain and engage key staff positions.

Learn more about emerging market trends in base salary, total cash compensation and pay practices from SullivanCotter’s 2019 Health Care Staff Compensation Survey – featuring critical benchmarking data from more than 600 organizations on over 450 different administrative, nursing, professional, supervisory and management positions.

Don't miss your chance to participate. The 2020 survey is now open!

DOWNLOAD INFOGRAPHIC

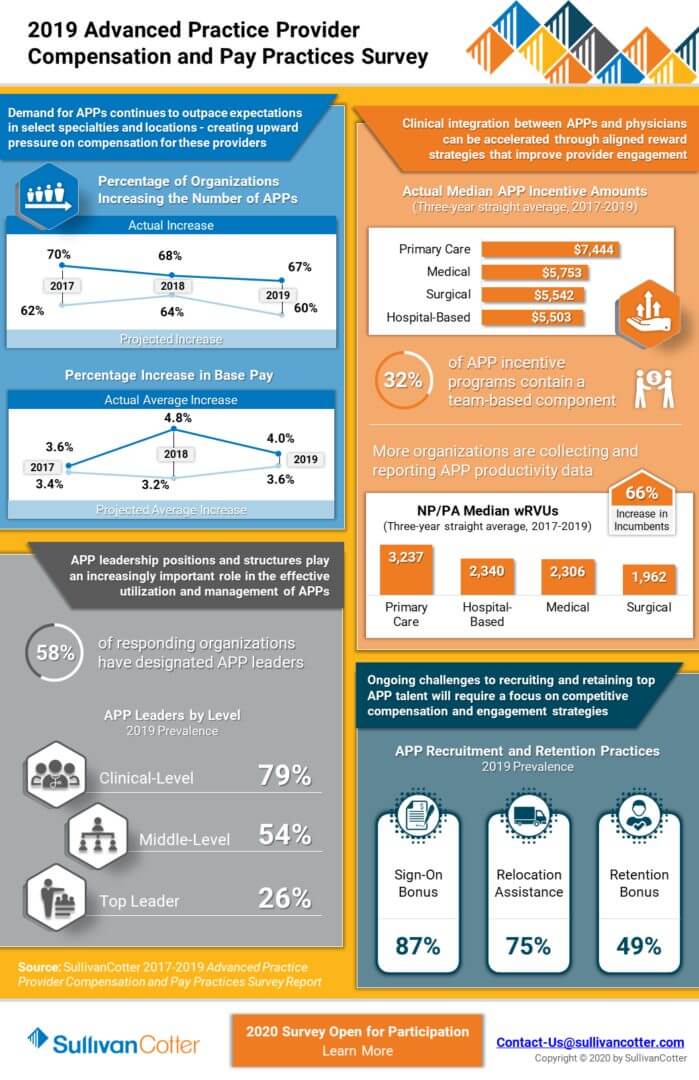

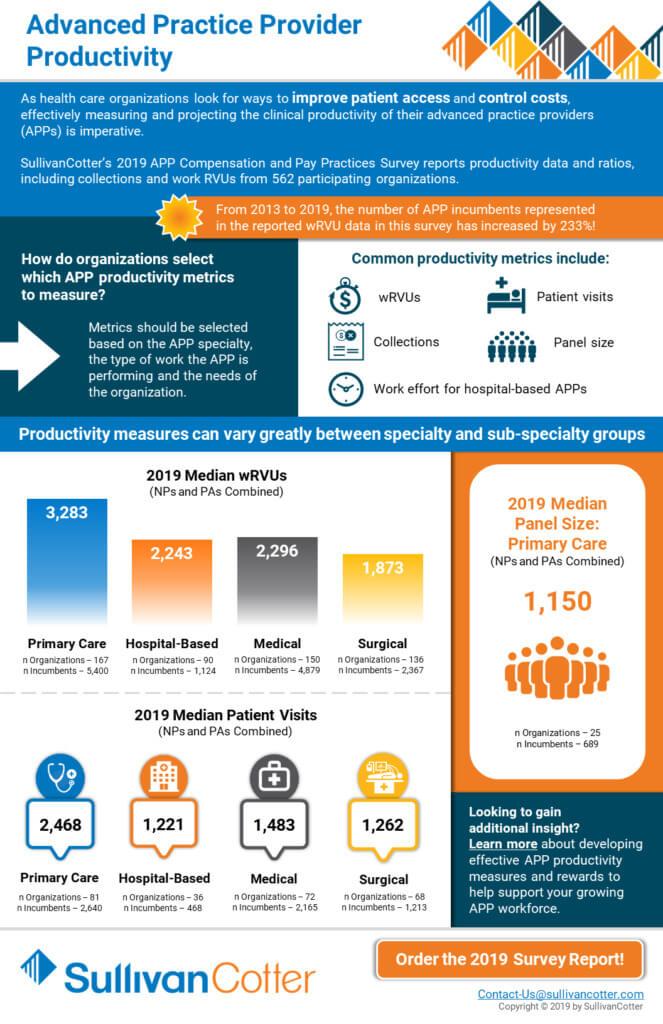

APP Compensation Programs Shifting to Address Growing Market Demand and Changing Models of Care

READ ON PR NEWSWIRE

February 4, 2020 – Chicago –SullivanCotter, the nation's leading independent consulting firm in the assessment and development of rewards programs and workforce solutions for the health care industry and not-for-profit sector, recently released survey results indicating that advanced practice provider (APP) compensation programs continue to evolve as organizations recognize the roles APPs play in helping to achieve key organizational goals.

There are a number of key factors driving this shift in APP compensation and pay practices, including (1) the increased integration and utilization of APPs to help enhance access, quality, service and affordability in a value-based health care environment; (2) a need for APPs amidst a growing physician shortage; (3) clinical integration and new team-based models of care, which suggest a potential need for greater alignment between physician and APP rewards strategies and; (4) the rising prevalence of APP leadership positions and structures to support the effective management of this rapidly expanding workforce. Many organizations are restructuring their pay programs accordingly as ongoing challenges in recruiting, retaining and engaging key APP talent requires a more competitive approach to compensation.

APPs are currently among the fastest growing segments of the health care workforce and, on average, comprise more than one-third of an organization's clinical providers.i As APPs move beyond traditional inpatient and outpatient settings, this growth is driven in part by increased utilization in new and/or emerging practice settings such as urgent care, retail-based and skilled nursing. An analysis of results from SullivanCotter's 2019 Advanced Practice Provider Compensation and Pay Practices Survey confirms the demand for APPs as participating organizations reported significant growth in this workforce. In fact, this growth exceeded yearly estimates by 7%. Similarly, actual increases in base pay continue to outpace expectations. In 2018, the projected average increase was 3.2% compared with an actual average increase of 4.8%. The actual average increase in 2019 was 4%, which is slightly higher than what was projected.

