As the marketplace for health care grows increasingly complex, organizations must develop a better understanding of what drives performance in order to remain competitive.

Today’s health care board members, executives and physician leaders are tasked with enhancing the quality of care, maintaining financial stability, and advancing key system-wide objectives. Aligning these goals with annual and long-term strategy is critical and requires a more integrated approach to analyzing workforce performance.

In an industry driven by information, turning data into actionable insights is a top priority for hospitals and health systems nationwide. With a growing network of hospitals, the volume of patient, provider and performance data is increasing and comes with a number of complexities and nuances – making it difficult for organizations to properly evaluate and benchmark their performance in relation to peers. As a result, ensuring focus on the right set of goals, identifying areas for meaningful improvement and developing targeted approaches to support incremental change are key challenges for health care organizations.

With a comprehensive suite of proprietary benchmarking data, and extensive insight into the industry’s growing collection of externally-published ratings, rankings and quality benchmarks reports, SullivanCotter’s Performance Analytics and Advisory Services (PAAS) is uniquely positioned to help organizations measure and assess performance across the care continuum. Leveraging our data-driven approach and in-depth knowledge of emerging trends, the evolving executive talent market, best practices in goal setting, and total rewards and alignment strategies, we work closely with organizations to engage leadership in the delivery of long-term, sustainable results.

Our comprehensive performance analytics and advisory services include:

- Providing the right mix of data and analysis to help organizations evaluate performance at the individual hospital, submarket and system-level and identify targeted improvement opportunities

- Identifying key organizational objectives and developing goals that help support targeted improvement efforts across organizational pillars

