PRESS RELEASE | Median Hourly Rates Up by Over 5% for Health Care Employees

Survey report indicates upward pressure on compensation for hourly employees due to health care workforce crisis

—

December 7, 2023 – CHICAGO – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for health care and not-for-profits, has released the findings from its 2023 Health Care Staff Compensation Survey Report.

Despite annual salary budget increases returning to pre-pandemic levels of 3.0% to 3.5%, the report finds that actual median base hourly pay across all jobs nationally increased by 5.3% in 2023 – continuing the growth trend experienced in the prior two years. The most significant gains are in the South Central and Southeast regions, which go beyond the national median at 8.0% and 6.2%, respectively. When looking specifically at registered nurses (RNs), most regions are also seeing increases in base hourly rates well above the national median increase rate for all jobs of 5.3%, with RN pay growth in the South Central region reaching double-digits at 13.4%.

With findings reported from over 1,630 organizations representing more than 600 positions and approximately 1.4 million individuals, SullivanCotter’s dataset represents the largest and most comprehensive health care staff compensation resource for hospitals and health systems.

Health care organizations nationwide continue to grapple with a number of external market forces that are shaping how they operate. Labor shortages amidst growing staff and provider burnout remain an issue and are creating upward pressure on compensation to help organizations attract and retain staff and hourly employees in a tight market for talent.

Significant Increases in Median Base Pay

Many new roles demonstrated high percentage increases on both the clinical and non-clinical sides. On average, pay for some clinical jobs increased more than 11% from last year. While Certified Medical Assistant (9.3%) remains from last year’s list, RN Surgical Services (13.0%), Surgical Technologist First Assistant (10.1%), RN Ambulatory/Outpatient Care (9.5%), and EKG Technician (9.1%) are all new entrants seeing significant market movement compared to last year when they ranged from 3.0% to 8.0%.

Historical pay change levels have not been as high for non-clinical jobs as compared to clinical jobs. The exception is the recruiting and retention function, which remains an important priority for many organizations. This year, the median base pay for the Talent Acquisition Specialist role increased by 14.0% – landing itself just under Wellness Program Coordinator (17.9%) on the high-growth list.

Premium Pay Practices

Most organizations recognize the need to pay premiums to compensate for less desirable shifts and ensure full staffing. More than 80% of organizations offer premium pay programs. Of those, roughly 80% pay premiums as flat dollar amounts, while most others utilize percentages of hourly rates. Premium pay eligibility is more widespread for the clinical job group and more frequently paid due to the nature of staffing those jobs. Bedside RNs and Clinical Pharmacists have some of the highest rates.

Change in Internal Minimum Pay Rates

90% of organizations have an internal minimum pay rate that is higher than the federal, state, and local minimum wage. In 2022, there was a significant rise in organizations choosing to increase their internal minimum rate above the federal, state, or local minimum – from 64% in 2021 to 82% in 2022. The trend continued in this year’s survey, with a staggering 90.4% of respondents setting internal minimum rates above federal, state, or local minimums. “The establishment of internal minimum rates at a higher level has become a necessity for many organizations as they compete for employees within an increasingly competitive marketplace. Additional market pressures such as specific health care wage requirements, pay equity initiatives, collective bargaining pressures and pay transparency requirements are also driving wages up,” said Cathy Loose, Employee Workforce Practice Leader, SullivanCotter.

Considerations for 2024 and Beyond

External health care market forces continue to change how organizations are responding both strategically and operationally to recent workforce challenges. As organizations look cautiously towards greater financial stability and expect a return to pay growth more akin to pre-pandemic levels, it is important to take the following planning considerations into account:

- Market-driven base salary increases will focus more acutely on high-performing executives, critical clinical roles and the resolution of internal equity.

- Performance-based incentive compensation is expected to moderate.

- In a tight market for talent, leaders should ensure both pay levels and compensation delivery methods are aligned with the organization’s talent strategy.