"The strong demand for APPs continues to be a significant trend and can place added pressure on an organization's staffing budget. Actual increases in base pay have been consistently outpacing projections for the past five years, and health care organizations must be mindful of the impact this can have on the bottom line - especially if APPs make up a significant portion of your overall workforce," said Amy Noecker, Principal, SullivanCotter.

As with physicians, APP compensation is evolving to reflect differences between major specialty categories – primary care, medical, surgical and hospital-based. While all categories have seen increases in combined nurse practitioner and physician assistant median total cash compensation (TCC, equal to base salary plus annual incentives) from 2017 to 2019, medical and hospital-based rates have seen the most growth at 5.3% and 5.0%, respectively. Primary care, up 4.6%, and surgical, up 4.4%, follow closely behind.

Additionally, incentives are becoming a component of APP total cash compensation as rewards strategies continue to evolve. Nearly half of participating organizations, at 48%, report utilizing incentive pay for at least some of their APPs. While this prevalence has remained steady year over year, median annual incentive amounts have increased across all specialty categories from 2018-2019. Despite having the lowest overall TCC rates, primary care APPs continue to have the highest reported median annual incentive amounts in 2019 expressed as both a dollar amount, $7,701, and as a percentage of base salary, 6.9%. As in past years, these incentive opportunities are predominantly structured as add-on dollars, 73%, rather than at-risk, 15%.

Clinical integration and the focus on new team-based models of care are also driving the evolution of APP compensation programs. "Although there are still some important differences in the design of physician and APP compensation programs, aligning rewards more closely to ensure complementary versus competitive team-based care delivery is important. As organizations look to establish and reinforce a clinical team-based mindset, many are considering a strategic restructuring of their APP compensation plans to reflect certain elements of physician pay programs," said Trish Anen, Principal and APP Workforce Practice Leader, SullivanCotter.