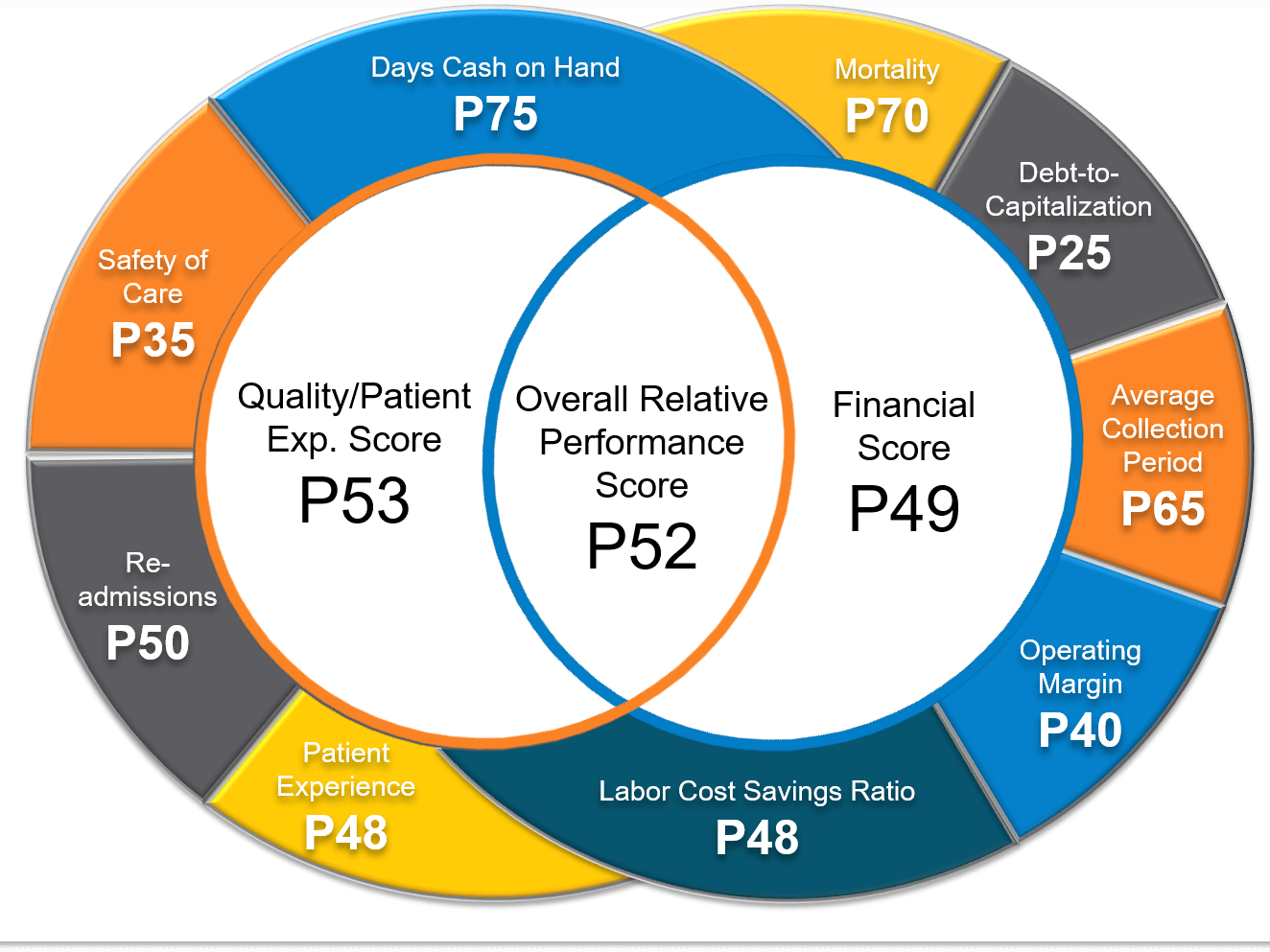

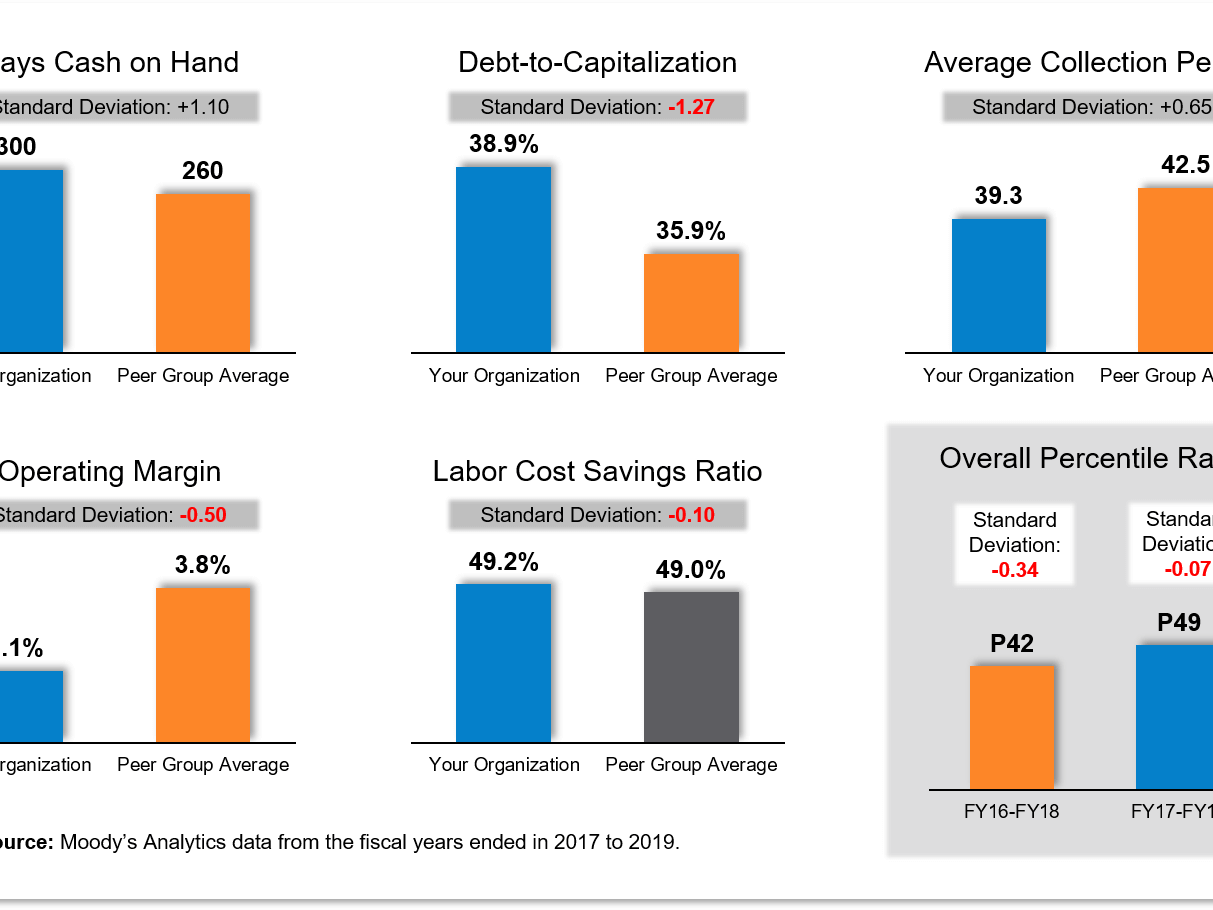

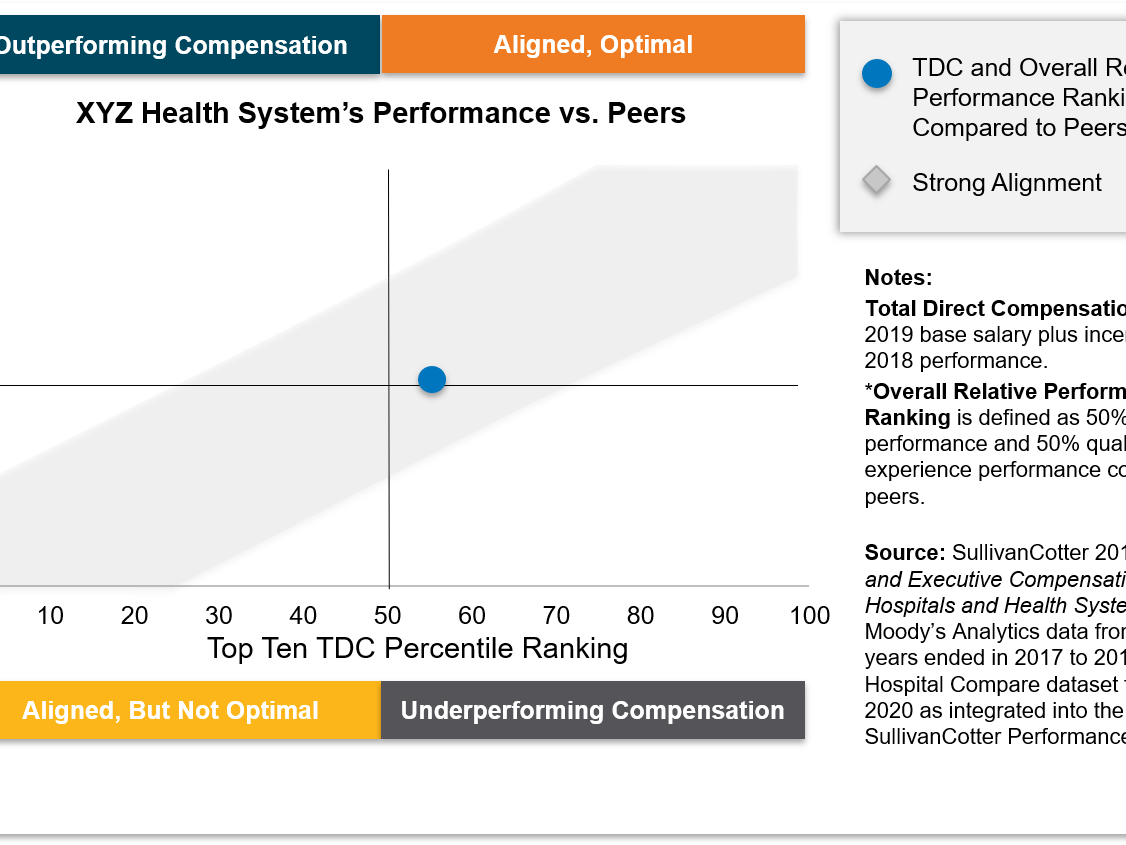

- Creating custom peer group comparisons using key measures of quality, patient experience and financial performance, including percentile positioning and trends over time, and assessing pay-for-performance relationships for executives

- Providing board members, executives and physician leaders supporting analyses for peer group development through the aggregation of market share, near-term liquidity indicators, credit ratings, reputational and quality/patient experience national rankings to ensure appropriate relative comparisons for purposes of compensation recommendations