- The aging baby boomer population will have a profound effect on the supply of executive and provider talent.

- Difficult choices and changes in the workforce will support an organization’s financial sustainability.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improves outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and data products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision, and values.

For more information on SullivanCotter’s surveys, please visit our website at www.sullivancotter.com, or contact us via email or by phone at 888.739.7039.

Note to media: Additional data and interviews are available on request.

PRESS RELEASE | SullivanCotter Co-Sourcing Services Help Health Care Providers Address Labor Shortage, Add Critical Skills and Optimize HR Resources

September 14, 2023 – MINNEAPOLIS – SullivanCotter, the nation’s leading independent consulting firm in the assessment and development of total rewards programs, workforce solutions, and data products for health care and not-for-profits, has announced its new co-sourcing services, designed to address the health care labor shortage and maintain critical skills needed to keep providers running at peak performance.

This offering allows SullivanCotter clients to access the expert resources of SullivanCotter as an extended version of their internal teams without the associated costs of insourcing. Unlike traditional outsourcing, co-sourcing combines the skills of both internal and external professionals, giving teams external resources that build on and enhance existing internal capabilities.

“Co-sourcing services allow organizations to access expertise as needed in areas we’ve consulted in every day. Our highly flexible services can be customized to meet each client’s unique needs, maximizing the value of their investment,” said Ted Chien, President and CEO of SullivanCotter. “Our goal is to deliver efficient and sustainable solutions that enable our clients to reach their highest potential.”

Health systems nationwide struggle to meet staffing requirements and establish a sustainable pipeline of future talent. Persistently high turnover rates, escalating burnout levels, and an overwhelming demand for patient care that surpasses the available supply are all factors.

“These ongoing challenges impose a substantial burden on HR teams but also open the door to a flexible co-sourcing approach. A lack of proper staffing can result in a lack of focus on critical operational needs, so the importance of finding effective solutions and ensuring consistency and quality in the service delivery cannot be understated,” emphasized Cathy Loose, Practice Leader of Employee Workforce Solutions at SullivanCotter.

Co-sourcing/interim services offered by SullivanCotter include:

Compensation Planning: Review salary structure and model costs, identify areas for improvement and recommend compensation adjustments.

Survey Operations: Facilitate annual benchmarking by managing employee survey submissions, mapping client jobs to appropriate survey matches, auditing/peer reviewing facts, maintaining market-standard compliance and more.

Portfolio Management: Track and administer ongoing changes to survey job profiles, coordinate with survey vendors to ensure successful implementation, and effectively manage multiple survey platforms on the client’s behalf.

Market Analysis: Conduct competitive analysis and compare organizational practices to market benchmarks – including access to SullivanCotter’s proprietary Benchmarks360™ workforce compensation and performance insights platform.

Market Insights: Provide strategic insight on market trends, including annual pay structure movement and merit adjustments.

Job Descriptions: Support documentation needs associated with creating new roles or revisions to existing roles, aiming to market price and evaluate roles upon completion.

Interim Support: Provide strategic support via a dedicated SullivanCotter Consultant to deliver ad-hoc advisory services, train new hires, and provide various operational and tactical compensation services.

SullivanCotter offers additional specialized services tailored to meet client needs through co-sourcing, including essential initiatives such as Pay Equity and developing and maintaining governance structures.

For more information about SullivanCotter co-sourcing, please visit www.sullivancotter.com, or contact us via email or phone at 888.739.7039.

About SullivanCotter

SullivanCotter partners with health care and other not-for-profit organizations to understand what drives performance and improve outcomes through the development and implementation of integrated workforce strategies. Using our time-tested methodologies and industry-leading research and information, we provide data-driven insights, expertise, and data products to help organizations align business strategy and performance objectives – enabling our clients to deliver on their mission, vision and values.