In 2019, 32% of APP incentive programs contained a team-based component. This prevalence has increased by 5% since 2017. Based on survey responses, most APP incentive plans are relatively simple, with 64% of organizations utilizing just one or two metrics. The most prevalent metrics selected in all practice settings are work RVUs, value/quality-based and patient experience. In an effort to better understand and track impact, the interest in APP productivity continues to grow as more organizations collect and report this information. From 2017-2019, there was a substantial 66% increase in the amount of reported work RVU data and a 26% increase in patient visit data.

Lastly, APP leadership compensation continues to evolve as organizations develop new positions and outline key responsibilities to effectively support the management of this growing workforce. As a result, a clear structure of leadership roles has solidified. In 2019, 58% of organizations reported having designated APP leaders. Of these organizations, 26% utilize a top APP leader. This typically represents one or two leaders dedicated to developing the overall APP workforce strategy. Annual TCC for these top APP leader positions falls between $155,527 and $212,850 (25th-75th percentile) and tends to correlate with the number of employed APPs.

SullivanCotter's 2019 Advanced Practice Provider Compensation and Pay Practices Survey Report is now in its 8th year. With data from more than 560 organizations on nearly 74,000 individual APPs, this survey provides critical information on physician assistants, nurse practitioners and other certified providers across 127 different specialties. The survey includes insight into base salary, TCC, productivity, incentive plan design and other pay practices such as extra shifts, on-call pay, shift differentials, recruitment and retention bonuses, and more. For more information on SullivanCotter's surveys, please visit our website at www.sullivancotter.com or contact us by phone at 888.739.7039.

Don't miss your chance to participate! The 2020 Advanced Practice Provider Compensation and Pay Practices Survey is now open for submission.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights and expertise to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

iSource: SullivanCotter 2019 Organizational Characteristics Database

Clinical provider includes: nurse practitioner, physician assistant, certified registered nurse anesthetist, certified nurse midwife, doctor of medicine and doctor of osteopathic medicine

INFOGRAPHIC | 2019 Advanced Practice Provider Compensation and Pay Practices Survey

Advanced practice providers continue to play an important role in transforming care delivery

To help meet the demand for providers and avoid potential disruption to quality, service and cost, many health care organizations are expanding their advanced practice provider (APP) workforces – including physician assistants, nurse practitioners and other clinicians. APPs are effective in helping to transform care delivery and achieve key organizational goals in the shift to value-based health care, and access to key compensation, performance and pay practices benchmarks for this growing provider group is critical.

View related highlights from SullivanCotter’s 2019 Advanced Practice Provider Compensation and Pay Practices Survey, which features data from more than 560 organizations on nearly 74,000 individual physician assistants, nurse practitioners and other clinicians.

Don't miss your chance to participate. The 2020 survey is now open!

DOWNLOAD INFOGRAPHIC

PRESS RELEASE | Physician Compensation Evolving to Address Complex Operating Environment

Results from SullivanCotter's 2019 Physician Compensation and Productivity Survey

December 3, 2019 – Chicago – SullivanCotter, the nation's leading independent consulting firm in the assessment and development of rewards programs and workforce solutions for the health care industry and not-for-profit sector, recently released survey results indicating that physician compensation programs are evolving as organizations address a variety of new challenges in a rapidly changing health care environment.

Some of the key environmental factors driving the need for new approaches to physician compensation and performance programs include (1) new models of care focusing on population health, supporting the transition from volume to value, and enhancing access, quality, service and affordability; (2) a growing demand for key talent amidst a looming shortage of physicians, resulting in a more competitive labor market; (3) aligning physician performance with overall organizational goals; and (4) developing physician compensation plans that are ready to address the challenges associated with CMS quality programs such as MIPS and potential changes to the Stark Law.

An analysis of the survey data indicates that market supply and demand for physicians continues to drive increases in total cash compensation (TCC, equal to base salary plus annual incentives) as organizations look to remain competitive amidst talent shortages. There is a continued year over year increase in median TCC across all major specialty categories – including primary care, hospital-based, medical and surgical specialties. This has been the case for the past ten years.

Despite increases in TCC across the board for these major specialty categories, productivity remains relatively flat and in many cases is even declining. From 2014-2019, median TCC for primary care physicians increased by 14.7%, whereas work RVU (wRVU) productivity declined by 0.2%. As organizations look to expand their primary care providers, there is upward pressure on family medicine and internal medicine compensation without significant changes in wRVU productivity. To meet population health goals, organizations are adding other measures of performance such as panel management and telehealth to their primary care scorecards. Over the same 5-year time period, hospital-based physicians saw the largest growth in median wRVU productivity at 5.2%. This was the only major specialty group to see an increase greater than 1.5%.