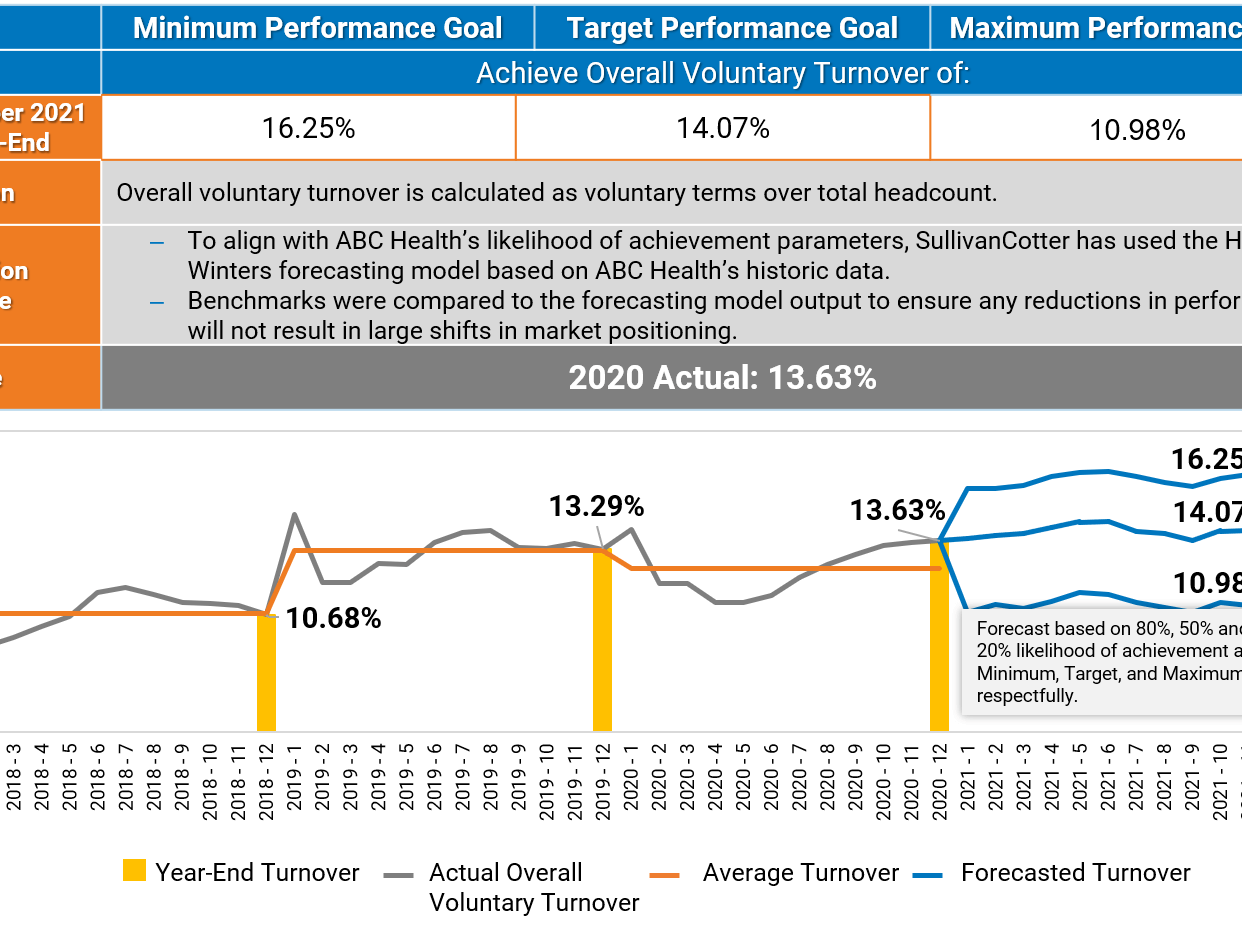

- Calculating the industry’s historic and forecasted rate of change for key measures