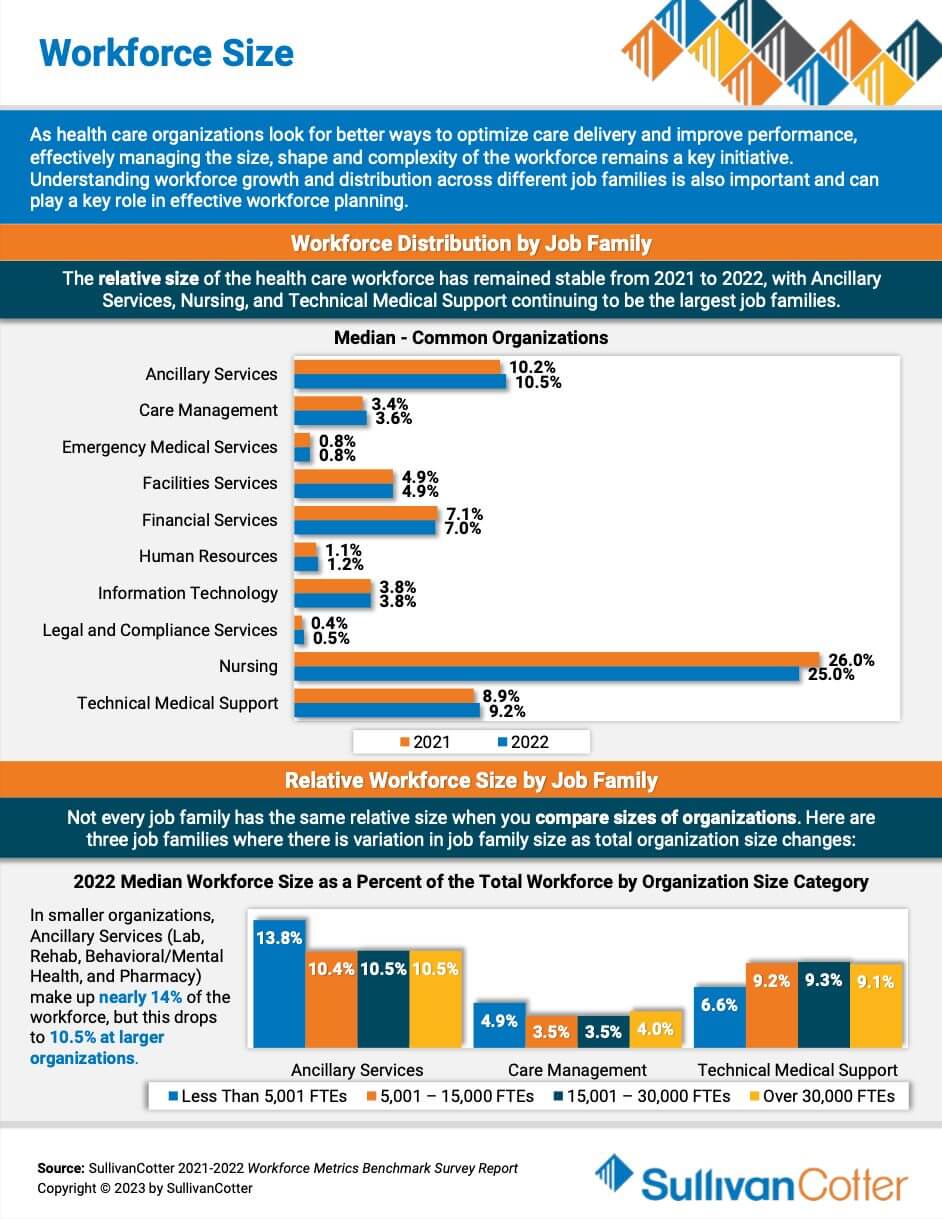

INFOGRAPHIC | Workforce Size

As health care organizations look for better ways to optimize care delivery and improve performance, effectively managing the size, shape and complexity of the workforce remains a key initiative. Understanding workforce growth and distribution across different job families is also important and can play a key role in effective workforce planning. Featuring data from SullivanCotter’s Workforce Metrics Benchmark Survey Report, this infographic features insights on workforce size to help your organization navigate health care workforce staffing challenges.