"With growing concerns regarding provider supply and demand, organizations are evolving their compensation programs to align with an increasingly competitive talent market. With a looming physician shortage placing pressure on organizational recruitment and retention strategies, this demand continues to push physician compensation upwards without being supported by corresponding gains in productivity or reimbursement – resulting in higher levels of organizational investment per physician," said Dave Hesselink, Principal, SullivanCotter.

Additionally, from 2018 to 2019 the prevalence of value-based incentives, which rewards performance on measures such as clinical quality, patient experience and access, has increased by 5-7% across all four major specialty categories. For primary care, the prevalence of value-based incentive components in plan design was up 5% from last year, with 62% of organizations incorporating these incentives into their physician compensation programs. Medical, surgical and hospital-based specialties all fell in the range of 55-57%.

"While reimbursement models continue to evolve and organizations are focused on incorporating more value-based components into their physician compensation programs, it is important to note that quality incentive payments still only comprise a small portion of TCC. We expect to see continued growth in value-based incentives as organizations work to further develop and refine these programs to ensure they have credible measurement and reporting systems in place before moving forward," said Mark Ryberg, Principal, SullivanCotter.

The actual amounts paid for value-based performance remain relatively small at 6.2% of TCC across all specialties at the median. However, this is up from 5.6% in 2018. Primary care is highest at 7.0% of TCC with hospital-based specialties following at 6.3% and medical and surgical specialties at just below 6.0%.

SullivanCotter's 2019 Physician Compensation and Productivity Survey is now in its 27th year. With data from nearly 700 organizations on more than 206,000 individual physicians and advanced practice providers (APPs), this survey is the largest and most comprehensive dataset of its kind. It provides insight into base salary, TCC and productivity data and ratios including wRVUs, collections, patient visits and panel sizes. For more information on SullivanCotter's surveys, please visit our website at www.sullivancotter.com or contact us by phone at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights and expertise to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

PODCAST | Executive Compensation Committee Update

Tim Cotter featured in McDermott Will & Emery's Governing Health Podcast Series

LISTEN TO PODCAST

Health care continues to evolve at a rapid pace, and executives with the skills and competencies to navigate complex change and lead transformation are in high demand. As a result, boards of directors are increasingly focused on the supervision, compensation and retention of the senior executive leadership team.

In this episode, the first in a two-part series, Michael Peregrine welcomes Tim Cotter, Chairman and Managing Director of SullivanCotter, and Ralph DeJong, Partner at McDermott Will & Emery, for a discussion on the latest trends and developments impacting the executive compensation committee's decision-making process.

This episode includes a discussion of the following:

- Where health care executive compensation is trending in 2020

- Impact of today's high CEO turnover on board oversight standards and talent retention practices in health care

- How coordination between the executive compensation committee and other board-level committees is increasing

- Impact of certain environmental factors on health care executive compensation decisions