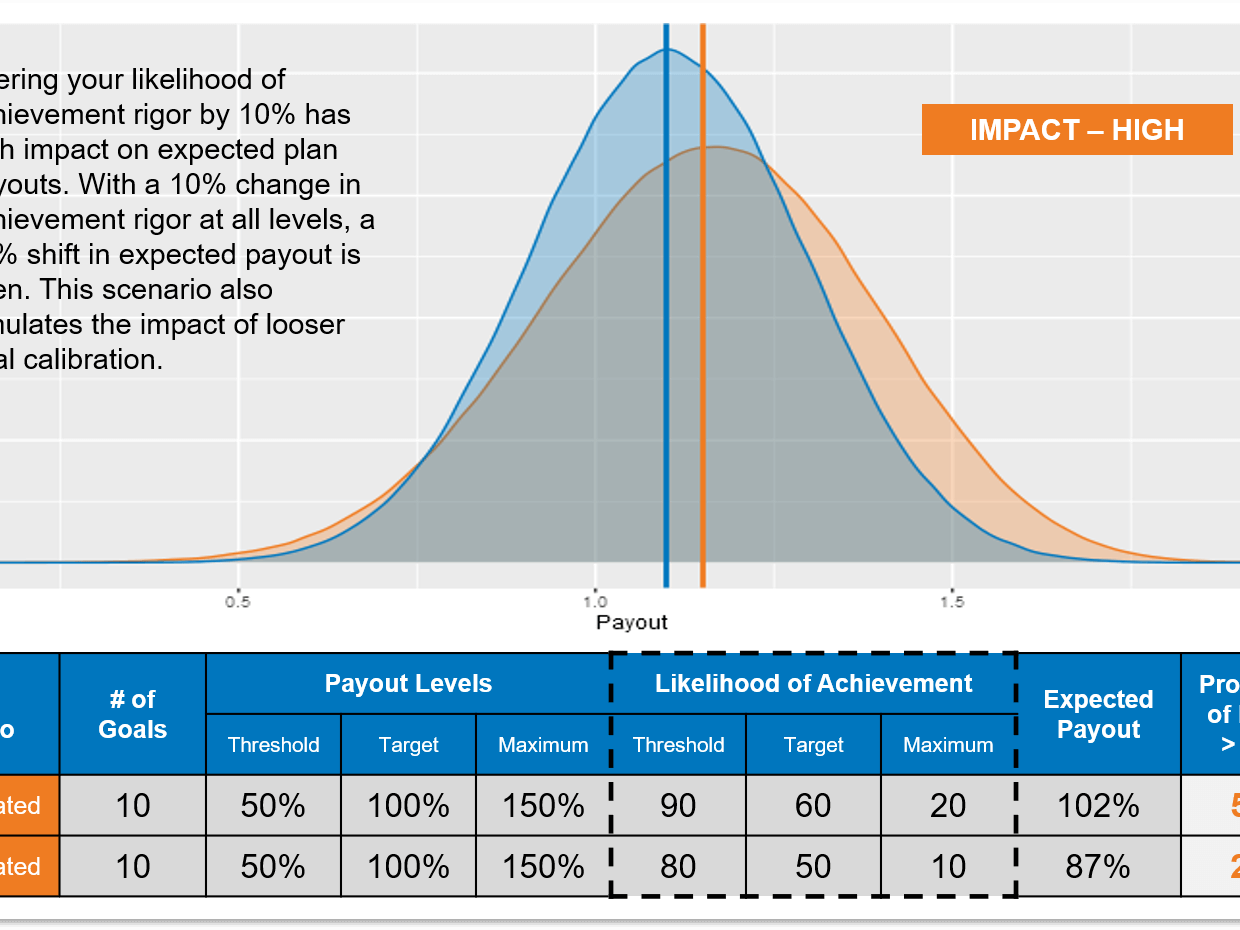

- Calibrating organizational goals to ensure health systems are challenging themselves to bridge the gap between current and desired performance while still maintaining the probability of achievement in accordance with incentive plan design

- Defining goal setting and incentive plan best practices such as calendar planning, reasonable improvement opportunity, number of goals, standardized goal documentation, and calibration rigor

Examples

Related Information

Learn more about our Performance Analytics and Advisory Services

Related Resources

Physician Compensation Governance: Best Practices and Common Pitfalls

Robust physician compensation governance structures are fundamental to maintaining compliance. Dive deeper into best practices and common pitfalls from our experts!

INFOGRAPHIC | Lead Smarter: Evaluating Span of Control

Improve your management and leadership structures by getting span of control right! We've compiled the latest data and insights from our Workforce Metrics Benchmark Database.

Executive Compensation Committee: Top 10 Priorities for 2025

Is your executive compensation committee on the right path for 2025? Help them navigate the year ahead with timely insights from our experts!