Struggling to understand the effect of recent Physician Fee Schedule changes on the 2022 provider compensation and productivity survey benchmarks?

This year’s survey benchmarks for physician compensation and productivity have been materially impacted by recent modifications to the Physician Fee Schedule. The changes, which were made effective on January 1, 2021, by the Centers for Medicare and Medicaid Services (CMS), significantly altered the work Relative Value Unit (wRVU) weights applied to common Evaluation and Management (E&M) billing codes. Specifically, E&M wRVU weights were increased to benefit Primary Care and other specialties that most often provide these services. As a result, year-over-year comparisons of survey benchmarks require special review and must be carefully considered when incorporating insights into workforce planning and compensation decision-making.

To help organizations properly address the ongoing impact of these changes, SullivanCotter’s 2022 Physician Compensation and Productivity Survey requested that respondents supply data based on wRVU values from both the 2020 and 2021 Physician Fee Schedules. Utilizing this information, SullivanCotter conducted an analysis of the subset of survey participants that reported data under both the 2020 and 2021 PFS wRVU values – a “same-store” approach. Several useful findings emerged that provide organizations with data-driven insights for future changes to compensation programs.

Both the aggregate survey results and the same-store analysis are discussed in this article along with considerations and implications for health care organizations as they move forward with planning for 2023 and beyond.

Changes in Survey Data from 2020-2022

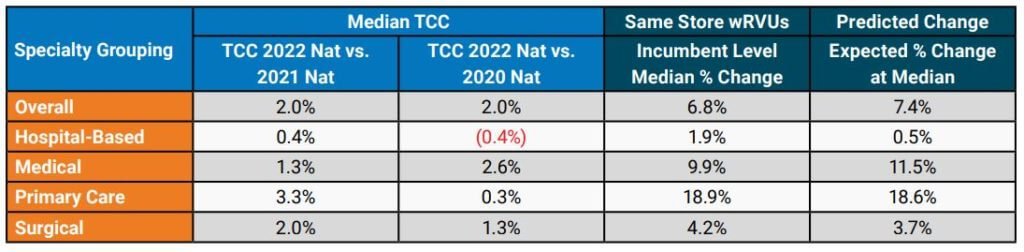

Results from SullivanCotter’s 2022 Physician Compensation and Productivity Survey Report indicate that median total cash compensation (TCC) across all specialties increased by approximately 2% over results reported in 2021 and 2020, respectively, as shown in the Overall grouping for Median TCC in Table A.1 In some recent years, we have seen slightly larger year-over-year increases due to inflation. As COVID-19 impacted some specialties in different ways, we believe the overall increases were muted.

Table A: Median TCC and Same-Store wRVU Impact by Specialty Grouping

1Note that median TCC in 2021 was fairly flat overall due to the impact of the COVID-19 pandemic.

Although the year-over-year increase in TCC was modest overall, some specialty groupings showed more significant increases. Primary Care (including Internal Medicine and Family Medicine) median TCC increased by 3.3% from the 2021 to 2022 surveys, which was likely driven in part by the changes to the Physician Fee Schedule. The change for Hospital-Based specialties, such as Hospitalists, yielded an increase of only 0.4% over the same time period. This limited change may be related to the common market practice of compensating Hospitalists on an hourly or shift basis instead of a predominantly wRVU-based formula.

For the subset of organizations included in the same-store analysis, SullivanCotter conducted an evaluation of wRVU changes. The Same-Store wRVUs column in Table A shows the median change in wRVUs using data at the incumbent level. Although all specialty categories yielded increases, some were more significant than others. As expected, Primary Care (+18.9%) and Medical (+9.9%) specialties had the most significant increases. At the same time, smaller changes occurred in Surgical (+4.2%) and Hospital-Based (+1.9%) specialties, which tend to use proportionately fewer E&M codes.

These results aligned fairly closely with the anticipated changes based on wRVU coding profiles for each specialty as reported in the Predicted Change column in Table A. The predicted changes are based on an analysis by SullivanCotter that included CPT-level detail that used CMS tables to estimate the impact of the PFS changes before the most recent survey data became available.

While the same-store wRVU analysis illustrates the impact of the 2021 PFS changes, other market forces – such as the lingering effects of the pandemic and expanded use of telemedicine services – also impacted reported wRVU information.

Organizations are still relatively split in regard to their approach to measuring wRVU productivity moving forward. SullivanCotter recently surveyed 40 large, integrated health care organizations and learned that approximately 40% were still maintaining the 2020 PFS to calculate physician compensation and another 50% were moving to or had already started utilizing either the 2021 or 2022 PFS.

Specialty-Specific Same-Store Analysis

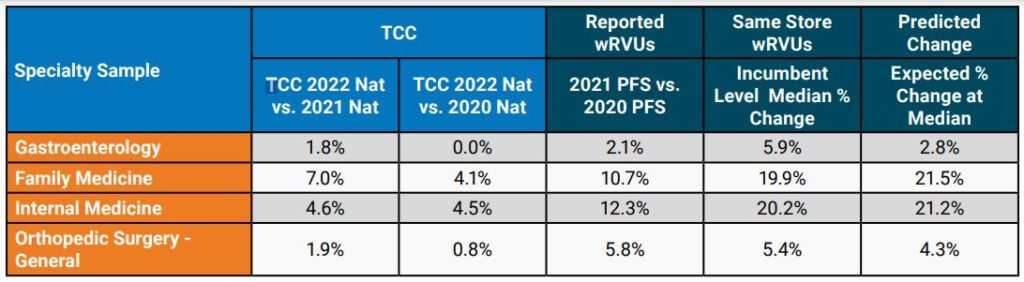

To illustrate the impact of the changes to wRVU values at the individual specialty level, a sampling of specialty-specific information is provided in Table B. This data highlights the reported increases in median TCC as well as the corresponding wRVU changes. Notable changes in TCC for Family Medicine and Internal Medicine can be seen in SullivanCotter’s 2022 survey data. Gastroenterology and Orthopedic Surgery – General showed more modest increases in TCC in the most recent year.