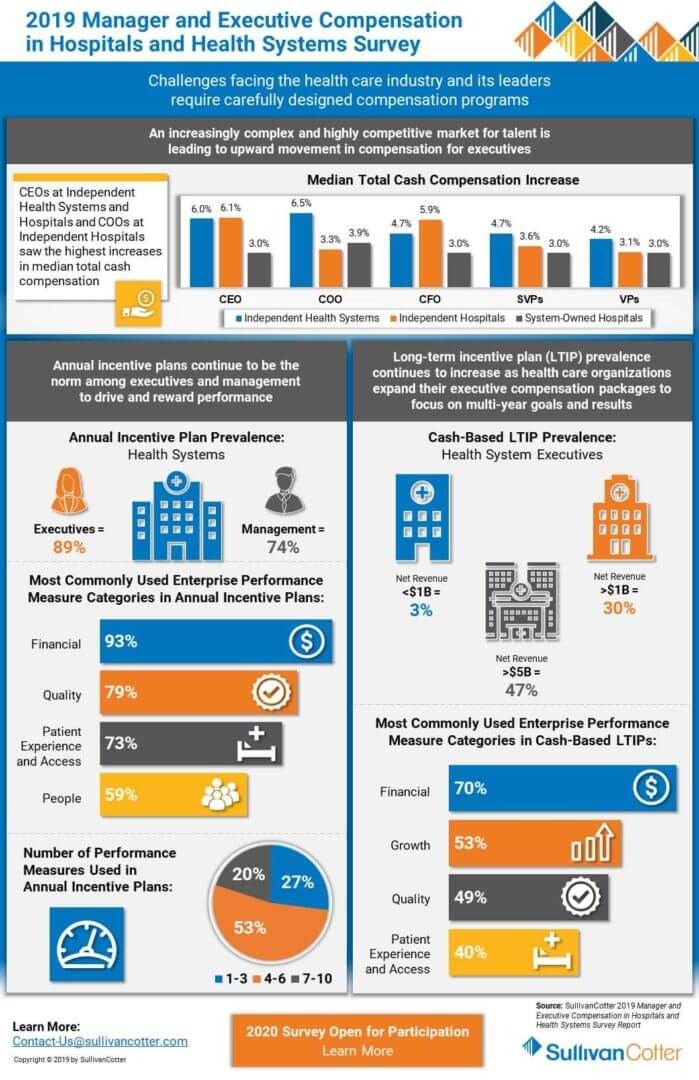

PRESS RELEASE | Industry Disruption and New Talent Requirements are Impacting Health Care Executive Pay

Results from the 2019 Manager and Executive Compensation in Hospitals and Health Systems Survey

November 4, 2019 – Chicago – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of rewards programs and workforce solutions for the health care industry and not-for-profit sector, recently released survey results showing that industry disruption and new talent requirements are impacting executive compensation levels and incentive programs.

The drivers of these changes are: (1) increased complexity of health care organizations due to consolidation, mergers and acquisitions, and new partnerships; (2) changing models of care, as organizations transform to integrate care across the continuum, enhance access, deliver an improved patient experience, and focus on population health/value based care; (3) pressures for cost efficiency; and (4) entry into new businesses to pursue revenue diversification and growth. C-suite leaders of health care organizations must possess the skills and competencies to manage the increased complexity, uncertainty and change. Proven talent is in high demand. Aggressive senior leadership recruitment and retention efforts are being observed in the market, particularly among the largest organizations, which is causing upward pressure on pay. At the same time, less senior roles within health systems and leaders of system-owned entities are experiencing less upward pressure on compensation due to the operational focus of these roles and more talent availability. There is also a growing emphasis on performance-based compensation for senior leaders to tie rewards to attaining short-term and long-term goals.

An analysis of the survey data indicates that median base salaries for the most senior executives of independent health systems with enterprise-wide responsibility (CEOs, COOs and CFOs) increased at a rate of 3.5% to 4.0%, versus 3.0% for these same roles at system-owned hospitals. For senior vice presidents, however, median base salary increases were more aligned at 3.1% for independent health systems and 3.0% for system-owned hospitals.

When considering organization size, salaries are rising faster for CEOs, COOs and CFOs at larger, more complex organizations. For health systems with more than $3B net revenue, median base salaries for these top executives rose between 4% and 5%, compared to 3.0% to 3.5% for smaller independent health systems with less than $3B net revenue. The median change in salaries for management, vice president, and senior vice president roles across both systems and hospitals was almost consistently 3.0% across the board (except senior vice presidents of larger health systems, which was 3.5%).

In addition, performance-based incentive levels are increasing for senior health system leaders. In most executive roles, total cash compensation (TCC, equal to base salary plus annual incentives) increased faster than base salary. Additionally, changes in TCC differed by type of organization, with health systems rising faster than system-owned hospitals. Median change in TCC for CEOs, COOs, CFOs and senior vice presidents at independent health systems ranged from 4.7% to 6.5%. In contrast, the median increase for these roles at system-owned hospitals ranged from 3.0% to 3.9%. As with base salaries, both the level of senior executive TCC increases and target incentive opportunities were higher for larger independent health systems (i.e. revenues greater than $3B) compared to smaller ones.

Furthermore, larger health systems use long-term incentive plans (LTIPs) more commonly for top executives to support the attainment of critical organization-wide objectives. Among health systems with greater than $5B in net revenue, 47% utilize LTIPs, versus 30% for health systems with greater than $1B in net revenue. “Large health systems are shifting their performance focus from individual facility success to measuring outcomes system-wide in the areas of population health management, alignment, integration, quality/patient safety and financial stewardship. Well-designed annual and long-term incentive programs can be effective in supporting these efforts and driving desired performance outcomes,” said Bruce Greenblatt, Managing Principal, SullivanCotter.