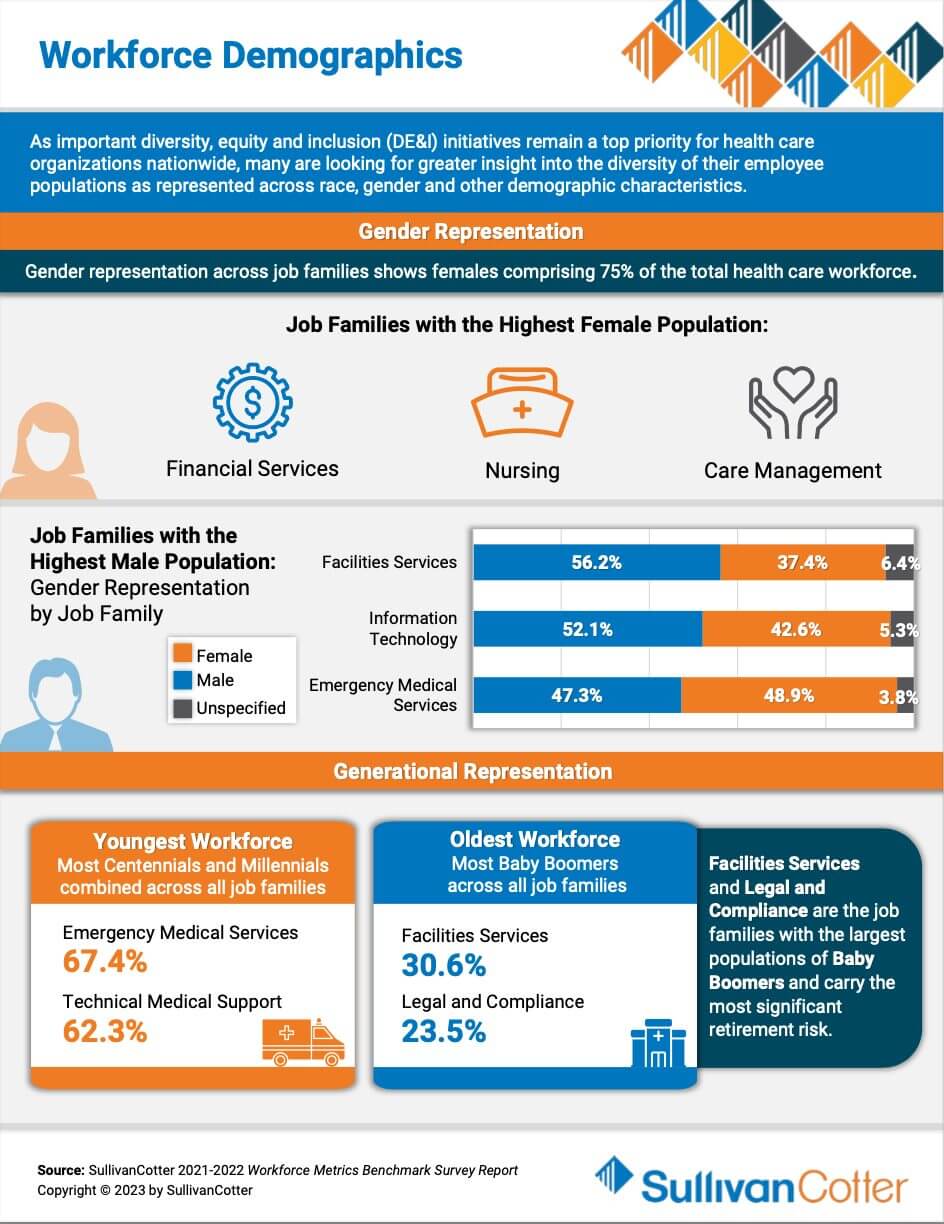

INFOGRAPHIC | Workforce Demographics

As important diversity, equity and inclusion (DE&I) initiatives remain a top priority for health care organizations nationwide, many are looking for greater insight into the diversity of their employee populations as represented across race, gender and other demographic characteristics. Featuring data from SullivanCotter’s Workforce Metrics Benchmark Survey Report, this infographic features demographic insights to help your organization navigate health care workforce staffing challenges.