Table B: Analysis of Selected Specialties

When limiting the analysis to the same-store incumbents, the median wRVU percent change increased noticeably for the specialties highlighted in Table B. The impact of the PFS changes can vary substantially from one specialty to another and, as organizations evaluate their physician compensation programs, understanding how to properly evaluate the market data will help inform more effective decision-making.

Considerations and Implications for Health Care Organizations

The impacts on this year’s survey benchmarks present a number of issues for consideration:

- It is imperative that organizations understand the full extent of wRVU value changes and decide how to move forward. Physicians and administrators must know which version of the PFS their group is using for internal wRVU productivity and compensation calculations and how that data compares to currently-published survey data.

- Benchmarking to market survey data without appropriate adjustments may yield inaccurate

results. For example, if an organization adopts the 2021 PFS wRVU values but continues to use compensation per wRVU conversion factors that were in effect under the 2020 PFS, the group risks substantially overpaying certain specialties. These payments could potentially invoke fair market value (FMV) and commercial reasonableness concerns. Recall that the overall increases in TCC have been modest at approximately 2% overall in recent years. - Not all third-party payors have adopted the 2021 PFS adjustments. As a result, an organization may be in a situation whereby maintaining historical conversion factors but using updated wRVU values would lead to significant financial strain as there may not be additional reimbursement to cover increased wRVUs. Many health care organizations have neutralized the cost impact of the wRVU changes with compensation formula/conversion factor adjustments (effectively lowering the compensation per wRVU on a specialty-specific basis). Notably, CMS attempted to neutralize the impact of the wRVU changes on cost through a decrease in its reimbursement conversion factor for professional services — which was subject to additional action by Congress.

Implications to Future State Compensation Planning

When deciding how to move forward to mitigate the impact of the PFS changes on compensation structures, there are several responses to consider. Table C summarizes some approaches that can be employed. Please note that a combination of these approaches may be necessary to accommodate various production-based and shift-based compensation models.

Table C: Options to Consider

| Across-the Board TCC Increases (e.g., 2.0%) | Determine funds available for annual compensation increases and adjust compensation formulas to achieve this result. Can be applied across-the-board or adjusted to achieve overall budgeted level. |

| Conversion Factor Adjustments with Guard Rails | Adjust conversion factors (compensation per wRVU) by specialty and incorporate guard rails to guide TCC changes so that no specialty would have an unsustainable increase/decrease year-over-year. |

| Compound Annual Growth Rate (CAGR) Approach | Determine the percentage change in compensation per wRVU over a number of years prior to the PFS changes (e.g., 3-year period) by specialty. Determine the average annual growth rate and apply it to 2021 actual PFS-adjusted conversion factors on a go-forward basis. |

| Full-Scale Compensation Plan Redesign | Instead of making adjustments to adapt to certain PFS changes, reconsider the compensation philosophy for the group and build flexibility into the compensation plan for current and future reimbursement/regulatory changes. |

In some cases, planning modest across-the-board increases in TCC for salaried or shift-based specialties while using more tailored conversion factor adjustments for production-based specialties may work well. Consider these changes on a specialty-specific basis as the PFS changes affected specialties differently as earlier illustrated in Table B.

The incorporation of guard rails may help to ensure that adjustments at the conversion-factor level do not result in TCC that is not desirable from an FMV perspective or is not financially sustainable. For example, an organization may decide that no specialty will see an increase greater than 5% in its conversion factor over a single year or that the change in the conversion factor would not result in TCC increasing by more than 3% for the same amount of services delivered (e.g., aggregate frequencies by CPT code do not change significantly). Be clear which version of the PFS wRVU values you are using so that conversion factors are appropriate – and recognize future market survey data will be based on the current version of the PFS (i.e., 2021 CMS PFS or later).

A more tailored approach to consider is a Compound Annual Growth Rate (CAGR) analysis. The analysis begins by taking historical compensation per wRVU data at a certain level – such as the median – for a number of years prior to the 2021 PFS changes. Using this data, the average annual growth rate is determined by specialty. This rate is then applied to the 2021 PFS-adjusted rates on a go-forward basis. Be sure to evaluate the results in terms of cost to the organization and other considerations such as FMV and commercial reasonableness.

For some health care organizations, it may also be an appropriate time to reconsider provider compensation overall. The recent PFS changes are substantial and additional modifications are

planned for the future. A revised compensation philosophy can assist in setting a new approach for compensation plan administration that evolves alongside changes in the market. A total compensation plan redesign also provides an opportunity for groups to better align physician and advanced practice provider (APP) incentives where the opportunity exists. This approach can also be used to reset compensation formulas where temporary plans were implemented to address pandemic-related needs. Some organizations may require or prefer a comprehensive compensation plan redesign over piece-meal adjustments by specialty.

One option for consideration is salary-based compensation with clearly defined performance expectations. These expectations may include production targets as well as clinical/value-based measures. If such an option is adopted, a carefully considered scorecard approach to compensation administration is recommended.

Through all of this work, it is important to provide ongoing education and communication to leaders, physicians and APPs. As decisions are made to adapt to the PFS changes and/or incorporate 2022 market data, providers should understand the impetus for change, how it impacts the specialty compensation plan and performance goals, and the benefits and limitations of these actions.