“We are seeing upward movement in compensation for health system executive positions, especially those in larger health systems and those located in cities with a high cost of living, reflecting the highly competitive market for talent and the difficulties faced by these organizations to attract talent. Increases are more modest for hospital executive positions, especially those at system-owned hospitals. This speaks to the broader availability of talent for these positions and the increasing operations focus at the hospital-level as shared services and administrative functions are aligned at the system-level,” explains Tom Pavlik, Managing Principal, SullivanCotter.

SullivanCotter’s 2019 Manager and Executive Compensation in Hospitals and Health Systems Survey is now in its 27th year. It provides critical benchmarking data on compensation levels and pay practices, and is the largest and most comprehensive of its kind for hospitals and health systems nationwide. The survey includes data from over 2,200 organizations, comprising 460 health systems and more than 1,800 hospitals, and captures information for more than 42,000 incumbents. For more information on SullivanCotter’s surveys, please visit our website at www.sullivancotter.com, email us at surveys@sullivancotter.com or contact us by phone at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights and expertise to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

READ ON PR NEWSWIRE

INFOGRAPHIC | 2019 Physician Compensation and Productivity Survey

Understanding physician compensation and productivity in a changing health care environment

As health care organizations today are faced with a number of competing forces, physician compensation programs continue to change in a rapidly evolving environment. With an acute focus on new and improved models of care to address population health concerns, keeping pace with a competitive talent market, and mitigating risk in an increasingly complex regulatory environment, organizations are looking to better align physician pay and performance with system-wide goals and objectives.

View related highlights from SullivanCotter’s 2019 Physician Compensation and Productivity Survey. Now in its 27th year, this survey is the largest and most comprehensive of its kind. Information was collected from nearly 700 organizations and includes data for more than 206,000 individual physicians and advanced practice providers.

Don't miss your chance to participate. The 2020 survey is now open!

DOWNLOAD INFOGRAPHIC

INFOGRAPHIC | 2019 Manager and Executive Compensation in Hospitals and Health Systems

Evolving executive compensation and performance programs

With a renewed focus on executive talent strategy and performance, health care organizations continue to evolve their compensation programs to keep pace with a rapidly changing industry. Challenges such as ongoing consolidation, the transition to value-based care, downward pressure on reimbursements, and rising consumerism and patient engagement require thoughtfully designed programs and pay practices in order to align executive compensation with overall organizational objectives.

View related highlights from SullivanCotter’s 2019 Manager and Executive Compensation in Hospitals and Health Systems Survey. Now in its 27th year, this survey is the largest and most comprehensive of its kind for hospitals and health systems nationwide. Information was collected from over 2,200 organizations comprising 460 health systems and 1,800 hospitals, and includes data for more than 42,000 individual managers and executives.

Don't miss your chance to participate. The 2020 survey is now open!

DOWNLOAD INFOGRAPHIC

INFOGRAPHIC | Advanced Practice Provider Productivity

Learn more about emerging trends and data in advanced practice provider productivity

As health care organizations look for ways to improve patient access and control costs, effectively measuring and projecting the clinical productivity of their advanced practice providers (APPs), including nurse practitioners and physician assistants, is imperative.

View related highlights from SullivanCotter’s 2019 Advanced Practice Provider Compensation and Pay Practices Survey, which reports productivity data and ratios, including collections, work RVUs and patient visits, from 562 participating organizations.

Compliance Today | Best Practices for a Compliant, Aligned Professional Services Agreement

Understanding professional services agreements in an ever-changing marketplace

Featured in the October 2019 issue of the Health Care Compliance Association's Compliance Today publication, SullivanCotter Principals Stan Stephen, Dina Unrath and Tom Johnston discuss how a systematic review of professional services agreements can help health systems better assess regulatory and financial risk, standardize contracting terms, and refine processes and oversight for contracting with providers.

This comprehensive process includes the following five steps:

- Form a central contract authority team that comprises a cross-section of key representatives to develop key assessment criteria and processes to evaluate PSAs.

- Inventory current PSAs to create a central database tracking key contractual terms.

- Review agreements for compliance with regulatory guidelines and to identify opportunities for economies of scale.

- Evaluate agreements for strategic need and overall performance requirements, including a review of needed support for desired services from employed and/or independent providers.

- Renegotiate when appropriate to address changing markets and regulatory guidelines.

READ FULL ARTICLE

Copyright [2019] Compliance Today Magazine, a publication of the Health Care Compliance Association (HCCA).