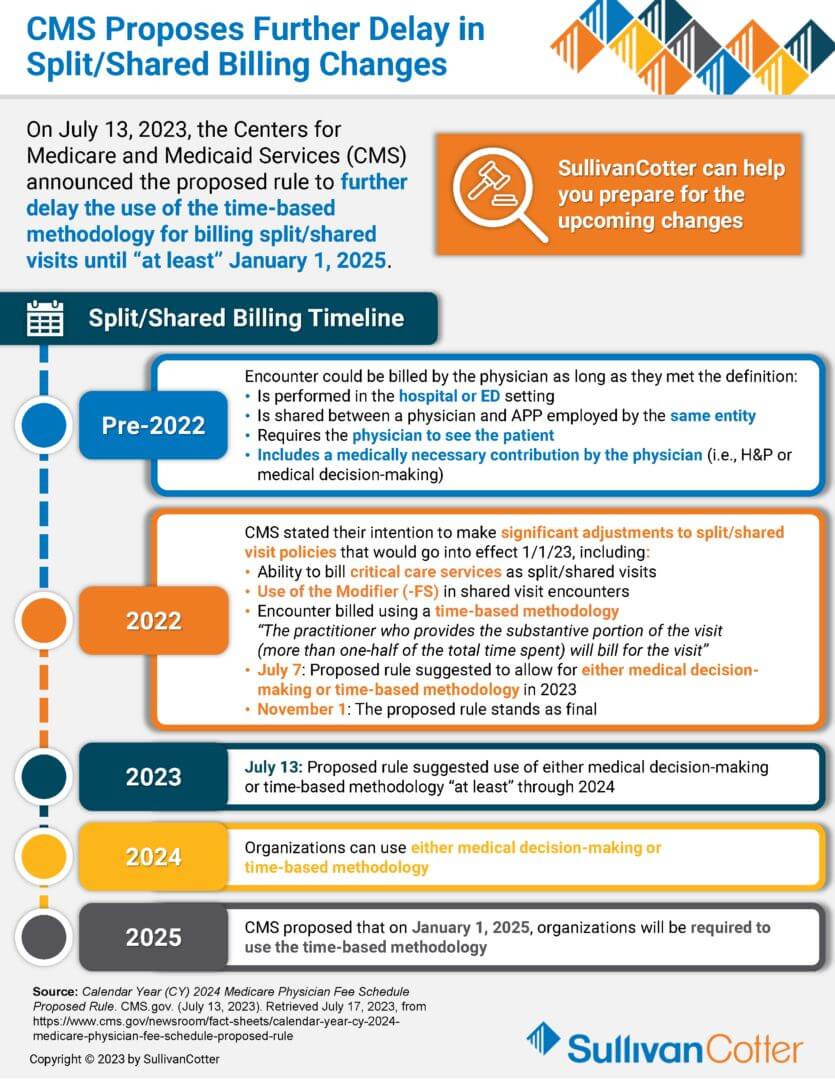

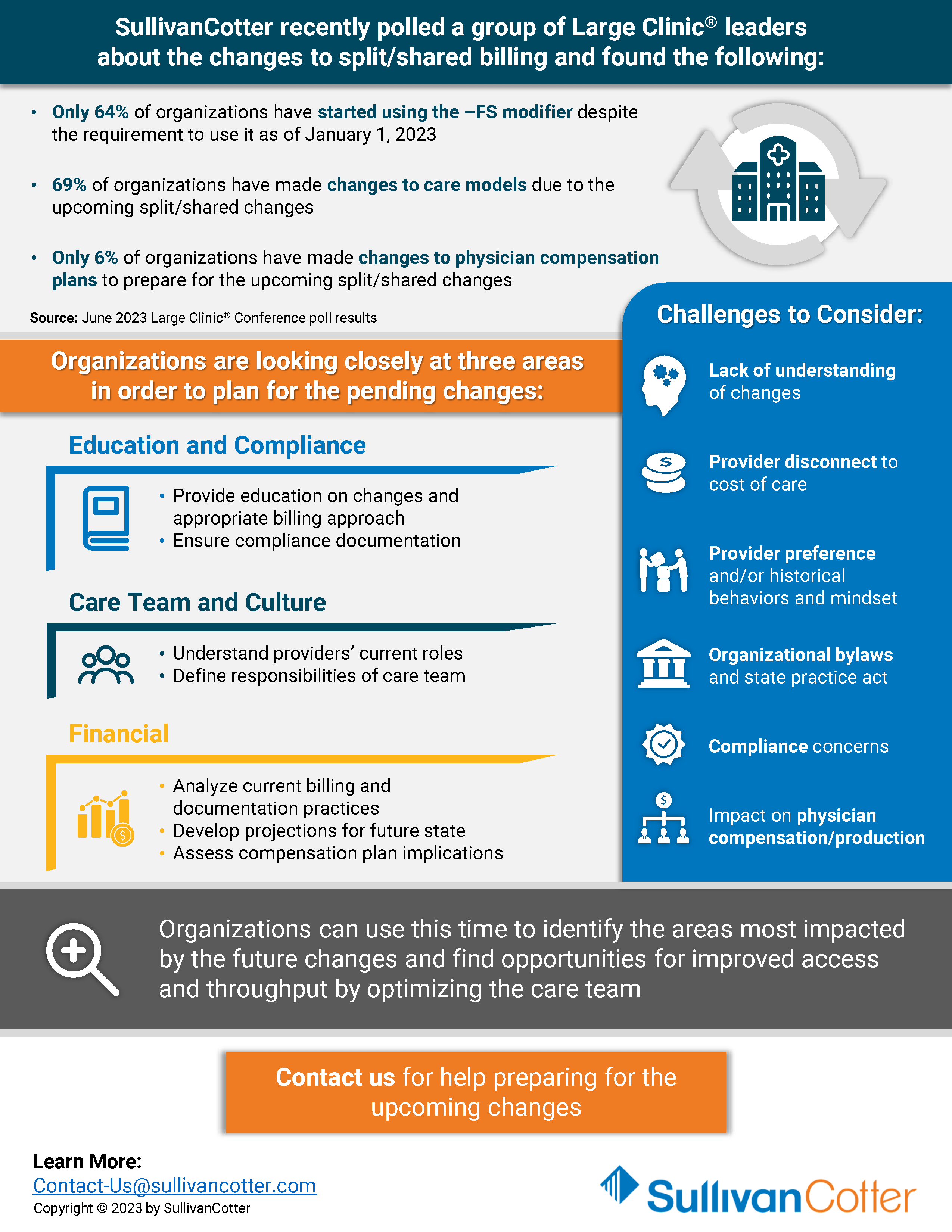

INFOGRAPHIC | CMS Proposes Further Delay in Split/Shared Billing Changes

On July 13, 2023, the Centers for Medical and Medicaid Services (CMS) announced the proposed rule to further delay the use of the time-based methodology for billing split/shared visits until “at least” January 1, 2025. Organizations can use this time to identify the areas most impacted by the future changes and find opportunities for improved access and throughput by optimizing the care team.

This insightful infographic provides an overview of the split/shared billing timeline. It also highlights three main focus areas that organizations are looking closely at in order to plan for the pending changes, as well as what challenges should be considered.

The 2023 survey is now open for submission! Register to participate in this year’s survey to gain access to critical compensation market data, information on key employee workforce practices, and insight into emerging industry trends.