Financial Investment News | Study Reveals Compensation Levels for Nonprofit Investment Staff

Driven by the demand for talent across the not-for-profit sector

In a recent article from Financial Investment News, SullivanCotter discusses how performance-based compensation continues to be a key component of pay for investment staff at private foundations and university endowments. The article features new data from SullivanCotter's 2019 Endowment and Foundation Investment Staff Survey as well as insights from Not-for-Profit Practice Director Nanci Hibschman.

READ FULL ARTICLE

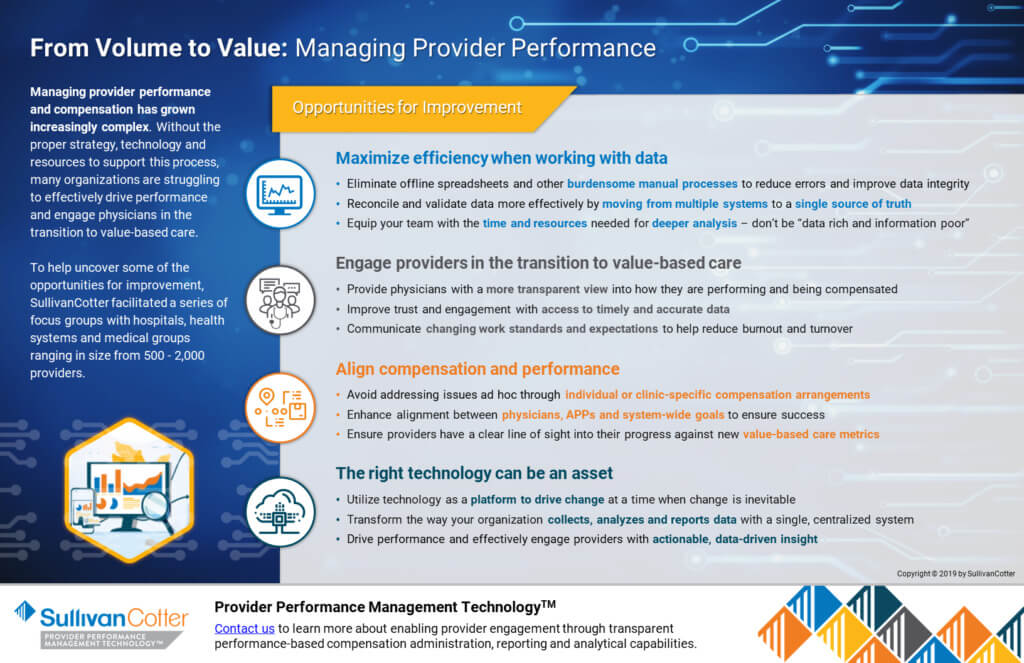

From Volume to Value: Managing Provider Performance

Managing provider performance and compensation has grown increasingly complex.

Without the proper strategy, technology and resources to support this process, many organizations are struggling to effectively drive performance and engage physicians in the transition to value-based care.

To help uncover some of the opportunities for improvement, SullivanCotter facilitated a series of focus groups with hospitals, health systems and medical groups ranging in size from 500 - 2,000 providers.

Learn more about how Provider Performance Management Technology can help.

DOWNLOAD ARTICLE

Modern Healthcare | 2019: Annual Executive Compensation Article

Hospitals and health systems focus on annual and long-term incentive strategies to help attract, retain and engage key executives

UPDATE: Don't miss the 2020 article

The industry goals of improving quality, access and satisfaction while also reducing costs remain a top priority in the transition to value-based care. Hospitals and health systems continue to explore bold new ideas impacting who administers care and how it is delivered, and must have executive leadership in place with the skills and experience necessary to lead such transformation.

With qualified talent in short supply as roles and responsibilities expand, a more deliberate approach to attracting, retaining and engaging key executives is required. Aligning pay with performance is critical, and organizations continue to focus on annual and long-term incentive strategies in order to keep pace in a rapidly evolving health care environment.

Learn more from Modern Healthcare's annual executive compensation article, featuring data from SullivanCotter's 2019 Manager and Executive Compensation in Hospitals and Health Systems Survey and insights from Managing Principals Bruce Greenblatt and Tom Pavlik.

READ FULL ARTICLE

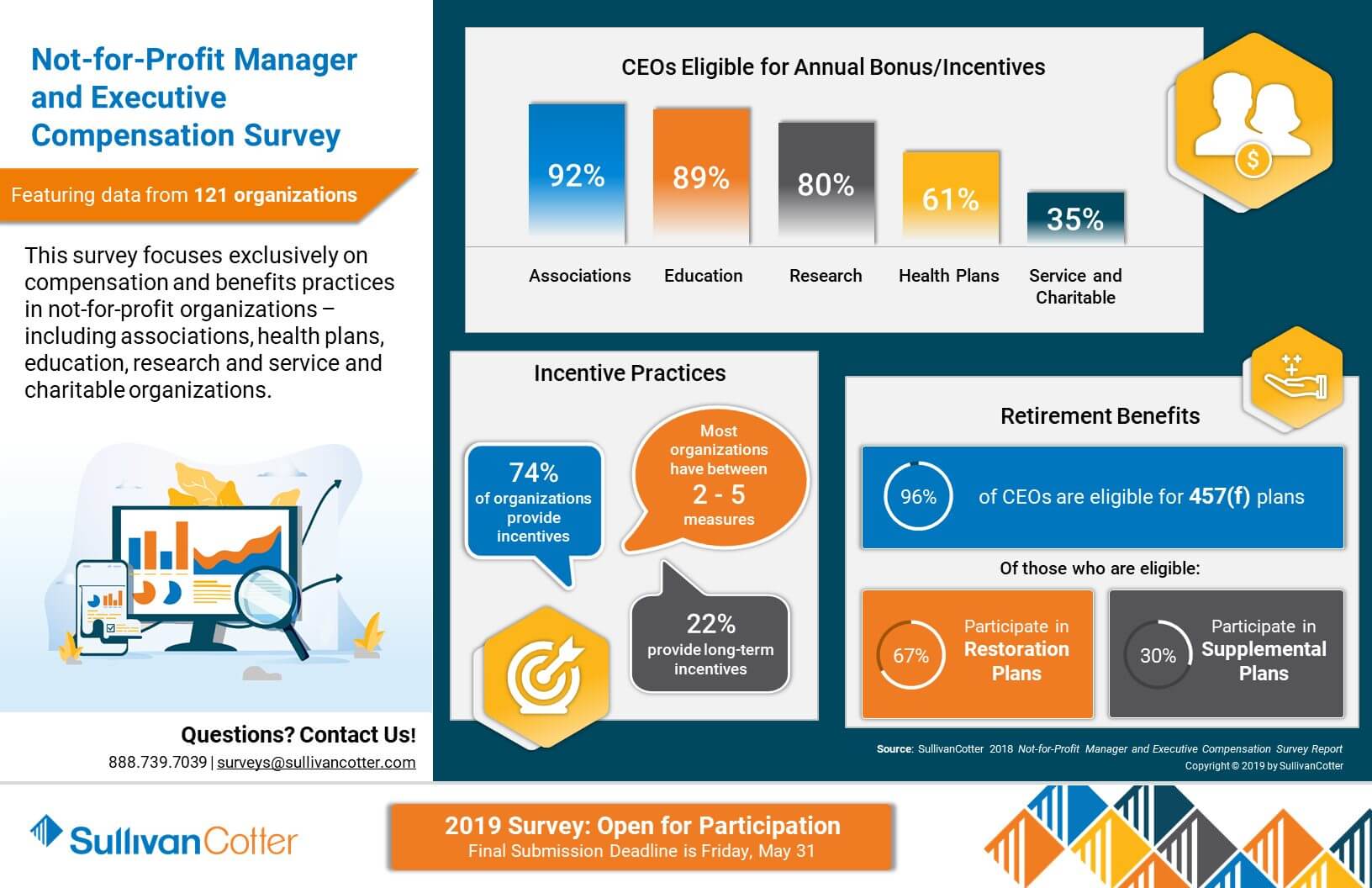

INFOGRAPHIC | 2018 Not-for-Profit Manager and Executive Compensation Survey

Featuring compensation and benefits data from 121 different not-for-profit organizations

Competitive compensation, benefits and talent strategies are essential to delivering on the mission of high-performing not-for-profit organizations. As organizations look to remain competitive in today's complex operating environment, attracting, retaining and engaging key talent is both a top priority and a constant challenge. Access to the right data is critical, and understanding key compensation benchmarks and pay practices can help to address the complexities that mission-based organizations are facing.

View highlights from the results of our 2018 Not-for-Profit Manager and Executive Compensation Survey, which features data from 121 organizations and focuses exclusively on compensation and benefits practices in service and charitable organizations, trade and professional associations, research institutes, health plans, education and more.